From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Mixed Despite Climate Pressure, China’s Production Key

Asia’s steel market presents a mixed picture as climate targets face scrutiny, with observed plant activity varying across the region. While the news articles “Cop: Climate plans project 12pc GHG cuts over 2019-35” and “Cop: Report says 2035 targets ‘make no difference’” highlight the ongoing pressure to reduce emissions, this does not appear to have a direct or immediate impact on observed steel plant activity levels. Negotiations are ongoing, with the article “Cop: Progress on divisive issues, but talks continue” suggesting possible future impacts but no concrete changes yet.

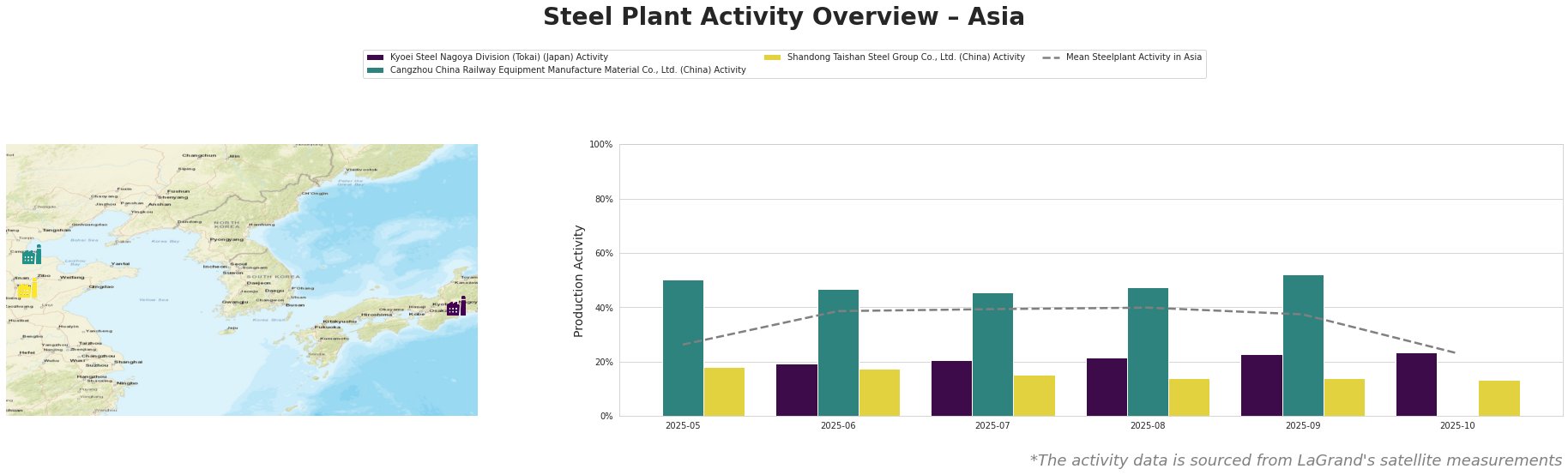

The mean steel plant activity in Asia fluctuated, peaking at 40% in August before dropping to 23% in October. Kyoei Steel Nagoya Division (Tokai) maintained a relatively stable activity level, increasing slightly from 19% in June to 23% in October. Cangzhou China Railway Equipment Manufacture Material Co., Ltd. showed higher activity, fluctuating between 45% and 52% from May to September. Shandong Taishan Steel Group Co., Ltd. exhibited a gradual decline in activity from 18% in May to 13% in October. No direct connection between these activity levels and the provided news articles can be established.

Kyoei Steel Nagoya Division (Tokai), a Japanese steel plant with a 1,264 ttpa crude steel capacity focused on EAF production of rebars for building and infrastructure, showed a gradual increase in activity from June (19%) to October (23%). This steady increase contrasts with the overall Asian mean but doesn’t have a clear link to the climate-focused news articles. Its ResponsibleSteel certification may play a role in maintaining stable operations amidst increasing environmental scrutiny.

Cangzhou China Railway Equipment Manufacture Material Co., Ltd., a major Chinese integrated steel producer with a 7,500 ttpa capacity utilizing BF and BOF technologies for high-quality hot-rolled coils used in tools, machinery, and transport, demonstrated relatively high activity levels, peaking at 52% in September. While the articles “Cop: Climate plans project 12pc GHG cuts over 2019-35” and “Cop: Report says 2035 targets ‘make no difference’” point to pressure on emissions, no immediate impact on Cangzhou’s output can be directly established from the observed data, despite its high emissions production route.

Shandong Taishan Steel Group Co., Ltd., another Chinese steel plant with a 5,000 ttpa capacity using both BF/BOF and EAF processes for hot and cold rolled coils and stainless steel, experienced a continuous decline in activity from May (18%) to October (13%). This contrasts with Cangzhou’s higher activity and highlights varied responses within the Chinese steel sector. While the climate negotiations continue, no explicit connection to the observed decline can be established.

Given the overall very positive sentiment, high activity levels in some Chinese plants, and the potential for future supply adjustments due to climate negotiations, procurement professionals should:

- Closely monitor price fluctuations for hot-rolled coils due to Cangzhou China Railway Equipment Manufacture Material Co., Ltd.’s stable output.

- Negotiate longer-term contracts with Kyoei Steel Nagoya Division (Tokai) for rebars, capitalizing on their consistent production amidst uncertainty.

- Prepare for potential disruptions in supply of coils and stainless steel from Shandong Taishan Steel Group Co., Ltd. and proactively identify alternative suppliers.