From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Booming: Tata Expansion & SAIL Mining Boost Signal Strong Supply

India’s steel sector is exhibiting strong growth, driven by capacity expansions and strategic initiatives to secure raw materials. This report analyzes recent developments using news articles and satellite-observed activity data to provide actionable insights for steel buyers.

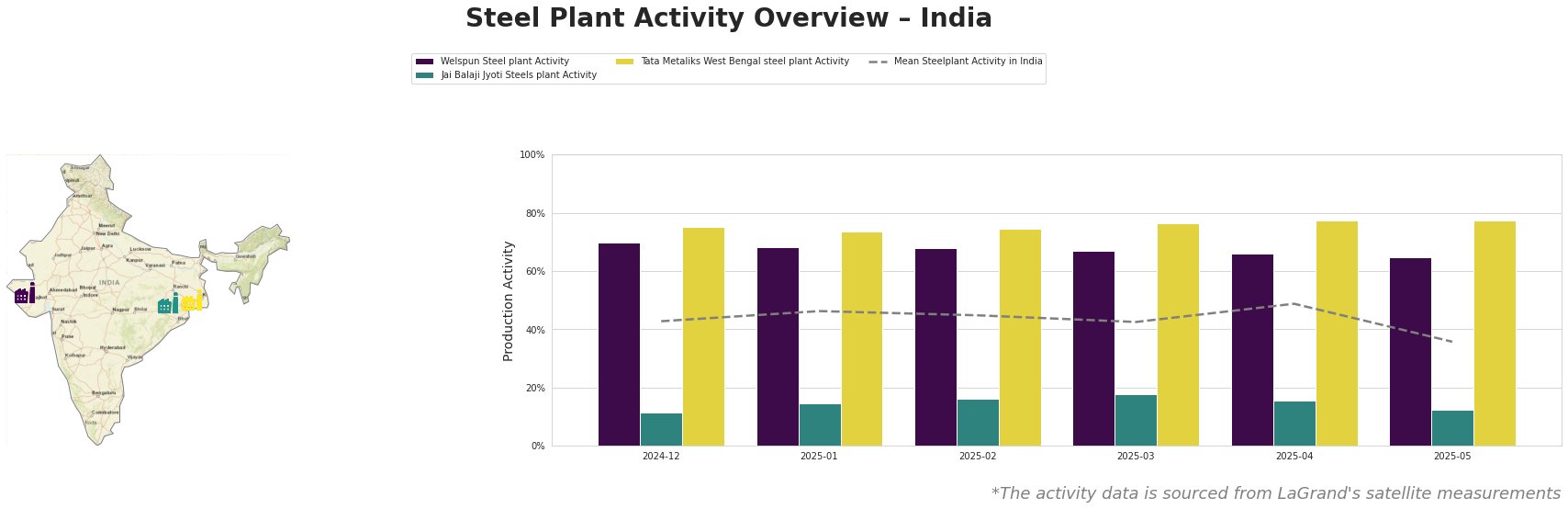

Recent developments in India’s steel industry are marked by increased production, as highlighted by “India’s NINL achieves operational profit in Q4 FY 2024-25” and “Tata Steel increases steelmaking capacity in Kalinganagar to 8 million tons per year“. These reports corroborate the satellite-observed activity with a discernible rise in the mean steel plant activity across India from 43% in December 2024 to 49% in April 2025. Furthermore, “India’s steel ministry planning separate mining vertical within SAIL to boost iron ore output” is a direct effort to bolster raw material supplies for this growing sector.

The mean steel plant activity in India shows an increase from 43% at the end of 2024 to a peak of 49% in April 2025, before falling back to 36% in May 2025. While there is an upward trend until April, the May figure indicates a significant correction. Welspun Steel plant activity has remained relatively stable, fluctuating between 70% and 65%, consistently above the national average. Jai Balaji Jyoti Steels plant activity shows a generally low level that peaks in March before trending back down in April and May. Tata Metaliks West Bengal steel plant activity has shown strong, consistent performance, starting at 75% and increasing to 77% by April, where it has since remained. No explicit connections can be established between the “India’s steel ministry planning separate mining vertical within SAIL to boost iron ore output” news article and the satellite-observed activity of the selected steel plants. The mining division planned within SAIL is intended to improve raw material production across the sector, and its impacts are therefore difficult to trace to the activity of single steel plants.

Welspun Steel, located in Gujarat and operating primarily with DRI technology, produces crude and semi-finished products, including TMT rebars. Activity at Welspun has been consistently high, ranging from 65% to 70%. The relatively stable activity levels at this plant do not correlate with any of the provided news articles, and no immediate conclusions can be drawn about its operational strategies in relation to overall market trends.

Jai Balaji Jyoti Steels plant in Odisha utilizes DRI and EAF technologies to produce crude, semi-finished, and finished rolled products. Observed activity has been consistently below average, fluctuating between 11% and 18%. The low activity levels observed at Jai Balaji Jyoti Steels plant cannot be directly linked to any of the provided news articles, and no immediate conclusions can be drawn about its operational strategies in relation to overall market trends.

Tata Metaliks’ West Bengal plant, an integrated BF route producer of pig iron and ductile pipes, has demonstrated strong and consistent activity, ranging from 73% to 77%. The consistent performance of Tata Metaliks does not have a direct relationship to the news articles about Tata Steel’s NINL turnaround or Kalinganagar expansion, but it supports the general sentiment of strong performance within the Tata Steel group.

The expansion news “Tata Steel increases steelmaking capacity in Kalinganagar to 8 million tons per year” coupled with “India’s NINL achieves operational profit in Q4 FY 2024-25” signals increased steel availability from Tata Steel facilities. The mean steel plant activity decrease in May could reflect temporary adjustments after capacity expansions or preparations for further increases. Given SAIL’s increased focus on iron ore production, a potential short-term disruption might occur as SAIL transitions to the new mining vertical as described in the news article “India’s steel ministry planning separate mining vertical within SAIL to boost iron ore output,” however, the effects on single steel plants are not traceable.

Recommended Procurement Actions:

- Monitor Tata Steel’s Output: Buyers should closely monitor the output from Tata Steel’s Kalinganagar and NINL plants. “Tata Steel increases steelmaking capacity in Kalinganagar to 8 million tons per year” suggests potential for increased supply, which may offer competitive pricing opportunities.

- Assess SAIL’s Iron Ore Transition: Steel buyers dependent on SAIL for iron ore should assess the potential impact of the transition to a separate mining vertical, especially if “India’s steel ministry planning separate mining vertical within SAIL to boost iron ore output” translates into short-term supply adjustments or pricing changes. Diversification of iron ore sources might be a prudent strategy.