From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Mixed Amidst OPEC+ Output Decisions

Asia’s steel market presents a neutral outlook amidst fluctuating plant activity and external pressures from the energy sector. Recent satellite observations show varied activity levels across key steel plants in the region, though no direct relationships to the articles “Opec+ eight move July output meeting to 31 May“, “Opec+ reaffirms formal output policy“, “Opec+ eight agree 411,000 b/d hike for July: Update“, and “Opec+ keeping options open on output hike: Kazakh min“ can be explicitly established.

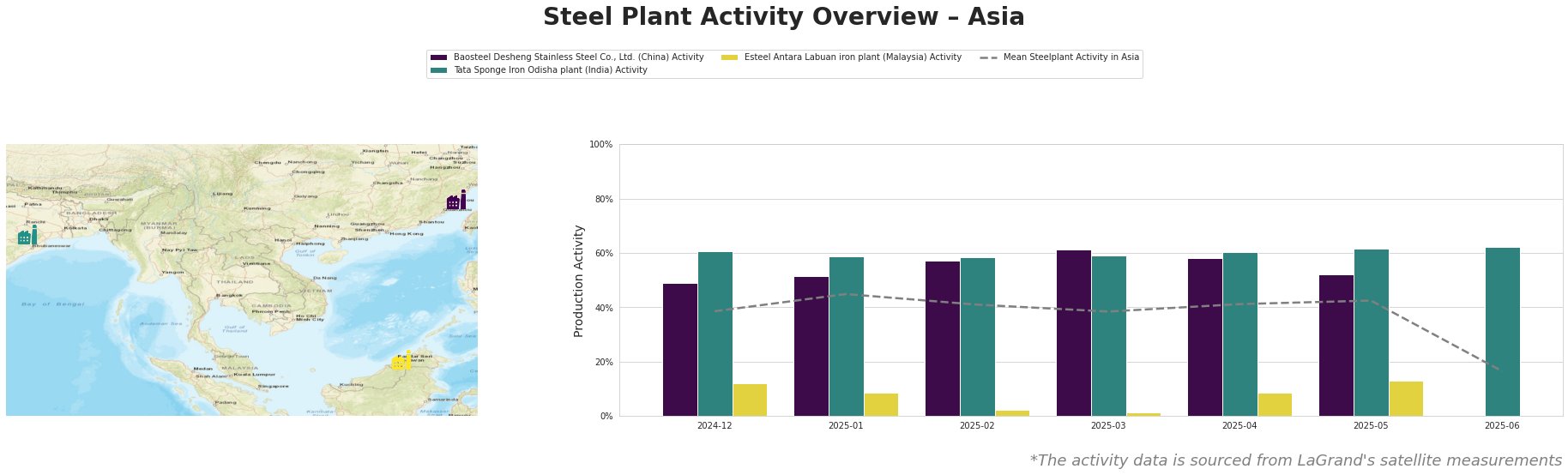

The mean steel plant activity in Asia fluctuated between 38% and 45% from December 2024 to May 2025, before dropping to 16% in June 2025.

Baosteel Desheng Stainless Steel Co., Ltd., a large integrated BF/BOF stainless steel producer in Fujian, China with a crude steel capacity of 3.41 million tonnes, showed a peak in activity in March 2025 at 61%, but has seen a decrease to 52% in May 2025. Activity data is unavailable for June 2025. No direct connection between these changes and the OPEC+ announcements can be established based on the provided information.

Tata Sponge Iron Odisha plant, an Indian DRI producer with a capacity of 400,000 tonnes of iron, maintained high activity levels, reaching 62% in May and June 2025. This represents the highest observed levels for this plant. No direct connection between these stable activity levels and the OPEC+ announcements can be established based on the provided information.

Esteel Antara Labuan iron plant, a Malaysian DRI producer with a capacity of 900,000 tonnes of iron, demonstrated significantly lower activity levels compared to the regional mean. Activity was at only 13% in May 2025, with activity data unavailable for June 2025. This follows a period of very low activity of 1% in March 2025. No direct connection between these activity changes and the OPEC+ announcements can be established based on the provided information.

Evaluated Market Implications:

The OPEC+ decisions on crude oil production, as detailed in “Opec+ eight move July output meeting to 31 May”, “Opec+ reaffirms formal output policy”, “Opec+ eight agree 411,000 b/d hike for July: Update”, and “Opec+ keeping options open on output hike: Kazakh min”, have implications for energy costs associated with steel production. However, no direct connection can be established between these specific news articles and observed activity level changes at the selected steel plants.

Recommended Procurement Actions:

- Given the consistent high activity at Tata Sponge Iron Odisha plant, steel buyers should consider securing DRI supply contracts with this producer to mitigate potential regional supply shortages.

- Monitor energy prices closely following OPEC+ meetings. Though a direct correlation between OPEC+ announcements and steel plant activity levels cannot be established based on the provided data, changes in crude oil prices can indirectly impact steel production costs.