From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Alert: US Shutdown Clouds Outlook Amid Activity Downturn

The Asian steel market faces increased uncertainty due to the US government shutdown and declining plant activity. The shutdown, detailed in “US government shutdown delays construction data,” “Fed shutdown disrupts most USDA data releases,” and “US gov shutdown lowers shroud on jobs, inflation data,” disrupts the flow of economic information, complicating demand forecasting. Observed activity levels across several key Asian steel plants have decreased in the most recent period (October), as captured by satellite monitoring. However, no direct causal link between the US government shutdown and Asian steel production activity can be explicitly established based on the provided news articles.

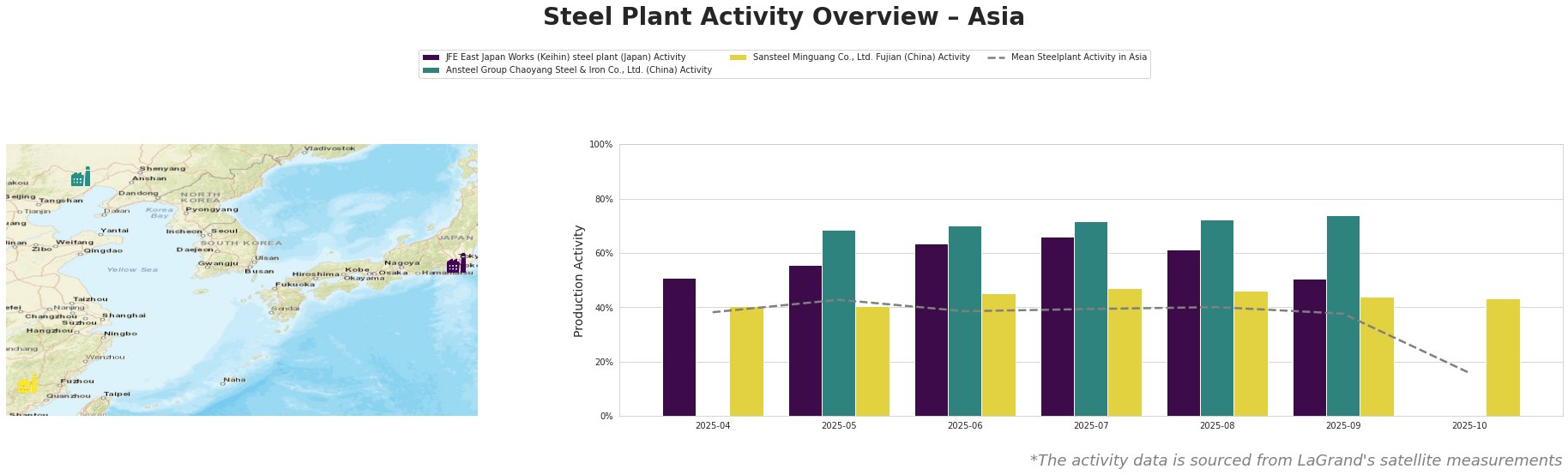

Overall, the mean steel plant activity in Asia experienced a significant decrease to 16% in October, a notable drop from the previous months, with September reporting 38%. Throughout April to September, mean steel plant activity fluctuated between 38% and 43%.

JFE East Japan Works (Keihin) steel plant, an integrated BF/BOF steel plant with a crude steel capacity of 4.075 million tonnes, showed relatively consistent activity between April and September, fluctuating from 51% to 66%. However, activity data for October is currently unavailable. This plant’s product portfolio includes sheets, stainless steel, plates, and pipes. It is worth noting that the BF and BOF are planned for shutdown by FY2023. No direct link between observed activity levels and the provided news articles can be established.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., a BF/BOF based steel plant in Liaoning with a capacity of 2.1 million tonnes, shows an increase in activity levels between May and September, reaching a peak of 74% in September. Activity data for April and October are not available. The plant produces finished rolled products such as steel plates and pipes. No direct relationship between the activity and the named news articles can be established.

Sansteel Minguang Co., Ltd. Fujian, an integrated BF/BOF steel plant with a capacity of 6.8 million tonnes, maintained a relatively stable activity level between 41% and 47% from April to September, dropping slightly to 43% in October. This plant primarily produces finished rolled products, including steel plates, round bars, and construction steel, serving the building, infrastructure, transport, and machinery sectors. No direct connection between these activity levels and the US government shutdown, as reported in the provided news articles, can be explicitly established.

The US government shutdown, as detailed in the provided articles, introduces significant uncertainty into the market. The shutdown’s impact on US construction data (“US government shutdown delays construction data“) and USDA export sales data (“Government shutdown halts USDA export sales report“) creates opacity in demand forecasting, indirectly affecting Asian steel exports to the US. The shutdown may also impact broader economic indicators (“US gov shutdown lowers shroud on jobs, inflation data,” “Fed shutdown disrupts most USDA data releases“), potentially influencing global steel demand.

Given the negative overall market sentiment, the sharp decline in average steel plant activity in Asia, and the increased uncertainty caused by the US government shutdown and its impacts on data availability:

- Steel buyers should: Closely monitor alternative, non-governmental data sources to compensate for the delayed US data releases. Specifically, focus on regional demand indicators within Asia to gauge immediate steel needs. Consider short-term procurement strategies to mitigate potential supply chain disruptions, but delay long-term commitments until the US government shutdown resolves and economic data stabilizes.

- Market analysts should: Prioritize analyzing high-frequency data and regional economic indicators to assess the true impact of the shutdown on Asian steel demand, given the lack of transparency. Further investigate the large drop in activity in October, as potential causes cannot be linked to the provided news articles. Analyze specific product segments (e.g., construction steel for Sansteel Minguang) to identify areas most vulnerable to US-related disruptions.