From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Exports Surge Amidst Construction Growth & Plant Activity Shifts

Asia’s steel market presents a mixed outlook driven by increasing Chinese exports and construction sector growth. Alexander Gordienko’s prediction at the IREPAS meeting, detailed in “IREPAS Meeting: 2025 set to be record year for China’s steel exports,” highlights surging Chinese exports due to stagnant domestic demand, although a direct relationship to observed plant activity levels cannot be established. This is coupled with Dr. Heinz-Jürgen Büchner’s insights from “Dr. Heinz-Jürgen Büchner: Growth in construction industry to drive steel demand,” forecasting boosted steel demand from the construction industry in Asia-Pacific. Raw material suppliers at IREPAS note “devastating” global trade conditions due to uncertainty, as per “Raw Material Suppliers at IREPAS: Global trade conditions are “devastating” due to uncertainty“, however no direct relation to plant activity can be established.

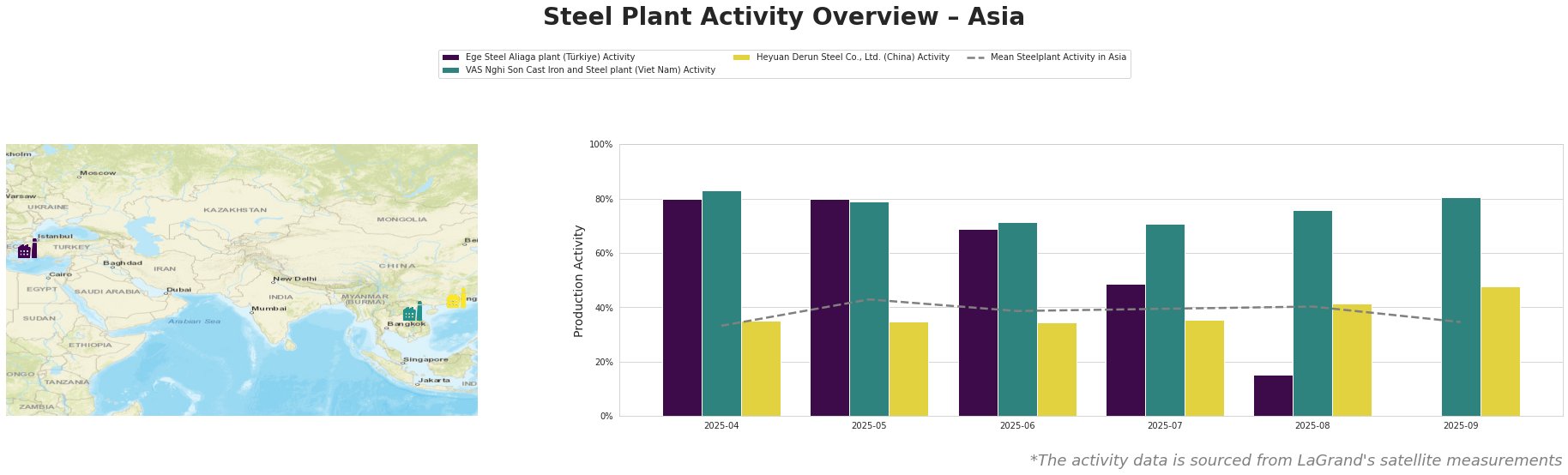

The mean steel plant activity in Asia fluctuated, peaking at 43% in May and declining to 35% in September. Ege Steel Aliaga plant, a Turkish EAF-based producer of 2,000 ttpa crude steel capacity focused on rebar and wire rod, experienced a sharp decline in activity from 80% in April and May to 0% in September. This drastic reduction suggests a potential significant disruption in their production, but no direct link to the provided news articles can be established. VAS Nghi Son Cast Iron and Steel plant in Vietnam, with a 3,150 ttpa EAF-based capacity producing billet, rebar, and wire rod, maintained relatively high activity levels, ranging from 71% to 83%, indicating stable production. Heyuan Derun Steel Co., Ltd. in China, an EAF-based producer with 1,200 ttpa capacity focused on hot rolled rebar and billet, showed a gradual increase in activity from 35% in April/May to 48% in September. This increase potentially reflects the surge in Chinese steel exports mentioned in “IREPAS Meeting: 2025 set to be record year for China’s steel exports,” although no direct causal link can be conclusively proven.

Given the expected surge in Chinese steel exports and the observed increase in activity at Heyuan Derun Steel Co., Ltd., steel buyers should prioritize securing supply contracts with Chinese producers, but consider trade tension, as highlighted in “Dr. Heinz-Jürgen Büchner: Growth in construction industry to drive steel demand“. Monitor Ege Steel Aliaga plant’s situation closely for potential rebar and wire rod supply shortages, and diversify sourcing to mitigate risks.