From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Exports Surge Amidst Regional Shifts: Activity Analysis and Procurement Strategies

Europe’s steel market shows a complex picture, with Ukrainian exports rising across multiple product categories while activity levels vary across European steel plants. The increased exports from Ukraine, as highlighted in “Ukraine increased exports of flat products to 554 thousand tons in January-April,” “Pig iron exports from Ukraine increased by 37% in 4 months,” “Ukraine increase exports of long products by 26% y/y in January-April,” and “Ukraine increased scrap metal exports by 45% in 4 months,” suggest a shift in regional supply dynamics. However, a direct relationship between increased Ukrainian exports and satellite-observed activity at the listed European plants cannot be explicitly established based on the provided information.

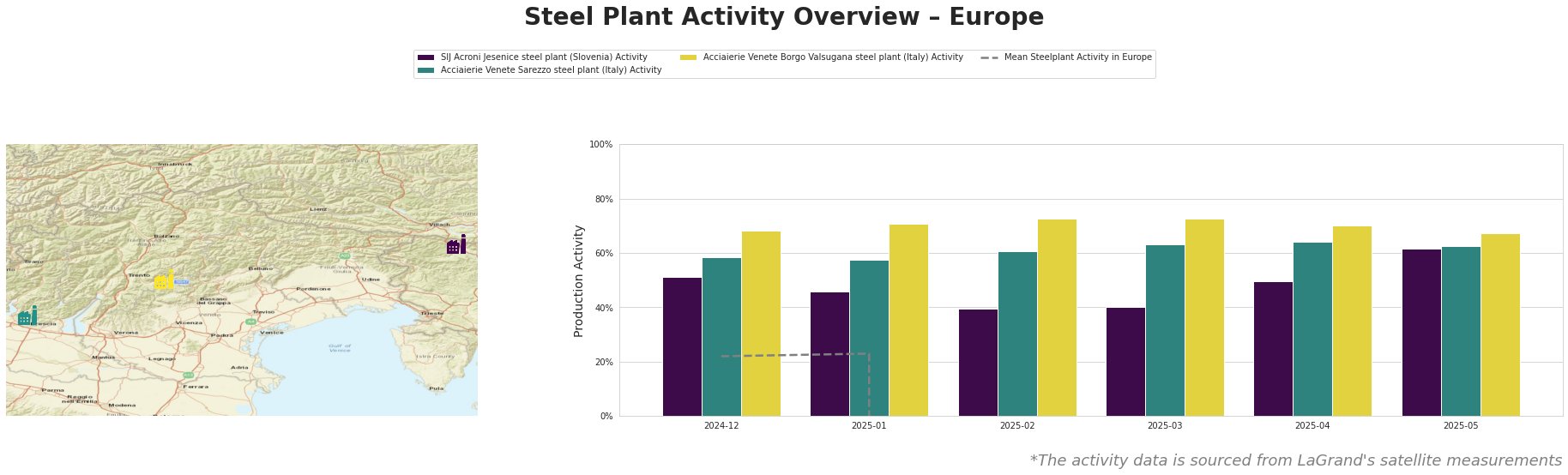

The mean steel plant activity in Europe data contains irregularities after 2025-01-31 that render it unusable for analysis. SIJ Acroni Jesenice steel plant shows fluctuating activity, starting at 51% in December 2024, dropping to 39% by February 2025, and then climbing to 62% by May 2025. Acciaierie Venete Sarezzo steel plant shows relatively stable activity, ranging between 58% and 64% during the observed period. Acciaierie Venete Borgo Valsugana steel plant shows high and relatively stable activity, ranging between 67% and 73% during the observed period.

SIJ Acroni Jesenice steel plant

SIJ Acroni Jesenice, a Slovenian steel plant with a 726 ttpa EAF-based crude steel capacity, primarily produces flat-rolled products. Activity at the plant decreased from 51% in December 2024 to 39% in February 2025, before rising to 62% in May 2025. While “Ukraine’s ferroalloy industry exported 39 thousand tons of products in January-April” mentions Poland as a key export market for Ukrainian ferroalloys, a clear connection to the fluctuating activity at SIJ Acroni Jesenice cannot be established from the provided information.

Acciaierie Venete Sarezzo steel plant

Acciaierie Venete’s Sarezzo plant in Italy, an EAF-based facility with a 540 ttpa crude steel capacity, focuses on long products like bars and wire rod. The plant’s activity remained relatively stable between 58% and 64% during the observed period. Given that “Pig iron exports from Ukraine increased by 37% in 4 months” highlights Italy as a significant destination for Ukrainian pig iron, one might expect some impact on EAF-based long product manufacturers. However, there is no distinct activity change to directly relate the news to the plant’s activity.

Acciaierie Venete Borgo Valsugana steel plant

The Acciaierie Venete Borgo Valsugana plant, also in Italy, operates an EAF with a 600 ttpa crude steel capacity and produces similar long products as the Sarezzo plant. The plant consistently maintained high activity levels between 67% and 73%. As with the Sarezzo plant, while Italy is a destination for Ukrainian pig iron according to “Pig iron exports from Ukraine increased by 37% in 4 months“, there’s no concrete, direct correlation identifiable from the observed activity to the news of increased Ukrainian exports.

Given the increase in Ukrainian steel exports, and the extension of duties as stated in “Ukraine extends duties on coated steel from Russia and China for another 5 years“, steel buyers should anticipate potential supply shifts and price adjustments, particularly for flat and long products. Buyers sourcing from Poland, a major destination for Ukrainian steel as noted in multiple articles including “Ukraine increased exports of flat products to 554 thousand tons in January-April” and “Ukraine increase exports of long products by 26% y/y in January-April“, should closely monitor Ukrainian export volumes and prices to leverage potential cost advantages, and be prepared for potential supply chain adjustments. Because the “Ukraine extends duties on coated steel from Russia and China for another 5 years” explicitly mentions increasing imports of flat products into Ukraine, analysts should be aware of competition Ukrainian steelmakers will face, and its potential knock-on effects in countries that import from Ukraine, as Ukrainian steelmakers attempt to maintain domestic market share.