From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Output Fluctuations & Indian Plant Activity Stable Amidst PPI Decline

In Asia, the steel market presents a mixed picture. While China experiences production fluctuations (“China cuts steel production to 73 million tons in September“), satellite data indicates relatively stable activity at several Indian steel plants. The observed Chinese crude steel output adjustments may be related to the PPI decline (“China’s steel industry PPI down 8.6 percent in January-September 2025“) but a direct link cannot be explicitly established based on the provided information.

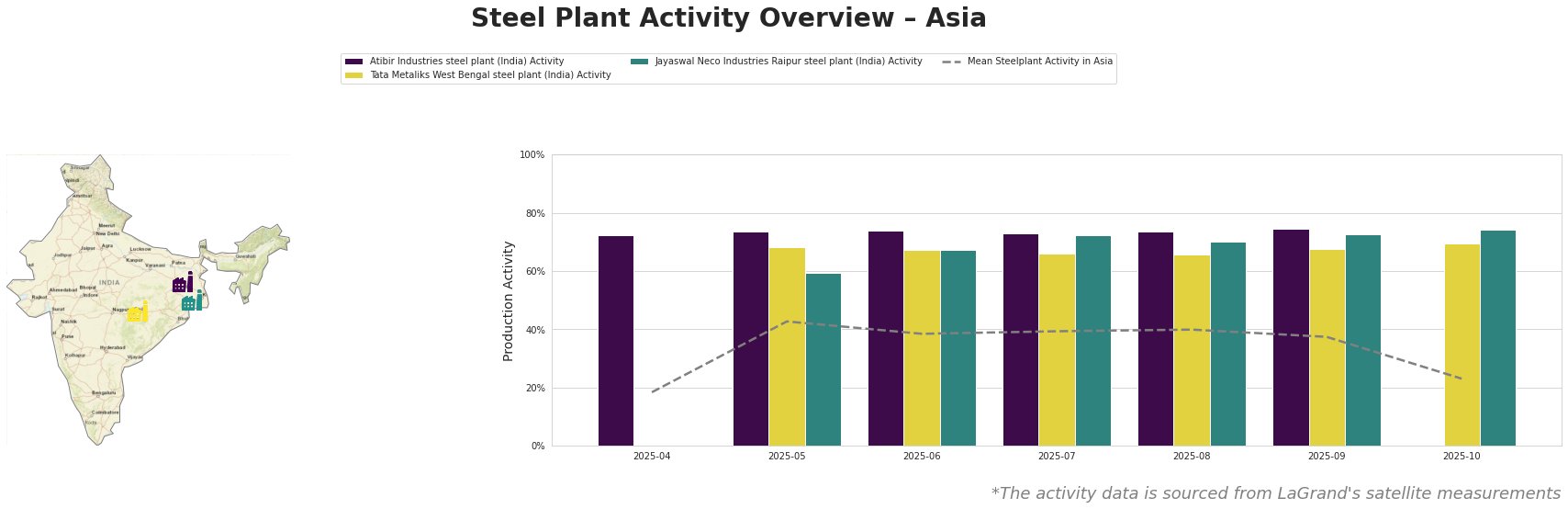

The mean steel plant activity in Asia, based on observed plants, shows a decline in October 2025 to 23%, significantly lower than the levels observed in the preceding months. Atibir Industries showed consistently high activity from April to September 2025, ranging from 72% to 75%. Tata Metaliks West Bengal steel plant maintained relatively stable activity between May and October 2025, fluctuating between 66% and 70%. Jayaswal Neco Industries Raipur steel plant also exhibited stable activity from May to October 2025, ranging from 60% to 74%. The Indian plants consistently operated above the mean Asian activity level during the monitored period, indicating stable production relative to the regional average. The overall lower mean activity in Asia for October appears to be driven by other plants not specified in the provided activity data.

Atibir Industries, a ResponsibleSteel certified integrated (BF) steel plant in Jharkhand, India, with a crude steel capacity of 600 ttpa using BOF technology, exhibited high and consistent activity (72%-75%) between April and September 2025. Activity data is not available for October. This stable production does not directly correlate with any of the provided news articles concerning China’s output or PPI, indicating potentially independent market dynamics for this plant.

Tata Metaliks West Bengal steel plant, a ResponsibleSteel certified integrated (BF) plant in West Bengal, India, with a crude steel capacity of 255 ttpa, showed stable activity between May and October 2025 (66%-70%). As with Atibir Industries, the plant’s stable activity appears independent of the Chinese market fluctuations reported in the provided news articles.

Jayaswal Neco Industries Raipur steel plant, a ResponsibleSteel certified integrated (BF and DRI) plant in Chhattisgarh, India, with a crude steel capacity of 1200 ttpa, also demonstrated stable activity between May and October 2025 (60%-74%). The plant utilizes both BF and DRI technologies, and its stable operation does not show a direct relationship with the news concerning China’s production cuts or PPI decreases.

Despite overall industrial output increases in China as noted in “Industrial output of China’s steel sector up 5.7 percent in Jan-Sept 2025”, September witnessed a production cut. This decline, as well as the rising CISA mills output and stocks (“CISA mills’ daily crude steel output up 7.5% in early October 2025, stocks also up“), indicate potential volatility in Chinese supply chains. This increased volatility, coupled with the PPI decline (“China’s steel industry PPI down 8.6 percent in January-September 2025”), suggests downward pressure on steel prices originating from China.

Given the reported fluctuations in Chinese steel production and the relatively stable activity observed in the provided Indian steel plants, procurement professionals should:

- Diversify Procurement: Actively explore and validate alternative steel sources outside of China, specifically in India, to mitigate potential supply disruptions caused by Chinese production volatility, as evidenced by “China cuts steel production to 73 million tons in September” and “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025“. Focus procurement on Indian plants that were identified above as keeping a high and steady production rate.

- Negotiate Pricing: Leverage the reported PPI decline in China (“China’s steel industry PPI down 8.6 percent in January-September 2025”) in price negotiations with Chinese suppliers to secure more favorable terms.

- Monitor Inventory: Closely monitor finished steel inventories held by CISA member mills, as reported in “CISA mills’ daily crude steel output up 7.5% in early October 2025, stocks also up”. A significant increase in inventories could signal weaker demand and potential for further price concessions.

- Assess Coke Supply Chains: Given the rise in Chinese coke output (“China’s coke output rises by 3.5 percent in January-September 2025“), assess the reliability and pricing of coke supply chains, particularly for integrated steel producers relying on BF technology. No further implications can be deduced, however, since the plants observed activity level doesn’t seem impacted.