From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Bullish: Indian Investments Drive Optimism Despite Vietnamese Output Dip

Asia’s steel market demonstrates a very positive sentiment, primarily driven by substantial investments in India. India’s Jindal Steel Chhattisgarh inks pact to invest $12 billion in local steel and power projects highlights a major capacity expansion. Observed steel plant activity levels offer mixed signals.

The news article India’s JSPL officially renamed as ‘Jindal Steel Limited’ reflects a strategic refocusing that does not show any direct connection with the observed steel plant activity. The ongoing legal complexities surrounding the acquisition of Bhushan Power and Steel Limited (BPSL) by JSW Steel, as reported in India’s Supreme Court to reconsider earlier order scrapping JSW Steel Limited’s acquisition of BPSL, introduces uncertainty into the Indian steel market. No direct influence on satellite-observed activities is visible yet.

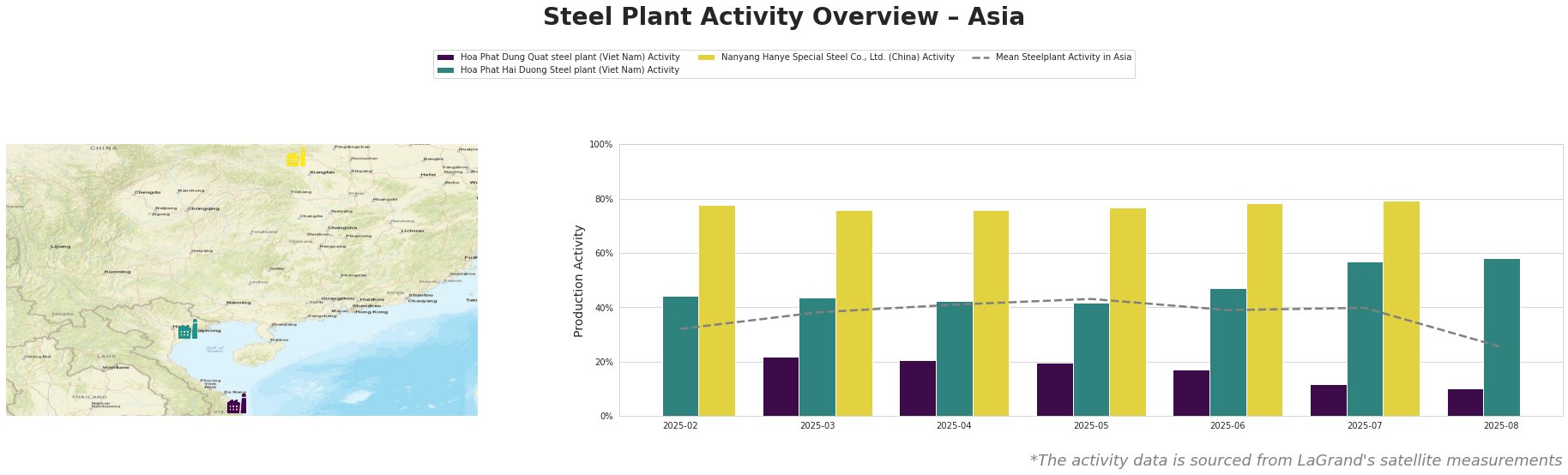

The mean steel plant activity in Asia saw a peak in May at 43.0%. A sharp drop to 25.0% was observed at the end of August.

Hoa Phat Dung Quat steel plant (Viet Nam): This integrated steel plant in Quang Ngai, Vietnam, boasts a crude steel capacity of 5.6 million metric tons per year (mtpy) using basic oxygen furnace (BOF) technology. The plant activity has consistently declined, reaching a low of 10.0% in August, significantly below the Asian average. There is no news directly explaining the observed activity decrease.

Hoa Phat Hai Duong Steel plant (Viet Nam): This integrated steel plant, located in Hai Duong, Vietnam, has a crude steel capacity of 2.5 million mtpy, also utilizing BOF technology. Activity at this plant rose significantly, reaching 58.0% in August, markedly above the observed Asian average. There is no news directly explaining the observed activity increase.

Nanyang Hanye Special Steel Co., Ltd. (China): This integrated steel plant in Henan, China, has a crude steel capacity of 2.588 million mtpy, using BOF technology. Activity at this plant has been consistently high and stable, reaching 79.0% in July. No plant activity was recorded for August. There is no news available to link with the activity trends.

The conflicting signals from the Vietnamese plants, with Dung Quat declining and Hai Duong increasing, suggest a potential shift in production focus within Hoa Phat. Given the $12 billion investment by Jindal Steel Chhattisgarh, the overall Asian market sentiment remains positive.

- For steel buyers: Closely monitor the Hoa Phat Dung Quat plant’s production and supply chains for potential disruptions due to the observed activity decline. Diversify sources if heavily reliant on Dung Quat steel, or consider increased orders with Hoa Phat Hai Duong.

- For market analysts: Further investigate the reasons behind the diverging activity trends of the two Hoa Phat plants, as this could indicate a strategic shift within the company and potentially impact regional steel supply dynamics. Observe the implications of India’s Supreme Court to reconsider earlier order scrapping JSW Steel Limited’s acquisition of BPSL, even if no immediate implications are seen.