From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Declines Amid US Steel Deal Uncertainty

The Asian steel market faces uncertainty as observed plant activity declines amid ongoing scrutiny of the potential Nippon Steel acquisition of US Steel. The news articles “Nippon Steel ready to invest $14 billion in US Steel if deal approved – Reuters“, “A steely challenge for Trump: Accept or block the deal with Japan again“, “USW calls on Trump to reject USS, Nippon deal“, and “US steelworkers urge Trump to block US Steel acquisition” highlight the complex political and economic factors influencing the global steel landscape, although no direct link to the plant activity in Asia has been found.

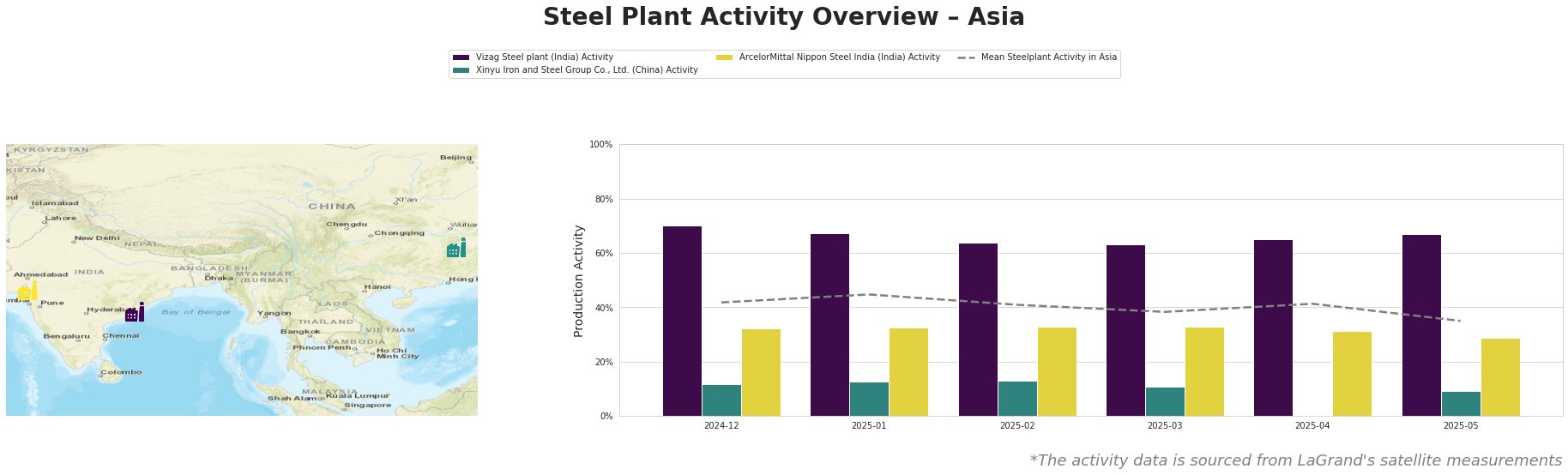

The mean steel plant activity in Asia has shown a generally decreasing trend, from 45.0 in January 2025 to 35.0 in May 2025, indicating a slowdown in overall production. Vizag Steel plant activity remains significantly above the Asian mean throughout the observed period, exhibiting relative stability between 63.0 and 70.0. Xinyu Iron and Steel Group Co., Ltd. shows the lowest activity levels and a decreasing trend, dropping to 9.0 in May 2025. ArcelorMittal Nippon Steel India shows relatively stable activity, around 33.0, but decreased to 29.0 in May 2025.

Vizag Steel plant in Andhra Pradesh, India, an integrated BF steel plant with a 7.3 million tonne crude steel capacity, has maintained a consistently high activity level relative to the Asian average. The plant utilizes BOF technology and produces semi-finished and finished rolled products for the building and infrastructure sectors. Despite the general downward trend in Asian activity, Vizag Steel Plant’s levels have remained high throughout the observed period. No direct connection can be established between these observations and the news articles regarding the potential US Steel acquisition.

Xinyu Iron and Steel Group Co., Ltd., located in Jiangxi, China, is an integrated BF steel plant with a 10 million tonne crude steel capacity. Its activity has been consistently low and declining, reaching 9.0 in May 2025, significantly below the Asian average. The plant produces finished rolled products, including plates for energy, building, infrastructure, and transport sectors. The observed decline in activity does not appear to be directly related to the news surrounding Nippon Steel’s US Steel bid.

ArcelorMittal Nippon Steel India, in Gujarat, India, operates as an integrated BF and DRI steel plant with a 9.6 million tonne crude steel capacity. It utilizes both BF and DRI technologies, producing semi-finished and finished rolled products for automotive, building, infrastructure, energy, and other sectors. While its activity remained relatively stable initially, there was a notable drop to 29.0 in May 2025, falling below the Asian average. This shift cannot be directly linked to the Nippon Steel/US Steel news.

The uncertainty surrounding the Nippon Steel acquisition of US Steel, as reported in “Nippon Steel ready to invest $14 billion in US Steel if deal approved – Reuters“, “A steely challenge for Trump: Accept or block the deal with Japan again“, “USW calls on Trump to reject USS, Nippon deal“, and “US steelworkers urge Trump to block US Steel acquisition“, creates potential market volatility, although no direct relationship could be established to Asian plant activity levels.

Evaluated Market Implications:

The potential shifts in the global steel landscape caused by the US Steel acquisition, coupled with declining mean plant activity in Asia, suggest that steel buyers should prioritize supply chain diversification. Steel buyers should consider increasing procurement from Vizag Steel, given its stable and high production levels, although it is important to note that the plant mainly focuses on the building and infrastructure sectors. Given the recent decline in activity at the ArcelorMittal Nippon Steel India plant, and considering they produce products for similar sectors, any procurement strategy should be closely monitored.