From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Production Cuts Despite Global Output Stability

In Asia, despite stable global crude steel output as reported in “World crude steel output up 0.3 percent in April,” production faces downward pressure, particularly in China. The news articles “China’s crude steel production fell 7% in April, m-o-m,” “China reduced steel production by 7% m/m in April,” and “China has reduced steel production” highlight a significant month-over-month decrease in Chinese output, although these production cuts have not yet been directly linked to observable activity levels at specific steel plants through satellite monitoring.

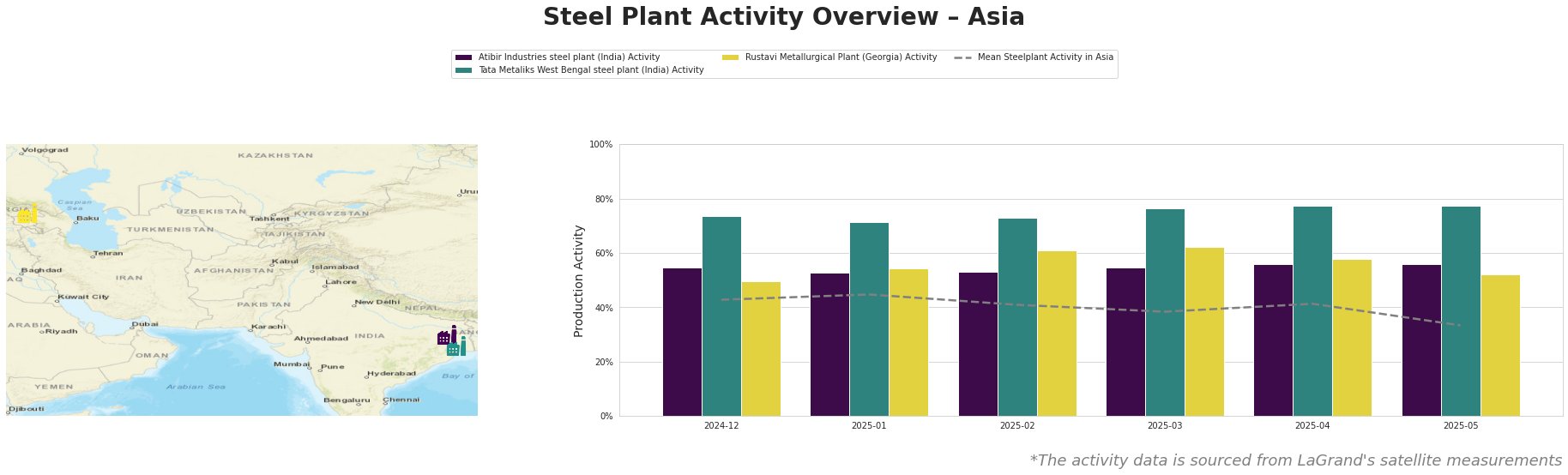

Observed steel plant activity data indicates a decline in the average activity across the observed steel plants in Asia, dropping to 33.0% in May 2025, which is the lowest value since December 2024. Atibir Industries and Tata Metaliks facilities show relatively stable activity levels. Rustavi Metallurgical Plant activity peaked in March 2025 at 62.0% but has since declined to 52.0% in May 2025. The relatively stable operation rates, as measured by satellite observations, are contrasting the production curtailments described in news articles such as “China’s crude steel production fell 7% in April, m-o-m“.

Atibir Industries, an integrated steel plant in Jharkhand, India, utilizes basic oxygen furnace (BOF) technology with a crude steel capacity of 600 thousand tonnes per annum (ttpa). The plant’s activity has remained relatively stable around 55-56% between December 2024 and May 2025. The stable operation rates have not been directly linked to any of the recent production news.

Tata Metaliks, also an integrated steel plant located in West Bengal, India, also operates with BOF technology and has a crude steel capacity of 255 ttpa and an iron capacity of 600 ttpa. Satellite data reveals an increase in activity levels, reaching 78.0% in May 2025, up from 74.0% in December 2024. This observed increase may reflect the broader trend of increased steel production in India, as noted in “World crude steel output up 0.3 percent in April“, where India’s output is up 5.6%.

The Rustavi Metallurgical Plant in Georgia, which employs BOF and EAF processes, has a crude steel capacity of 120 ttpa. Its activity fluctuated between December 2024 and May 2025, peaking in March 2025. The most recent value shows 52% activity in May 2025. No direct correlation could be established to the named news articles.

Given the reported decrease in China’s steel production as indicated by “China’s crude steel production fell 7% in April, m-o-m,” and the stable-to-increasing activity observed at specific Indian plants, steel buyers should:

- Prioritize diversifying steel sourcing away from China to mitigate potential supply disruptions. The news article “China reduced steel production by 7% m/m in April” indicates potential future production cuts, particularly in the second half of the year.

- Consider increasing procurement from Indian steel producers like Tata Metaliks to capitalize on their stable or increasing production, indicated by the increase from 74% to 78% in the period of December 2024 to May 2025, which suggests they may be able to fill supply gaps.