From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Capacity Expansions and Green Steel Initiatives Drive Positive Outlook

Asia’s steel market shows strong growth potential driven by capacity expansions focused on high-value steel grades and a push toward green steel production. The news of “China’s Shanxi Jingang New Materials Technology orders ESP line from Primetals” indicates increased production capacity for electrical and automotive-grade steels, while “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group” points to growing domestic supply of silicon steel for electric vehicle motors. However, no direct relationship could be established between these news developments and the provided satellite activity data.

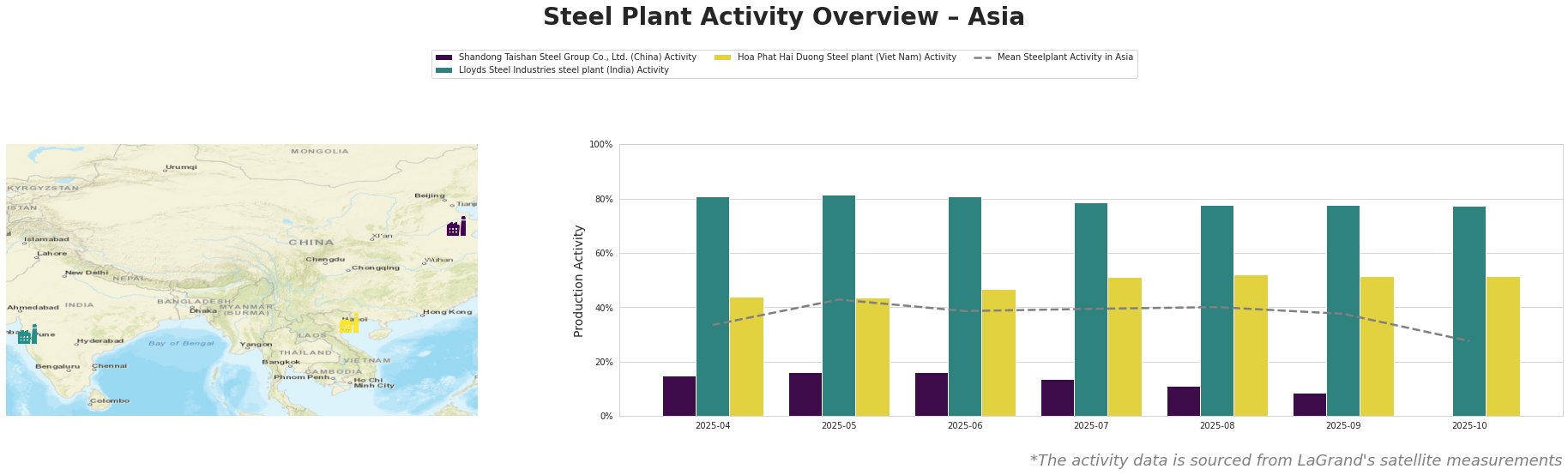

The mean steel plant activity in Asia fluctuated between 34% and 43% from April to September before dropping to 28% in October.

Shandong Taishan Steel Group Co., Ltd., an integrated BF-BOF steel plant with a 5 million mt crude steel capacity, experienced a consistent decline in activity from 15% in April to 8% in September. October data is missing. No direct link can be established between this decline and the provided news articles.

Lloyds Steel Industries steel plant, an EAF-based producer with a 641,000 mt crude steel capacity focused on semi-finished and finished rolled products, maintained high activity levels, fluctuating between 78% and 82% throughout the observed period. This sustained high level of production might reflect strong demand from the energy and machinery sectors. No direct link can be established between these high activity levels and the provided news articles.

Hoa Phat Hai Duong Steel plant, an integrated BF-BOF steel plant with a 2.5 million mt crude steel capacity focused on finished rolled products for construction, showed a steady increase in activity from 44% in April to 52% in August, stabilizing at 51% in September and October. This increase, followed by stable high production, may signal strong regional demand for construction steel. No direct link can be established between these activity levels and the provided news articles.

The overall decline in mean activity in October, combined with the absence of activity data for Shandong Taishan, warrants close monitoring. While Lloyds Steel maintained high activity, the sector needs monitoring for potential disruptions and supply adjustments based on demand elasticity of energy and machinery sectors. Steel buyers focused on electrical, deep-drawing, and hot-forming steels should proactively engage with suppliers able to leverage the ESP technology announced in “China’s Shanxi Jingang New Materials Technology orders ESP line from Primetals” to secure future supply. Also, buyers of silicon steel, especially those supporting electric vehicle manufacturing, should closely follow the progress of the ArcelorMittal/China Oriental Group NEMM project announced in “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group” to diversify supply chains and capitalize on local production. While “SSAB Zero steel meets IEA carbon thresholds” does not directly impact the Asian market presently, the advancements in green steel production should be monitored for potential future adoption in Asia.