From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Braces for Uncertainty Amid US-India Tariff Dispute & Declining Plant Activity

Asia’s steel market faces headwinds due to potential trade disruptions and declining plant activity. The ongoing negotiations between the US and India regarding tariffs are a key factor, highlighted by the news articles “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US” and “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8“. Observed plant activity shows a general decline, but a direct relationship to these news articles is difficult to explicitly establish based on the provided data alone.

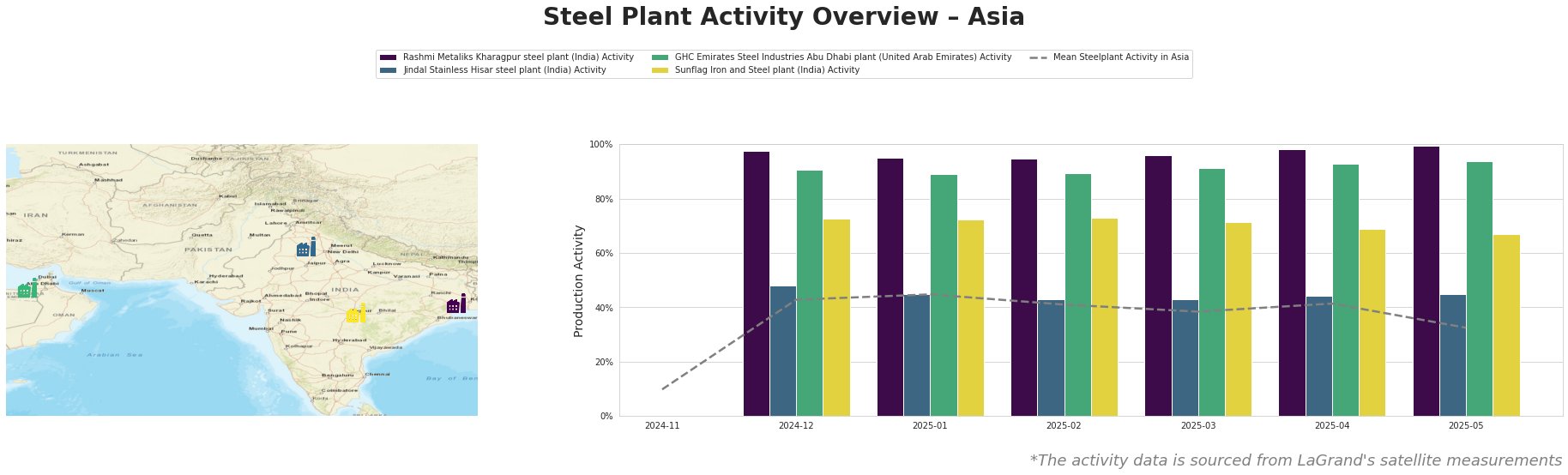

Overall, the mean steel plant activity in Asia has declined from 45% in January 2025 to 32% in May 2025, indicating a weakening trend. Rashmi Metaliks Kharagpur shows consistently high activity, near 100%, throughout the observed period. GHC Emirates Steel also maintains a high activity level, fluctuating slightly but remaining above 89%. Jindal Stainless Hisar’s activity is lower and relatively stable, around 43-48%. Sunflag Iron and Steel experienced a gradual decrease from 73% to 67%.

Rashmi Metaliks Kharagpur steel plant, an integrated producer with a 1.5 million tonne crude steel capacity primarily using DRI technology, shows consistently high activity (98-99%) between December 2024 and May 2025. While the plant’s activity remains robust, the potential impact of US-India tariff disputes on its export markets, as detailed in “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US,” cannot be disregarded.

Jindal Stainless Hisar steel plant, with an 800,000-tonne EAF-based crude steel capacity, shows relatively stable activity between 43% and 48%. Given its focus on stainless steel products for automotive and infrastructure, any disruption from tariffs, as mentioned in “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8“, could affect its supply chain if raw material imports are impacted. No direct correlation between the news articles and the observed plant activity can be established.

GHC Emirates Steel Industries Abu Dhabi plant, a 3.5 million tonne EAF/DRI-based producer, exhibits high activity, increasing from 90% in December 2024 to 94% in May 2025. Given its focus on rebar and construction materials, its activity does not appear to be immediately affected by the US-India trade discussions. No direct connection to the named news articles can be established.

Sunflag Iron and Steel plant, an integrated BF/DRI-based producer with a 500,000-tonne crude steel capacity, has seen a decline in activity from 73% in December 2024 to 67% in May 2025. The cause of this decline is not explicitly evident from the provided news articles.

Evaluated Market Implications:

The potential for a 26% tariff on Indian goods exported to the US, as highlighted in the news articles, poses a downside risk for Indian steel producers, despite current high activity at plants like Rashmi Metaliks Kharagpur. If the tariff dispute is not resolved by July 9, 2025, Indian steel exports to the US could become significantly less competitive. The observed decline in average activity across Asia steel plants could also signal weakening demand.

Recommended Procurement Actions:

- For steel buyers exposed to the US market: Closely monitor the US-India trade negotiations. If an agreement is not reached by July 9, 2025, consider diversifying steel sourcing away from Indian suppliers to mitigate potential price increases and supply disruptions.

- For analysts focusing on Indian steel: Scrutinize the product portfolios of major steel exporters in India, especially Rashmi Metaliks, to assess potential re-routing of exports to other regions if US tariffs materialize, which could increase supply and reduce prices in alternative markets.

- For buyers in the Middle East: Monitor the activity of GHC Emirates Steel. While seemingly unaffected by the US-India dispute, sustained high activity may indicate a tightening regional supply for construction-grade steel products. Consider securing supply contracts or exploring alternative suppliers.

- Monitor Iron Ore Prices: Should the US-India Trade dispute not be resolved by July 9, 2025 it is highly likely that Indian steel production will be reduced and the demand for Iron Ore within India may face a downturn, which might affect the global price for Iron Ore, a key ingredient in steel production.