From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Shifts Amid Tech Sector Uncertainty

In Asia, steel plant activity displays mixed trends amidst growing concerns in the technology sector. Notably, while no immediate link can be established, increased plant inactivity levels come at a time when challenges in the Chinese market are impacting major tech players, as evidenced by the article “Synopsys set to wipe out 2025 gains as shares tank on China business woes“. The article “China schlägt zu: Schock‑Vorwurf gegen Nvidia” further underscores the uncertainty in the region’s tech landscape, though no direct relation to steel plant activity can be established at this time.

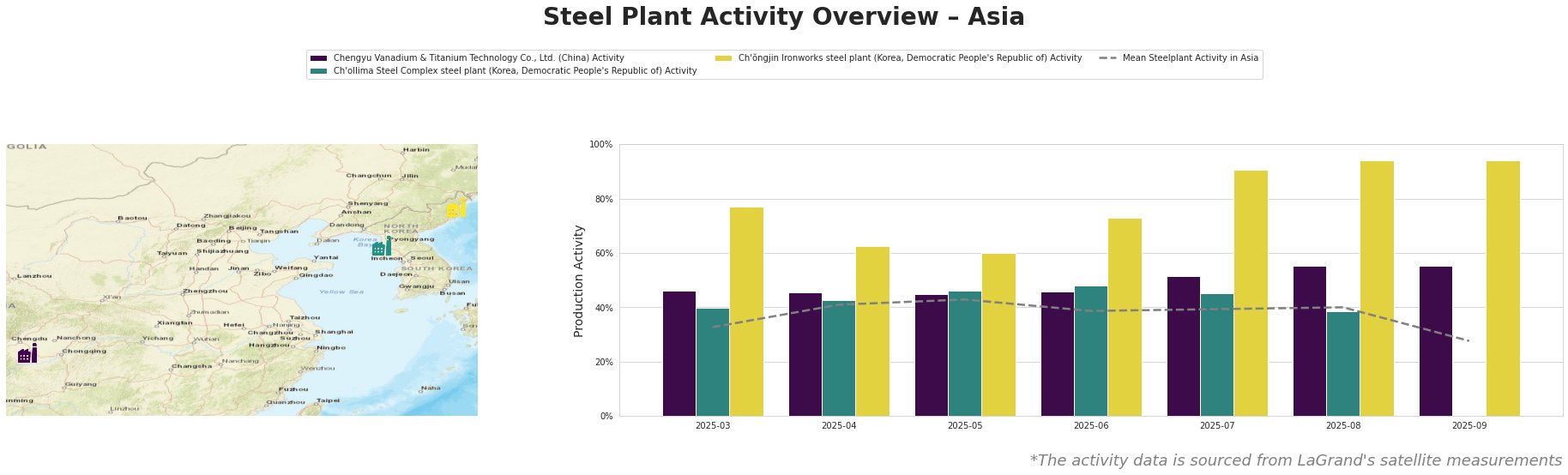

The mean steel plant activity in Asia decreased to 28% in September, a notable drop from the 40% observed in August. Chengyu Vanadium & Titanium Technology Co., Ltd. has steadily increased its activity, reaching 55% in August and maintaining that level in September, contrasting the overall regional decline. Activity at the Ch’ŏngjin Ironworks steel plant remains high, consistently above 60% and peaking at 94% in August and September. In contrast, Ch’ollima Steel Complex steel plant activity fluctuated and dropped to below 40% in August, with no data available for September.

Chengyu Vanadium & Titanium Technology Co., Ltd., located in Sichuan, China, primarily produces vanadium-containing hot-rolled ribbed steel bars and steel wire rods using integrated BF and BOF processes. The plant has a crude steel capacity of 6000 ttpa and is ResponsibleSteel certified. The activity level has been consistently increasing and bucking the regional downward trend, however there is no clear linkage between this and the provided news articles.

The Ch’ollima Steel Complex steel plant in South Pyongan, North Korea, produces plates and wire rods. Its capacity stands at 760 ttpa. Activity decreased from 48% in June to 39% in August. No activity level is observed for September, suggesting a potential production halt; however, this cannot be linked to any of the provided news articles.

The Ch’ŏngjin Ironworks steel plant, located in North Hamgyeong, North Korea, produces slab and plate, utilizing integrated DRI processes and equipment including BOF and EAF, reaching a crude steel capacity of 2000 ttpa. The plant’s activity has been consistently high, maintaining 94% in both August and September. There is no clear connection to the provided news articles.

The observed drop in mean steel plant activity across Asia, particularly the reduction in activity and missing data for the Ch’ollima Steel Complex, could indicate potential supply disruptions, particularly for plates and wire rods. Steel buyers should closely monitor this situation and consider diversifying their supply sources. Given the high and stable activity levels at Ch’ŏngjin Ironworks steel plant, it could serve as a reliable supplier for slab and plate in the short term.