From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel: Guangxi Plant Surge Offsets Regional Dip Amidst European Import Concerns

Asia’s steel market faces a mixed outlook. While overall regional activity shows a recent decline, production at Guangxi Iron and Steel Group Co., Ltd. continues to increase. Concerns surrounding potential anti-dumping investigations in Europe, as highlighted in “European CRC and HDG prices remain in a calm market; according to rumors, AD research is likely to reduce demand for Asian CRCs” could impact export strategies. A direct relationship between this article and recent Asian plant activity levels could not be established.

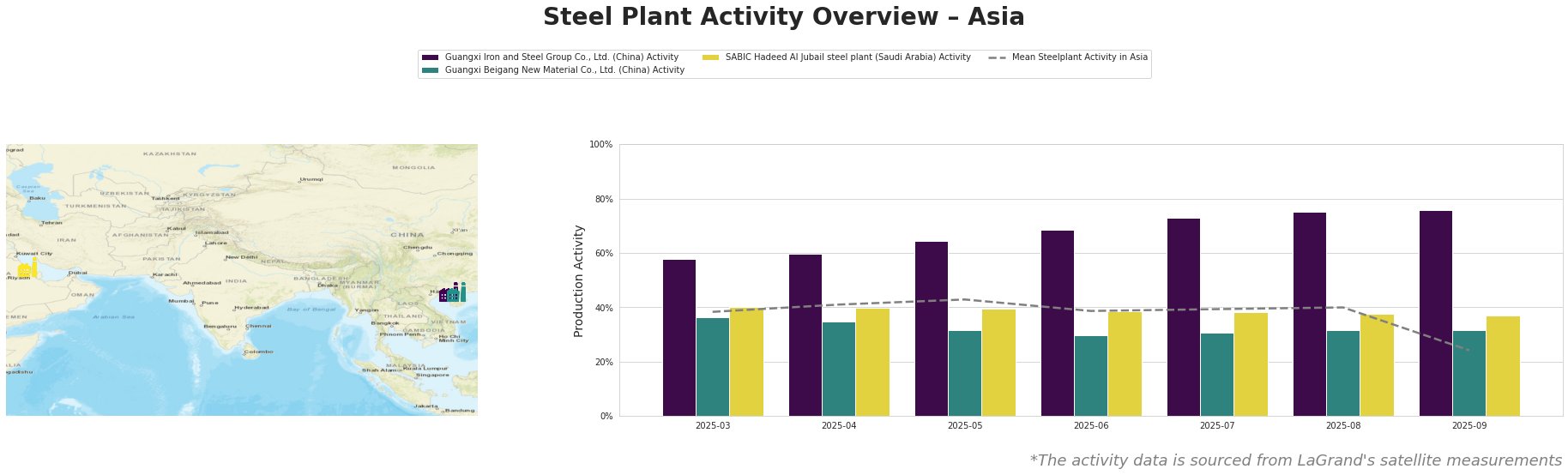

Across Asia, the mean steel plant activity has decreased significantly, from 40% in August to 24% in September. Guangxi Iron and Steel Group Co., Ltd. bucked this trend, increasing its activity from 58% in March to 76% in September, significantly exceeding the regional average. Activity at Guangxi Beigang New Material Co., Ltd. has remained relatively stable, fluctuating between 30% and 36%. SABIC Hadeed Al Jubail steel plant showed consistent activity, fluctuating between 37% and 40%.

Guangxi Iron and Steel Group Co., Ltd., an integrated BF/BOF producer with a crude steel capacity of 9.2 million tonnes, specializing in finished rolled products like cold rolled coil and hot-dip galvanized coil, has consistently increased its activity in recent months, reaching 76% in September. This upward trend is in contrast to the overall regional decline. A direct relationship between the observed increase in activity and the previously named news articles could not be established.

Guangxi Beigang New Material Co., Ltd., an integrated BF/EAF producer with a crude steel capacity of 3.4 million tonnes, specializing in finished rolled products like hot rolled coil and cold rolled coil, has maintained a stable activity level around 30-36% since March. A direct relationship between the stable activity and the previously named news articles could not be established.

SABIC Hadeed Al Jubail steel plant, a DRI/EAF producer with a crude steel capacity of 6 million tonnes, producing both semi-finished and finished rolled products including hot-rolled coil and hot-dipped galvanized coil, has shown stable activity levels, fluctuating between 37% and 40%. A direct relationship between the stable activity and the previously named news articles could not be established.

The observed decline in average Asian steel plant activity coupled with rising activity at Guangxi Iron and Steel Group Co., Ltd., suggests a potential shift in regional supply dynamics. The potential for decreased CRC exports to Europe due to possible anti-dumping investigations, as reported in “European CRC and HDG prices remain in a calm market; according to rumors, AD research is likely to reduce demand for Asian CRCs,” might further concentrate supply within Asia. Steel buyers should consider:

- Prioritizing procurement from Guangxi Iron and Steel Group Co., Ltd. to leverage their increased production capacity, potentially securing more favorable pricing.

- Monitoring the official commencement and scope of any anti-dumping investigations in Europe. This information is crucial for anticipating shifts in Asian steel supply and adjusting procurement strategies accordingly.

- Diversifying their supplier base within Asia, as reduced export opportunities might lead to increased competition among regional steel producers.