From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Production Cuts and Export Outlook Drive Bullish Sentiment

Asia’s steel market is poised for potential price increases as China implements production cuts amid a backdrop of robust export expectations. This report analyzes these trends using recent news and satellite-observed plant activity. The article “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025” directly explain this policy shift, though no immediate correlation to plant activity changes from space could be explicitly established during the August measurement period.

Here’s a summary of recent steel plant activity:

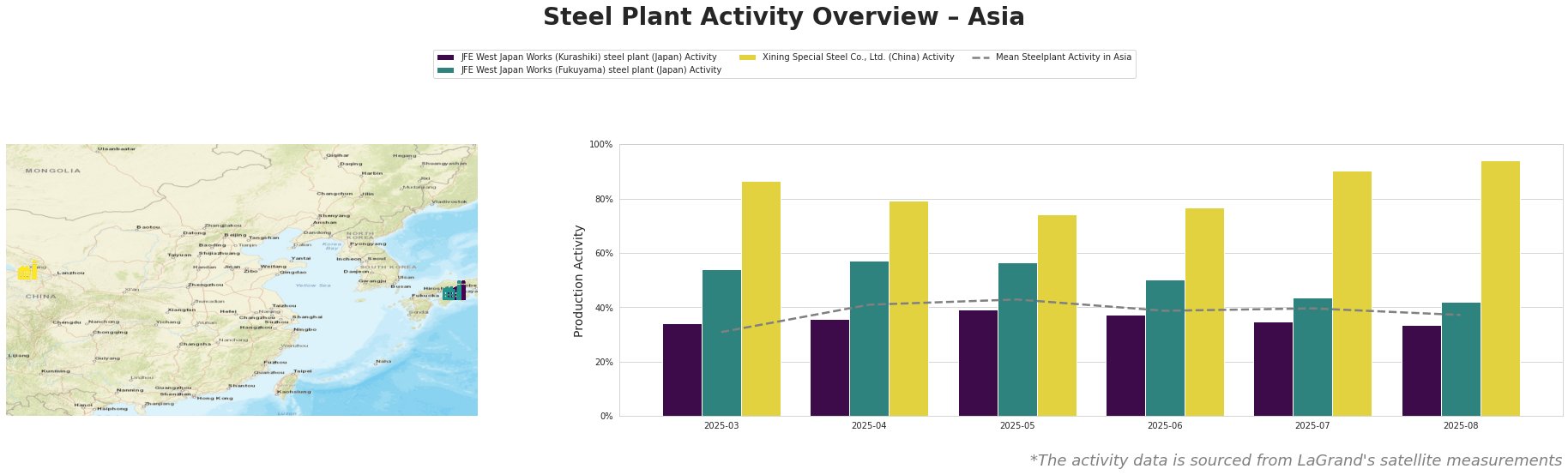

The mean steel plant activity in Asia decreased from 40% in July to 37% in August.

JFE West Japan Works (Kurashiki) steel plant, an integrated BF-BOF facility in the Chūgoku region of Japan with a 10 million tonne crude steel capacity, primarily produces hot and cold-rolled sheets, coated sheets, plates, and H-profiles for the automotive, construction, and energy sectors. The plant’s activity has seen a generally decreasing trend, dropping from 34% in March to 33% in August. No immediate impact can be established from “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” or from “China’s steel sector PMI declines to 49.8 percent in August 2025” on its activity.

JFE West Japan Works (Fukuyama) steel plant, another integrated BF-BOF facility in the same region, has a 13 million tonne crude steel capacity and manufactures similar products. Its activity also decreased, dropping from 54% in March to 42% in August. Similar to the Kurashiki plant, no immediate correlation between its activity levels and the cited news articles could be established.

Xining Special Steel Co., Ltd., a Chinese steel plant located in Qinghai province with a 2 million tonne capacity and integrated BF-BOF production, primarily manufactures specialized steel products for the automotive, energy, and engineering machinery sectors. The plant bucked the regional trend, with activity levels rising sharply from 86% in March to a peak of 94% in August. While the Chinese government’s announced production cuts could eventually impact Xining, there is no directly attributable impact yet observable via satellite data. The “China’s steel sector PMI declines to 49.8 percent in August 2025” article does not appear to immediately affect this plant.

According to “China’s steel exports will exceed 100 million tons in 2025 – Baosteel“, China expects to maintain high export volumes. “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025” indicate that these cuts are intended to affect domestic production.

Evaluated Market Implications:

Given the announced production cuts in China and Baosteel’s projection of sustained high export volumes, steel buyers should anticipate potential price increases, especially for products sourced from China, but with the caveat that the export volumes are predicted to be “potentially lower in the near term due to various factors”. Steel buyers who procure hot rolled sheets, cold rolled sheets, coated sheets, plates, and H-profiles from China, should consider securing contracts in advance. The rising raw material purchase prices reported in “China’s steel sector PMI declines to 49.8 percent in August 2025” further support this recommendation. Consider diversifying sourcing to Japanese suppliers, given the slightly decreasing but stable activity levels at JFE’s Kurashiki and Fukuyama plants, although these facilities may have limited capacity to fully compensate for Chinese supply reductions.