From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Analysis: Positive Trends Amid Trade Dynamics

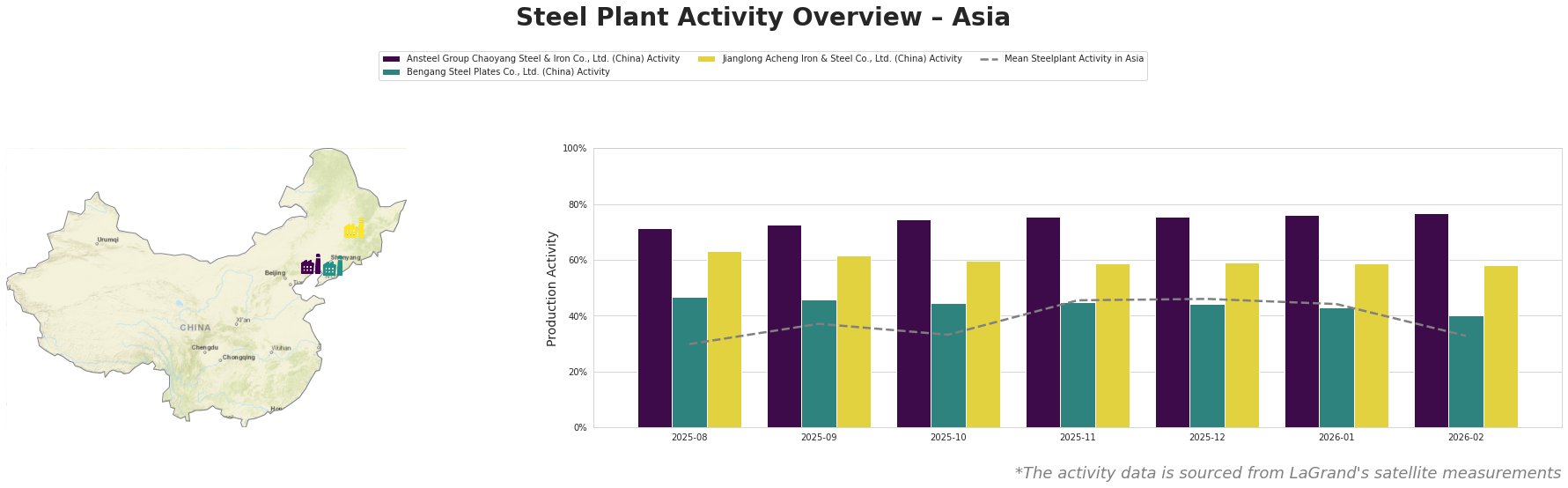

In Asia, steel market sentiment remains very positive, driven by notable changes in plant activity levels. Recent coverage, such as “European Parliament agrees EU-US trade deal terms“, outlines new trade agreements which could influence regional steel procurement dynamics, although no direct correlation to plant activity was established. Nonetheless, satellite imagery indicates fluctuations in operational levels at key plants like Ansteel Group Chaoyang Steel & Iron Co., Ltd.

Activity for Ansteel Group has generally risen, reaching a high of 77.0% by February 2026. This peak aligns with the ongoing regional demand for products amidst changes in global trade dynamics but does not present a direct link to the EU-US trade agreement developments. Bengang Steel exhibits a mild decline to 40.0% in February, with no identifiable justification linked to current reported news. In comparison, Jianglong Acheng remains stable, hovering around 58.0%, indicating consistent demand for its finished rolled products.

Ansteel Group’s significant activity is supported by its integrated production processes within Liaoning, specifically utilizing BOF technologies, producing steel plate and pipes. Meanwhile, Bengang Steel’s capacity for automotive plates and other applications might respond favorably to shifts from the EU-US trade resolutions. Nevertheless, the absence of specific geopolitical ties makes it challenging to pinpoint the direct effect on plant outputs.

Supply disruptions may occur in the region if geopolitical tensions escalate, particularly surrounding the trade agreements mentioned in “The EU reserves the right to restore duties on steel from the USA“ and “The European Parliament has unblocked a trade agreement with the US under new conditions“.

For steel buyers, maintaining flexibility in procurement strategies is crucial. Monitoring developments from the EU-US agreements will be essential in mitigating risks associated with tariffs and establishing ordering patterns that align with observed activity trends in local plants. Focus should also be placed on diversifying supply sources, particularly leveraging high-performing firms like Ansteel to ensure continuity in supply as the market evolves amid these changing trade landscapes.