From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Anticipates Price Pressure Amidst Fluctuating Plant Activity

In Asia, steel market sentiment remains positive, despite fluctuations in plant activity amidst global price increases. Although price increase news originated in North America ( “Canadian steel companies announce steel price increases“, “American steel producers are gradually raising prices for rolled products“, “NLMK USA raises prices for hot-rolled and cold-rolled steel by $50/t“), the potential impact on global markets, including Asia, warrants close monitoring. No direct relationship between these price increases and the observed plant activity levels in Asia can be definitively established based on the provided information.

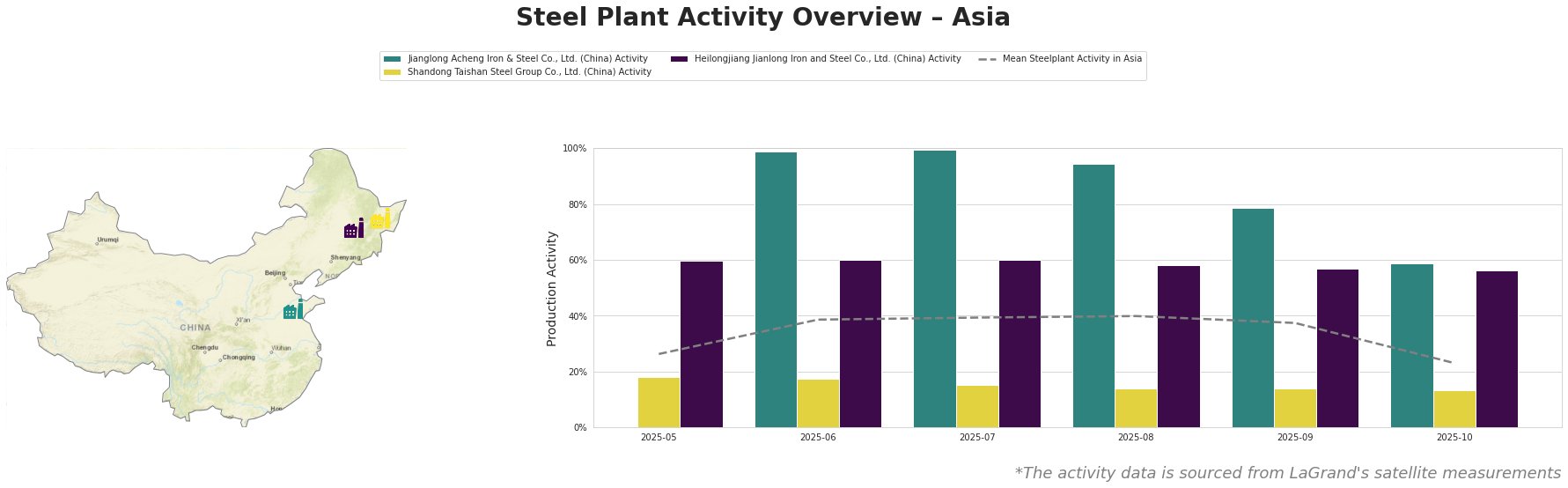

Overall, average steel plant activity in Asia exhibited a downward trend from August (40%) to October (23%). Jianglong Acheng Iron & Steel Co., Ltd. demonstrates activity consistently above the Asian average, peaking at 100% in July before decreasing to 59% in October. Shandong Taishan Steel Group Co., Ltd. shows consistently low activity, hovering around 13-18%. Heilongjiang Jianlong Iron and Steel Co., Ltd. maintains relatively stable activity, ranging between 56-60%. No explicit connection between these trends and the provided news articles can be established.

Jianglong Acheng Iron & Steel Co., Ltd., a Heilongjiang-based integrated steel plant with a crude steel capacity of 1.1 million tonnes, utilizes BOF technology and focuses on hot-rolled and coated steel products for the automotive, energy, and machinery sectors. Its activity peaked at 100% in July but experienced a drop to 59% by October. Given its focus on finished rolled products, potential impacts from North American price hikes may affect its export competitiveness, though no explicit connection can be established.

Shandong Taishan Steel Group Co., Ltd., located in Shandong, has a crude steel capacity of 5 million tonnes and utilizes BF, BOF, and EAF technologies. The plant produces hot-rolled coil, cold-rolled coil, and stainless steel. Its activity has remained consistently low at around 13-18% throughout the observed period. No explicit connection between this activity level and the provided news articles can be established.

Heilongjiang Jianlong Iron and Steel Co., Ltd., also in Heilongjiang, possesses a crude steel capacity of 2 million tonnes, employing BF and BOF processes. It produces hot-rolled ribbed steel bars, seamless steel tubes, and rebar. The plant’s activity has remained relatively stable between 56% and 60%. This plant’s focus on rebar could be influenced by the American price increases for rolled steel products, however, no explicit connection can be made.

Based on the observed decline in average Asian steel plant activity and concurrent price increases in North America, potential supply disruptions could emerge if Asian plants do not maintain or increase production levels. Steel buyers and analysts should:

- Monitor Jianglong Acheng Iron & Steel Co., Ltd. activity: Its recent activity decline, despite high prior levels, warrants close observation.

- Secure supply for hot-rolled and coated products: Given Jianglong Acheng’s focus on these products and the North American price hikes for similar products (“NLMK USA raises prices for hot-rolled and cold-rolled steel by $50/t”), buyers should proactively secure supply contracts to mitigate potential price increases or shortages.

- Diversify suppliers: The consistently low activity at Shandong Taishan Steel Group Co., Ltd., should encourage buyers to broaden their supplier base to reduce reliance on any single source.