From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Bolstered by New HBI Capacity Amidst Automation Surge

Asia’s steel market shows a very positive sentiment, driven by significant investments in new Hot Briquetted Iron (HBI) production capacity in Kazakhstan and advanced automation upgrades in China. The observed activity changes align with announcements like “ERG to build $1.2 billion HBI plant in Kazakhstan with Primetals and Midrex,” signaling long-term capacity expansion. While some monthly activity fluctuations are noted, these appear unrelated to the structural shifts indicated by the investment news.

The construction of new HBI plants, directly linked to news articles such as “Eurasian Resources Group to become global supplier of HBI,” implies a future shift in global HBI supply dynamics, especially with the plant utilizing MIDREX Flex technology to potentially transition to hydrogen. Simultaneously, upgrades to existing plants, as indicated by “HBIS Tangsteel accepts world’s largest push-pull pickling line from Primetals” and “Primetals implements advanced process automation systems at Rizhao Steel plant,” underscore a drive for improved efficiency and quality in Chinese steel production.

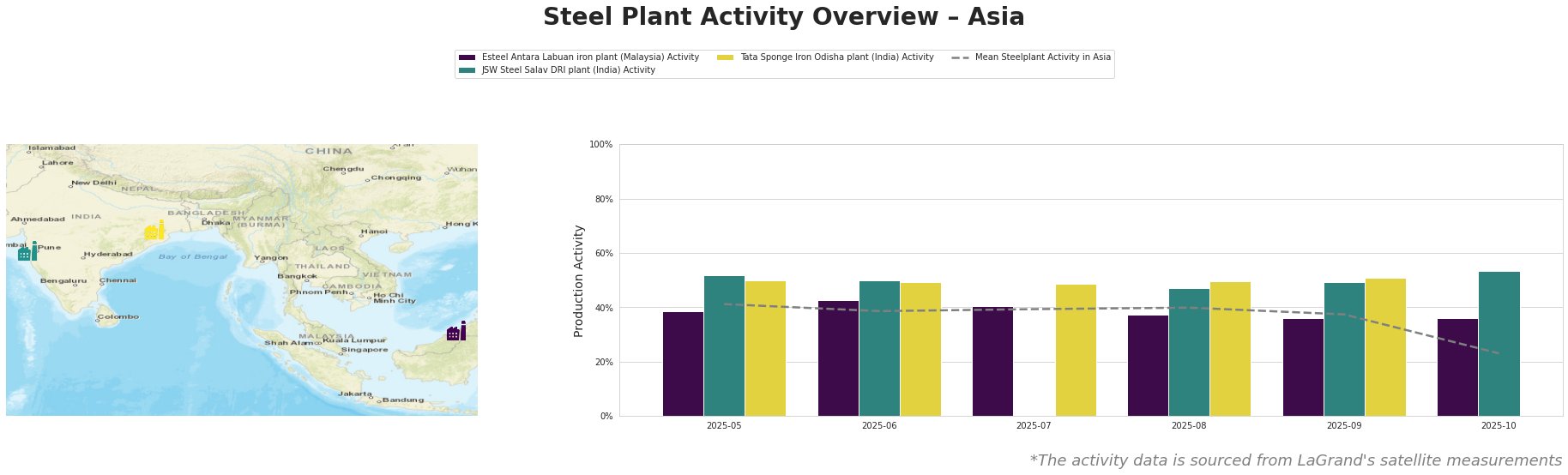

The mean steel plant activity in Asia saw a significant drop in October 2025 to 23.0, significantly below the previous months. This abrupt decline does not appear to be directly linked to any of the provided news articles, suggesting potentially unobserved factors influencing overall production, such as regional demand fluctuations or temporary shutdowns for maintenance.

Esteel Antara Labuan iron plant (Malaysia): This plant specializes in ironmaking via DRI technology, specifically producing HBI. The plant has a DRI capacity of 900 thousand tons per annum. Its activity level fluctuated between 36% and 43% during the observed period, ending at 36% in October. This is below the average, No direct connection can be established between these activity levels and the provided news articles.

JSW Steel Salav DRI plant (India): This DRI plant in Maharashtra, India, boasts a DRI capacity of 1 million tons annually, producing both DRI and HBI. Its activity levels have been consistently above the observed average activity for all steel plants in Asia, reaching 53% in October 2025. No direct connection can be established between these activity levels and the provided news articles.

Tata Sponge Iron Odisha plant (India): With a DRI capacity of 400 thousand tons per annum, the Tata Sponge Iron plant in Odisha primarily produces DRI. The plant’s activity levels have remained relatively stable, ranging from 49% to 51% during the observed period, showing a slight increase compared to the average. No direct connection can be established between these activity levels and the provided news articles.

The developments in Kazakhstan, particularly the investment in HBI production as highlighted in “ERG to build HBI plant in Kazakhstan worth more than $1.2 billion,” will likely impact the long-term supply dynamics of high-quality iron feedstock. The projects should result in a stable and growing market overall.

Evaluated Market Implications and Procurement Actions:

- Long-Term HBI Supply Shift: The new HBI capacity in Kazakhstan, as reported in multiple ERG-related articles, will increase global HBI availability.

- Recommended Action for Steel Buyers: Steel buyers should monitor the progress of the ERG plant and explore potential long-term supply contracts to secure access to HBI.

- Chinese Steel Quality and Efficiency Gains: The implementation of advanced automation systems at HBIS Tangsteel and Rizhao Steel plants, documented in “HBIS Tangsteel accepts world’s largest push-pull pickling line from Primetals” and “Primetals implements advanced process automation systems at Rizhao Steel plant,” will improve the quality and efficiency of steel production in China.

- Recommended Action for Steel Analysts: Market analysts should track the impact of these technology upgrades on Chinese steel exports and pricing.

- Unexplained Activity Drop: The significant drop in overall Asian steel plant activity in October 2025 warrants careful monitoring.

- Recommended Action for Procurement: Diversify steel procurement and stay informed on the specific factors impacting production in the short term to mitigate potential supply chain risks.