From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineArcelorMittal’s €1.3 Billion Dunkirk Investment Signals Robust Growth in Europe’s Steel Market

ArcelorMittal’s recent activity in Europe, notably the significant investment in an electric arc furnace (EAF) at its Dunkirk facility in France, has generated a highly positive sentiment across the steel market. The announcements made in articles titled “ArcelorMittal has confirmed a EUR 1.3 billion electric arc furnace investment in Dunkirk“ and “ArcelorMittal Confirms €1.3 Billion Investment in Electric Arc Furnace at Dunkirk Plant to Produce Green Steel“ tie directly to increased operational capacity and reduced carbon emissions, indicating a transformative shift in production methodologies.

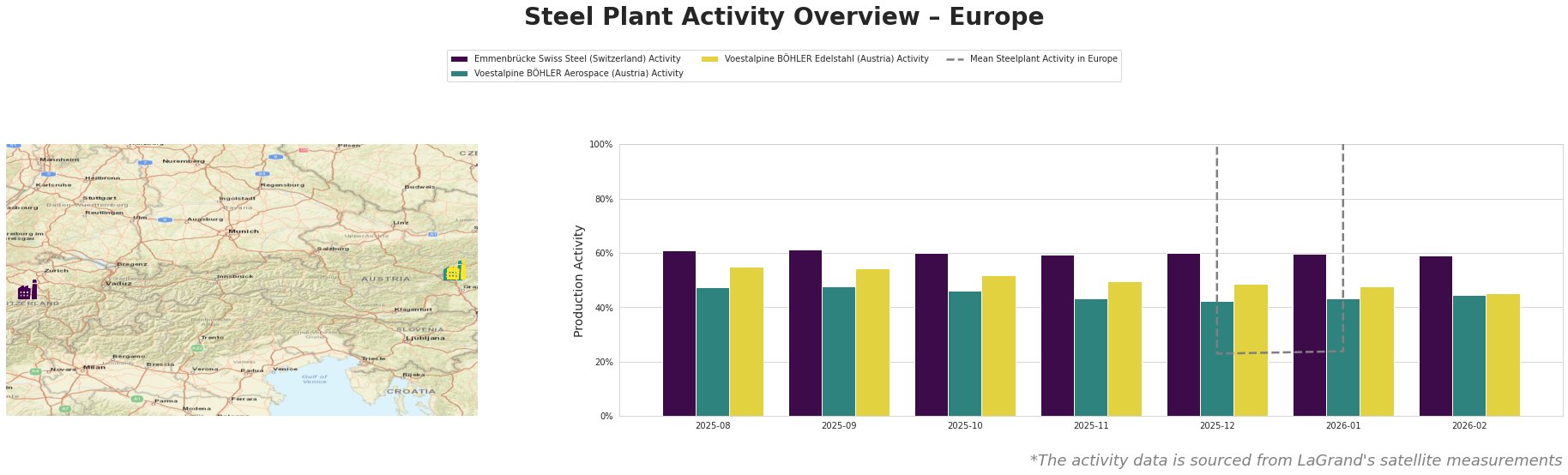

Measured Activity Overview

The monthly activity data indicates a fluctuation in production, with the overall average steel plant activity in Europe notably declining to 0% in December 2025 and January 2026 before a rebound to 19% in February 2026. Emmenbrücke Swiss Steel has consistently maintained high activity, holding steady around 61%. Conversely, Voestalpine BÖHLER plants exhibit more variability, with BÖHLER Aerospace’s activity dipping to 46% in October before marginal recovery to 44% in February. This decline aligns with challenges faced in the broader European context, specifically the slowdown attributed to affecting regulations and supply chain pressures recently reported in “ArcelorMittal to halt blast furnace in Spain for ‘several months’.”

Evaluated Market Implications

The investment in the Dunkirk EAF, as highlighted in “ArcelorMittal to build €1.3 billion EAF at Dunkirk to cut emissions,” illustrates a strategic pivot toward greener steel production, which is likely to enhance competitiveness within EU markets amid increasing demand for sustainable materials. This future-ready setup can directly contribute to alleviating anticipated supply disruptions stemming from the temporary halts of blast furnaces at various ArcelorMittal locations in Spain, as detailed in “ArcelorMittal announces shutdown of blast furnace B in Gijón.”

-

Potential Supply Disruptions: The temporary shutdowns of blast furnaces in Spain may restrict immediate steel supply; therefore, buyers should proactively seek alternatives from facilities maintaining higher operational capacity, like Emmenbrücke and the stable production in Dunkirk.

-

Recommended Procurement Actions: Steel buyers should prioritize securing contracts with producers actively investing in modern EAF technology, notably ArcelorMittal’s Dunkirk project, to ensure access to lower-emission steel products anticipated to align with stricter regulations in the EU. Additionally, rationalizing procurement from Voestalpine BÖHLER facilities may be crucial given their recent operational activity, which does not reflect instability as starkly as that of other facilities.

This landscape creates a focused opportunity for buyers looking to align with sustainable practices while mitigating risks from potential supply constraints due to plant shutdowns or capacity adjustments in the near future.