From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Exports Surge Amidst Production Adjustments, Impacting Regional Supply

Asia’s steel market shows a complex interplay of production shifts and export surges, primarily driven by China. Observed activity changes across select plants do not always directly correspond with the news data. The “China’s steel bar exports increase by 49.3 percent in Jan-May” article explains a substantial increase in exports, while “China’s rebar output down 1.6 percent in January-May” indicates domestic production adjustments. No direct correlation can be established with recent observed activity changes at the selected steel plants, as the news focuses on broad trends.

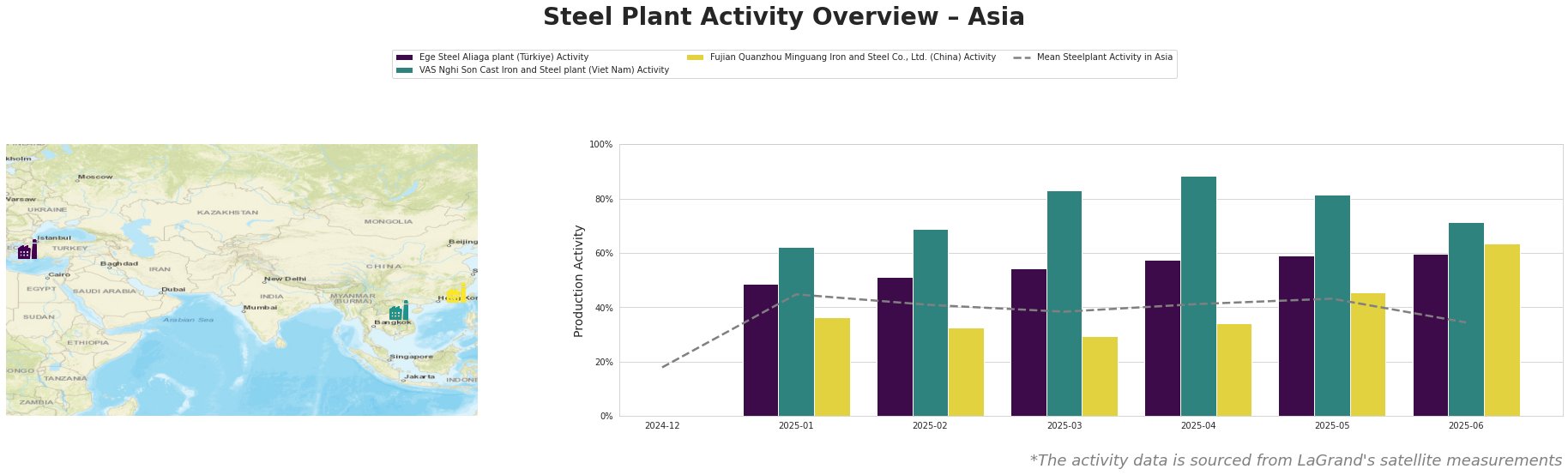

Across Asia, the mean steel plant activity reached a peak in January 2025 at 45% and has since generally declined to 34% by the end of June. Ege Steel Aliaga plant activity in Türkiye steadily increased from 49% in January to 60% in June. The VAS Nghi Son Cast Iron and Steel plant in Vietnam shows the highest activity levels overall, peaking at 88% in April before declining to 71% in June. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. in China shows the most volatile activity levels, starting at 36% in January, dropping to 29% in March, and then rising sharply to 64% in June.

Ege Steel Aliaga plant, located in İzmir, Türkiye, is an EAF-based steel plant with a crude steel capacity of 2 million tonnes per annum, focusing on rebar and wire rod production. Activity at Ege Steel Aliaga plant has steadily increased in the observed period, reaching 60% in June, diverging from the overall Asian average decline. No direct link to provided news articles can be established.

VAS Nghi Son Cast Iron and Steel plant, situated in Thanh Hoa, Vietnam, operates with EAF technology and has a crude steel capacity of 3.15 million tonnes per annum, producing billet, rebar, and wire rod. The plant demonstrated strong activity, peaking at 88% in April but dropping significantly to 71% in June. There is no explicit connection between the observed activity drop at the VAS Nghi Son plant and the provided news on Chinese production and exports.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., based in Fujian, China, is an integrated steel plant with a BF-BOF process and a crude steel capacity of 2.55 million tonnes per annum, manufacturing round bar, high-speed bar, coiled rebar, and wire rod. The plant’s activity showed the most significant fluctuation, rising sharply to 64% in June. The rise in activity observed in June at Fujian Quanzhou Minguang Iron and Steel Co., Ltd. does not directly correlate with the “China’s rebar output down 1.6 percent in January-May” article, which reports an overall decrease in Chinese rebar production for the January-May period.

The “China’s steel bar exports increase by 49.3 percent in Jan-May” article, coupled with the observed increase in activity at Fujian Quanzhou Minguang Iron and Steel Co., Ltd. in June, suggests a potential shift towards export-oriented production.

Evaluated Market Implications:

The “China’s steel bar exports increase by 49.3 percent in Jan-May” and “China’s rebar output down 1.6 percent in January-May” articles suggest a shift in China’s steel market dynamics. The increase in exports, combined with a decrease in overall rebar production, may lead to increased price competition in export markets.

Recommended Procurement Actions:

- Steel Buyers focusing on Rebar: Closely monitor rebar prices in Southeast Asia, particularly given the potential increase in Chinese exports.

- Steel Buyers sourcing from Vietnam: Be aware of the recent drop in activity levels at VAS Nghi Son plant and consider diversifying supply sources.

- Market Analysts: Focus on capacity utilization rates in coastal Chinese steel plants, as these may be most directly influenced by export demand.