From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Bolstered by Strong Plant Activity Despite US Import Shifts

Asia’s steel market shows strong plant activity, although developments in the US steel market might impact global trade flows. This report analyzes Asian steel plant activities in light of recent US import changes noted in “US Rolled Steel Coil Imports and Exports Decline in April” and “US HRC imports down 28.6 percent in April from March,” even though no immediate impact can be established directly from these articles to Asian plant activity. While the US experienced a dip in HRC imports in April, followed by an increase in May (“US increased its imports of rolled steel by 10.4% m/m in May“), Asian steel producers maintained robust activity levels, potentially positioning them to capitalize on shifting global demand dynamics.

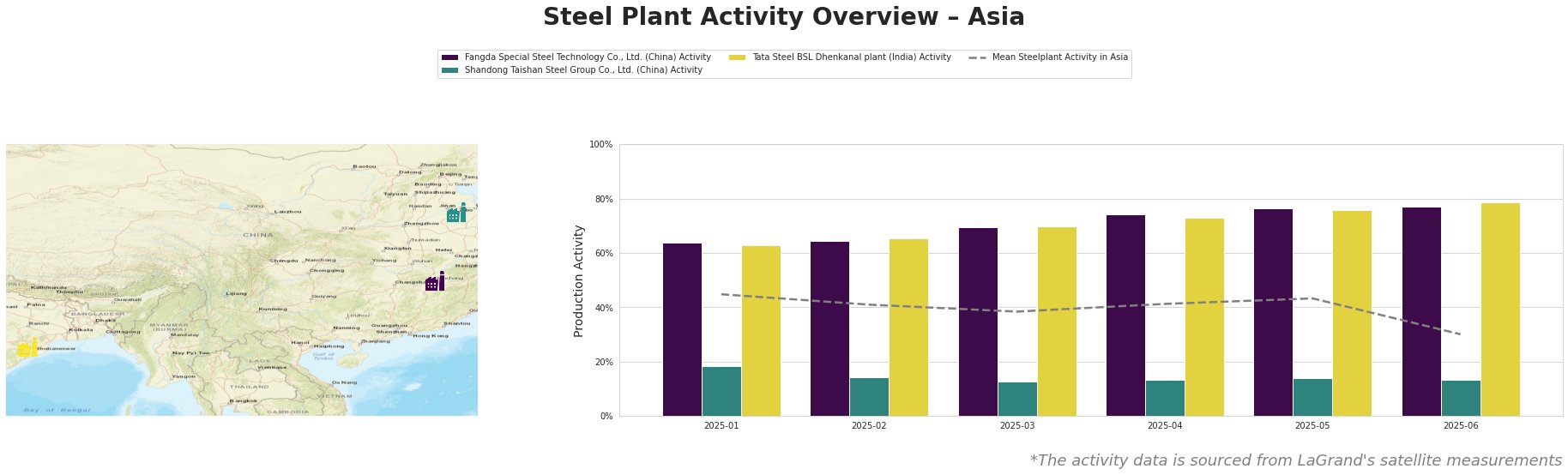

The mean steel plant activity in Asia saw fluctuation, peaking in January at 45% and gradually declining to 30% by June. Fangda Special Steel Technology Co., Ltd. consistently operated above the Asian average. Activity at Fangda Special Steel increased steadily from 64% in January to 77% in May, holding steady through June. Shandong Taishan Steel Group Co., Ltd. activity remained consistently low, ranging between 13% and 18% throughout the observed period, significantly below the regional average. Tata Steel BSL Dhenkanal plant saw a steady increase in activity from 63% in January to a peak of 79% in June, substantially outperforming the regional average.

Fangda Special Steel Technology Co., Ltd., a major Chinese steel producer in Jiangxi province with a 3.6 million tonne BOF-based crude steel capacity, has exhibited robust activity levels throughout the period. Its activity consistently outpaced the regional average, rising from 64% in January to 77% by May and holding steady in June. Given its specialization in finished rolled products like spring flat steel and alloy structural round steel, this sustained high activity suggests strong domestic demand. No direct connection to the US import news can be established.

Shandong Taishan Steel Group Co., Ltd., located in Shandong, China, operates an integrated BF-BOF steel plant with a crude steel capacity of 5 million tonnes. Unlike Fangda, its activity remained consistently low, fluctuating between 13% and 18%. Producing hot-rolled coil and cold-rolled coil, the low activity may reflect maintenance, strategic production cuts, or other operational factors. Given the lack of specific news regarding Shandong Taishan Steel Group Co., Ltd., a direct link between activity and news articles cannot be established.

Tata Steel BSL Dhenkanal plant, located in Odisha, India, boasts a 5.6 million tonne crude steel capacity utilizing both BF and DRI routes. Its activity steadily increased from 63% in January to 79% in June, outpacing the regional average. As a producer of hot-rolled coil and sheets, this increase indicates rising demand in the Indian market. No connection to any of the named news articles can be established.

Despite the reported changes in US steel imports and exports, the observed strong activity at Fangda Special Steel and Tata Steel BSL suggests stable or growing regional demand in Asia. This, however, requires steel buyers to adapt by verifying current supplier production capacities.

Recommended Procurement Actions: Steel buyers should prioritize securing contracts with producers like Fangda Special Steel and Tata Steel BSL who demonstrate consistent high activity to mitigate potential supply disruptions. Given the US market’s fluctuating import behavior reported in “US increased its imports of rolled steel by 10.4% m/m in May” procurement professionals should closely monitor global trade flows. Verify production capacity to ensure reliable fulfillment and consider diversifying suppliers, including Indian and Chinese mills with demonstrated high capacity utilization, to reduce reliance on single sources.