From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Boosted by US-China Trade Deal: Plant Activity and Procurement Insights

Asia’s steel market sentiment is positive, potentially driven by the preliminary trade agreement between the US and China. This is particularly suggested by the news articles “USA und China erzielen Rahmenabkommen für den Handel“, “Aussenhandel: China und USA erzielen vorläufiges Ergebnis“, “Handelsstreit: China und USA mit Zwischenergebnis“, and “Deal zwischen USA und China – Trump: USA und China haben sich auf einen Handelsdeal geeinigt“. These articles highlight a potential de-escalation of trade tensions, which could positively impact steel demand and production in Asia. However, no direct relationship between specific plant activity changes observed via satellite and the news articles can be definitively established based solely on the provided information.

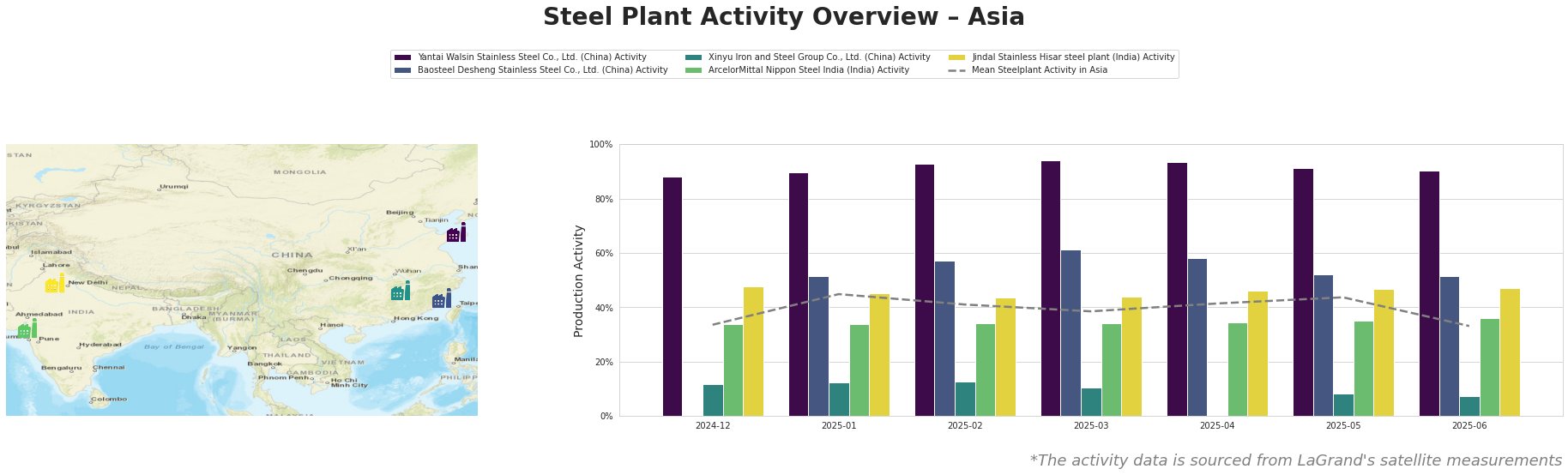

Overall, the mean steel plant activity in Asia fluctuated, peaking at 45% in January 2025 and dipping to 33% in June 2025.

Yantai Walsin Stainless Steel Co., Ltd., a Chinese EAF-based stainless steel producer with a capacity of 1.4 million tonnes, consistently operated at high activity levels, ranging from 88% to 94% throughout the observed period, significantly exceeding the regional mean. The plant’s activity remained consistently high even as the mean activity in Asia decreased, which might indicate a more robust demand for its specific product lines (special steel, stainless steel billets, and rolled steel). A peak in activity was reached in March 2025 (94%) before slightly decreasing to 90% in June 2025.

Baosteel Desheng Stainless Steel Co., Ltd., an integrated BF/BOF-based stainless steel producer in Fujian, China, with a capacity of 3.41 million tonnes, exhibited fluctuating activity. Starting at 51% in January 2025, activity peaked at 61% in March before declining to 52% by June 2025. These fluctuations are above the mean regional activity, but the decrease in the last two months may reflect broader market corrections or specific operational adjustments.

Xinyu Iron and Steel Group Co., Ltd., a large integrated BF/BOF-based steel producer in Jiangxi, China, with a substantial 10 million tonne capacity, operated at significantly lower activity levels compared to the regional mean, with activity consistently remaining around 10% throughout the observed period, dropping to 7% in June 2025. No direct link to the news articles can be established.

ArcelorMittal Nippon Steel India in Gujarat, operating with both BF/DRI-based integrated and EAF processes, showed relatively stable activity, hovering between 34% and 36% throughout the period, close to the overall regional mean.

Jindal Stainless Hisar steel plant in Haryana, India, an EAF-based stainless steel producer with a capacity of 0.8 million tonnes, also demonstrated stable activity levels, ranging from 44% to 48%, indicating consistent production.

Evaluated Market Implications

The consistently high activity at Yantai Walsin suggests a potentially stable supply of their specialized stainless steel products. Conversely, the lower activity at Xinyu Iron and Steel, combined with the fluctuations at Baosteel Desheng, could indicate potential supply instability within China.

Procurement Actions:

- Steel Buyers: Given the potential positive impact of the US-China trade deal on overall steel demand and prices, buyers are recommended to closely monitor price trends. While specific price predictions are impossible without more granular data, locking in contracts for specialized stainless steel from Yantai Walsin may be a prudent strategy to ensure supply stability. Actively diversify procurement sources and consider suppliers outside of China due to potential internal supply adjustments, especially for products similar to those produced by Xinyu Iron and Steel and Baosteel Desheng.

- Market Analysts: Focus on gathering more detailed data on end-user sector demand in Asia to confirm the impact of the US-China trade agreement. Further investigation into Xinyu Iron and Steel’s operational reasons for its low activity level is warranted, as is detailed monitoring of monthly production/shipment data from all major Asian steel plants.