From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Decline Amid Global Economic Uncertainty

In Asia, recent steel plant activity indicates a general downward trend, primarily in Iranian and Japanese facilities, possibly tied to the economic uncertainty amplified by global events and tariff concerns, as highlighted in “Trump’s Geopolitics and Tariffs have overheated Gold“. This decline is further compounded by the gold market’s reaction to tariff concerns. The observed changes in plant activity may be indirectly linked to shifts in investor sentiment noted in “WGC: Investment demand keeps gold in good shape“.

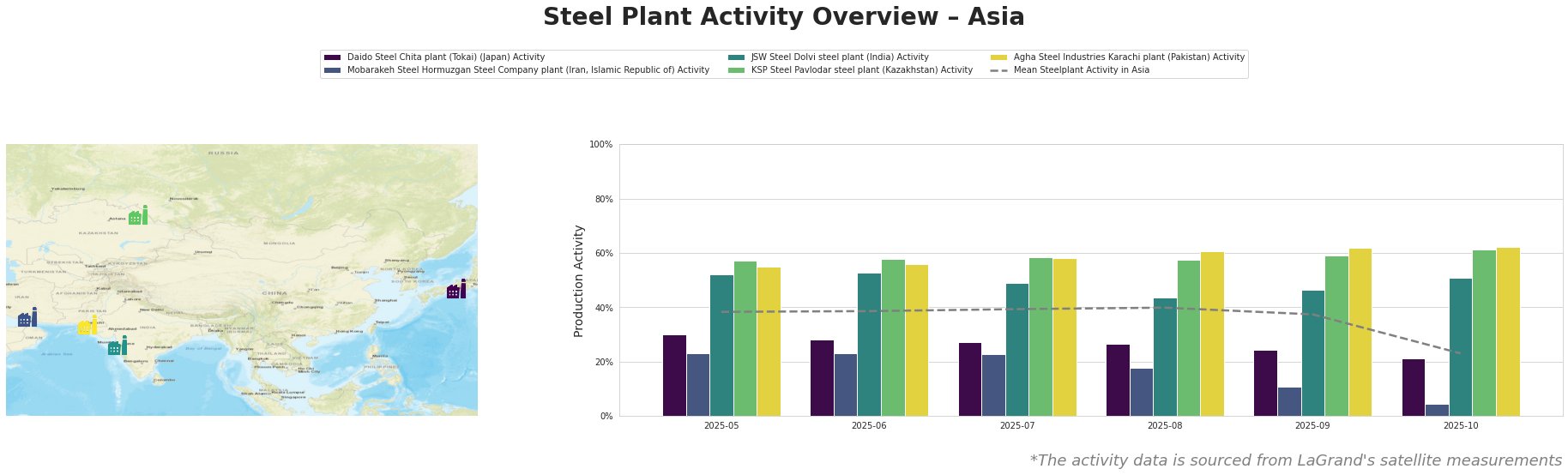

The mean steel plant activity in Asia shows a notable decline in October, dropping to 23% from a high of 40% in August. Daido Steel Chita plant’s activity has consistently decreased, from 30% in May to 21% in October. Mobarakeh Steel Hormuzgan Steel Company plant experienced a sharp decline, hitting a low of 4% in October. Conversely, JSW Steel Dolvi steel plant shows some fluctuation, and activity for both KSP Steel Pavlodar steel plant and Agha Steel Industries Karachi plant show relative stability in comparison to the others.

Daido Steel Chita plant (Tokai)

Daido Steel Chita plant, a Japanese facility with a 1.5 million tonne EAF-based crude steel capacity, specializes in high-grade products such as stainless steel and tool steel for the automotive industry. Satellite data shows a consistent decline in activity levels, from 30% in May to 21% in October. No direct connection can be established between this observed decrease in activity and the provided news articles.

Mobarakeh Steel Hormuzgan Steel Company plant

Mobarakeh Steel Hormuzgan Steel Company plant, located in Iran, operates with a 1.5 million tonne capacity utilizing DRI and EAF technology and producing semi-finished and finished rolled products. The plant’s activity has sharply declined from 23% in July to a mere 4% in October. No direct connection can be established between this observed decrease in activity and the provided news articles.

JSW Steel Dolvi steel plant

JSW Steel’s Dolvi plant in India is an integrated facility with both BF and DRI processes, boasting a 5 million tonne crude steel capacity. The plant’s activity fluctuated slightly from 52% in May, dipping to 44% in August, and recovering to 51% in October. No direct connection can be established between this observed activity and the provided news articles.

KSP Steel Pavlodar steel plant

KSP Steel’s Pavlodar plant in Kazakhstan, an EAF-based facility with a capacity of 800,000 tonnes, produces various products, including billets and rebar. This plant showed a steady, gradual increase in activity and is stable with slight increases to 61% activity. No direct connection can be established between this observed stability and the provided news articles.

Agha Steel Industries Karachi plant

Agha Steel Industries’ Karachi plant in Pakistan, with a 700,000-tonne EAF capacity, produces billets and rebar. The plant maintains relative stability, reaching a high of 62% in September and October. No direct connection can be established between this observed stability and the provided news articles.

Evaluated Market Implications

The decline in activity at Daido Steel Chita plant and Mobarakeh Steel Hormuzgan Steel Company plant indicate potential supply disruptions, especially for specialized steel products and rolled products respectively. Given the potential for increased economic uncertainty driven by geopolitical tensions, as mentioned in “Trump’s Geopolitics and Tariffs have overheated Gold“, steel buyers should:

- Diversify sourcing: For steel buyers reliant on Daido Steel Chita plant for specialized steel or Mobarakeh Steel Hormuzgan Steel Company plant for rolled products, immediate diversification of supply chains is recommended to mitigate potential disruptions. Prioritize suppliers in regions with stable or increasing production.

- Negotiate long-term contracts: Secure long-term supply contracts with fixed pricing, where possible, to buffer against potential price volatility linked to macroeconomic uncertainty.

- Increase inventory levels: Consider increasing inventory levels of critical steel products to provide a buffer against potential supply shortages arising from decreased activity at key plants. However, carefully consider inventory costs versus the potential for supply disruption.