From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Exports Surge: China’s Rise Offsets Regional Fluctuations – August 2025

China’s increasing steel exports, as reported in “China increased steel exports by 1.6% m/m in July,” are impacting overall Asian steel market dynamics. While plant-level activity data provides insights into production trends, a direct causal link between individual plant activity and specific export figures cannot be definitively established with the provided information. The rise in Turkey’s wire rod exports, detailed in “Turkey’s wire rod exports up 0.5 percent in H1 2025,” indicates a regional divergence from the dominant Chinese trend.

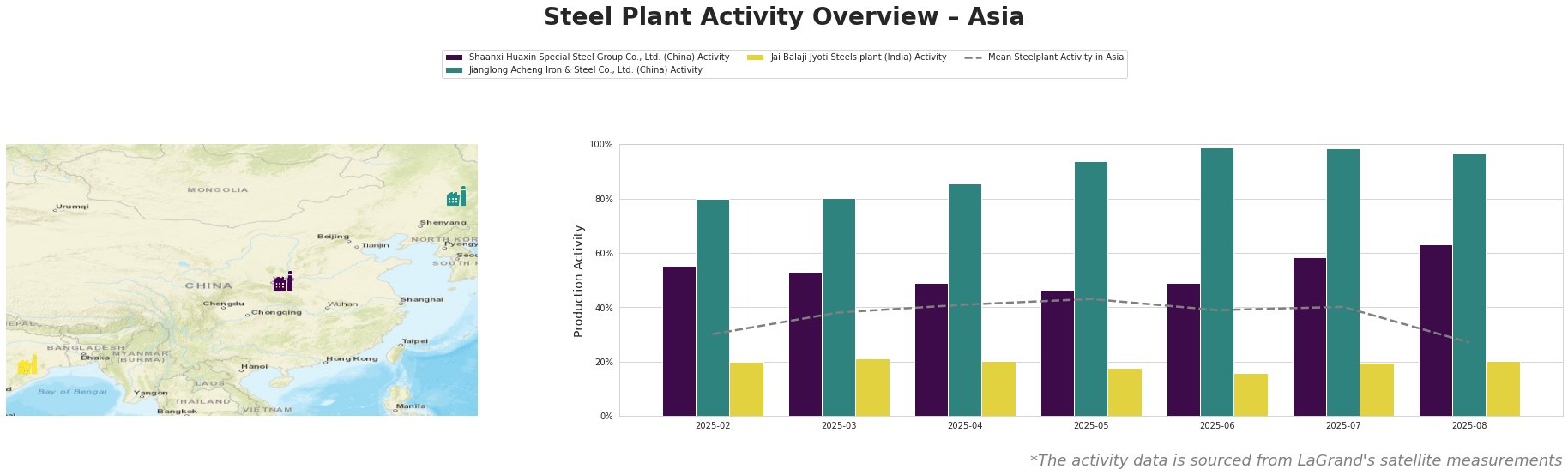

Observed monthly plant activity levels (in %) are shown in the table below:

The mean steel plant activity in Asia saw a peak in May 2025 at 43.0% and has decreased since, reaching a low of 27.0% in August 2025. Shaanxi Huaxin Special Steel Group Co., Ltd. shows a fluctuating trend, dipping to 46.0% in May and then rising to 63.0% in August, consistently operating above the Asian average. Jianglong Acheng Iron & Steel Co., Ltd. has maintained very high activity levels, peaking at 99.0% in June and July. Jai Balaji Jyoti Steels plant operates significantly below the average, exhibiting a slight decrease from 20.0% in February to 16.0% in June, before climbing back to 20.0% in July and August.

Shaanxi Huaxin Special Steel Group Co., Ltd.

Shaanxi Huaxin Special Steel Group Co., Ltd., a Chinese steel plant with a 1200 ttpa crude steel capacity using primarily EAF technology, produces finished rolled products like round steel plates and hot-rolled rebar. The plant’s activity increased significantly in July and August, reaching 63.0%, suggesting increased production, which could contribute to the rising Chinese steel exports reported in “China increased steel exports by 1.6% m/m in July.” This increase is notable after the plant’s activity dropped to 46.0% in May 2025.

Jianglong Acheng Iron & Steel Co., Ltd.

Jianglong Acheng Iron & Steel Co., Ltd., also in China, boasts an 1100 ttpa crude steel capacity, employing integrated BF and BOF processes. It produces hot-rolled and coated steel products for the automotive, energy, and machinery sectors. This plant has operated at very high activity levels in recent months, holding steady at 99.0% in June and July before slightly decreasing to 97.0% in August. While the “China increased steel exports by 1.6% m/m in July” news indicates a general export increase from China, a direct correlation between Jianglong’s high activity and specific export volumes cannot be definitively established without more granular data.

Jai Balaji Jyoti Steels plant

Jai Balaji Jyoti Steels plant, located in India, possesses a 92 ttpa crude steel capacity, utilizing DRI and EAF technology. Its product range includes DRI, billets, bars, wire rods, and iron ore. Activity levels remain consistently low, around 20%, which is significantly below the Asian average. There is no clear connection between this plant’s activity and the news articles provided.

Evaluated Market Implications

The “China increased steel exports by 1.6% m/m in July” news, coupled with observed high activity at plants like Jianglong Acheng Iron & Steel Co., Ltd., suggests increased availability of Chinese steel in the global market. The fluctuating, but overall increasing, activity levels at Shaanxi Huaxin Special Steel Group Co., Ltd. further support this trend. The “Turkey’s wire rod exports up 0.5 percent in H1 2025” news indicates regional competition in specific product categories like wire rod. The reduced activity at the Indian Jai Balaji Jyoti Steels plant, coupled with the “China’s iron ore imports decrease by 2.3 percent in January-July 2025” implies potential cost reductions for steel manufacturers in China, where steel producers can access iron ore at slightly decreased prices.

Procurement Actions:

- Steel Buyers: Given increased Chinese export volumes, buyers should leverage this increased supply to negotiate favorable pricing, especially for hot rolled steel and coated steel products. Consider diversifying suppliers to include Turkish wire rod exporters to mitigate reliance on Chinese sources for this specific product.

- Market Analysts: Closely monitor Chinese steel inventories and export data for August and September to confirm the sustainability of the export growth trend. Examine regional wire rod pricing trends to assess the impact of increased Turkish exports. Analyze iron ore price fluctuations for impacts on producer margins.