From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Booms on FTA Progress: Plant Activity Surges Amid India-Israel Trade Deal

Asia’s steel market is showing positive momentum, driven by advancements in free trade agreements. Recent satellite observations of steel plant activity coincide with news of strengthened trade relations, particularly between India and Israel. The news articles “India, Israel Finalise Terms For Trade Deal; Piyush Goyal Sees Big Boost To Ties” and “India-Israel FTA Set To Move Faster, First Tranche Can Be Expedited: Piyush Goyal” highlight significant progress, which might indirectly influence steel production and trade in the region, although a direct impact on plant activity cannot be explicitly established from the data.

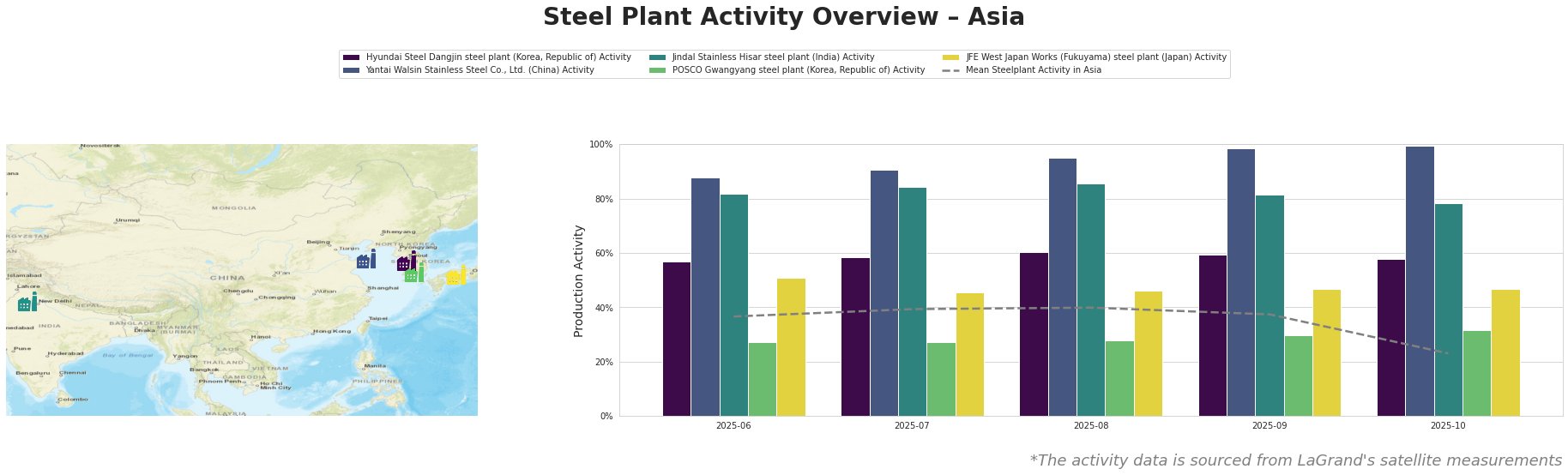

Overall, the mean steel plant activity in Asia peaked in August 2025 at 40% and then experienced a significant drop to 23% by October 2025. Hyundai Steel Dangjin shows relatively stable activity, fluctuating between 57% and 60%. Yantai Walsin Stainless Steel saw continuous growth, reaching a peak activity of 100% in October 2025, significantly above the regional average. Jindal Stainless Hisar shows high activity, though it dipped to 78% in October. POSCO Gwangyang has the lowest activity levels and a slight upward trend, while JFE West Japan Works shows stable activity between 46% and 51%.

Hyundai Steel Dangjin steel plant

Hyundai Steel’s Dangjin plant, an integrated BF/BOF facility with EAF capacity totaling 16.6 million tonnes per annum (ttpa) of crude steel, maintained a relatively stable activity level, ranging from 57% to 60% between June and October 2025. This stability contrasts with the overall regional decline, but no direct connection to the provided news articles regarding FTAs can be established.

Yantai Walsin Stainless Steel Co., Ltd.

Yantai Walsin, an EAF-based stainless steel producer with 1.4 million ttpa capacity, exhibited a strong upward trend, reaching 100% activity in October 2025. This indicates robust demand for its special steel products, including stainless steel billets and coils. No direct connection to the provided news articles regarding FTAs can be established.

Jindal Stainless Hisar steel plant

Jindal Stainless Hisar, an EAF-based stainless steel producer with 0.8 million ttpa capacity, operated at high activity levels. A slight dip to 78% in October 2025 was observed. This plant produces various stainless steel products for multiple sectors. No direct connection to the provided news articles regarding FTAs can be established.

POSCO Gwangyang steel plant

POSCO Gwangyang, a major integrated BF/BOF steel plant with a 23 million ttpa crude steel capacity, recorded consistently low activity, ranging from 27% to 32%. This is significantly below the regional average. The plant produces a wide range of finished rolled products. No direct connection to the provided news articles regarding FTAs can be established.

JFE West Japan Works (Fukuyama) steel plant

JFE West Japan Works (Fukuyama), an integrated BF/BOF steel plant with 13 million ttpa capacity, maintained relatively stable activity, fluctuating between 46% and 51%. This plant produces a wide array of steel products. No direct connection to the provided news articles regarding FTAs can be established.

Evaluated Market Implications:

The finalized trade agreement between India and Israel, as reported in “India, Israel Finalise Terms For Trade Deal; Piyush Goyal Sees Big Boost To Ties” and “India-Israel FTA Set To Move Faster, First Tranche Can Be Expedited: Piyush Goyal,” may lead to increased demand for Indian steel. While no direct correlation is seen in the satellite data, if demand increases, steel buyers should consider forward purchasing from Indian mills, particularly Jindal Stainless Hisar, which has been running at high capacity utilization, to secure supply. Buyers should closely monitor capacity utilization, particularly as the “First Tranche” of the India-Israel trade agreement is expedited.