From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Booming: Production Surges Amidst EU Trade Concerns

Asia’s steel market shows strong activity amidst evolving EU trade dynamics. Increased steel plant activities are possibly unaffected by the European Commission’s considerations for new steel safeguard measures, as highlighted in “The EC has launched consultations on replacing protective measures for steel,” “EU launches consultation on new steel safeguard measures to combat trade risks,” and “European Commission starts consultation on new trade measures to replace steel safeguards“. Satellite data does not directly link observed Asian steel plant activity levels to these EU consultations.

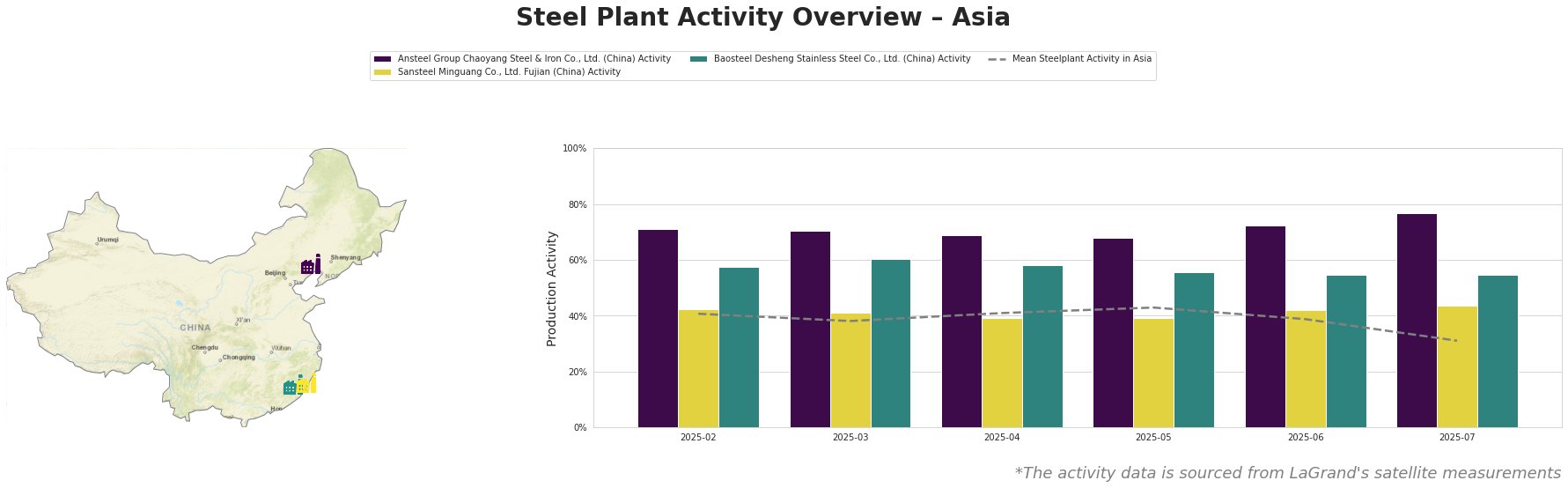

The mean steel plant activity in Asia fluctuated, with a peak of 43% in May and a recent drop to 31% in July. Ansteel Group Chaoyang Steel & Iron Co., Ltd. consistently operated significantly above the Asian mean, peaking at 77% in July, marking a significant rise of 9 percentage points since May. Sansteel Minguang Co., Ltd. Fujian remained close to the mean activity, ending at 44% in July. Baosteel Desheng Stainless Steel Co., Ltd. also showed relatively stable activity around the mean until July.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., a major integrated steel plant in Liaoning province with a 2,100 thousand tonnes per annum (ttpa) BOF crude steel capacity, has shown consistently high activity. The plant’s reliance on BF-BOF production suggests strong domestic demand for its steel plate and pipe products. A rise from 68% in May to 77% in July could indicate increased domestic orders or restocking efforts, potentially independent of the trade concerns highlighted in the news articles, as no direct relationship can be established.

Sansteel Minguang Co., Ltd. Fujian, another integrated BF-BOF steel plant with a larger 6,800 ttpa crude steel capacity, produces finished rolled products, including construction steel. Its activity levels remained consistently near the Asian mean, suggesting it reflects the general market trend in Asia. There is no clear connection between its production activity and the EU safeguard discussions as observed in the news articles.

Baosteel Desheng Stainless Steel Co., Ltd., located in Fujian, has a 3,410 ttpa crude steel capacity, primarily dedicated to stainless steel production using the integrated BF-BOF process. Its activity has remained relatively stable, showing only minor fluctuations. There is no indication that the EU trade consultations are impacting its production strategy, indicating a primary focus on regional Asian markets, as no direct relationship can be established.

Given Ansteel Group Chaoyang Steel & Iron Co., Ltd.’s high activity levels, steel buyers focused on steel plates and pipes should monitor price developments closely. While no immediate supply disruptions are apparent based on the provided data, the continued high activity suggests robust demand and potential for upward price pressure. Procurement professionals should proactively engage with suppliers to secure favorable terms, particularly for construction steel. Steel analysts should further investigate domestic demand drivers for finished rolled products, and steel plate, in mainland China to anticipate future price trends.