From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Geopolitical Tensions & Stalled Aid Threaten Supply Chains

The European steel market faces increasing uncertainty amid escalating geopolitical tensions. UK’s decision to pause trade talks with Israel, as reported in “Utterly Intolerable”: UK Pauses Israel Trade Talks Over West Bank Violence” and the broader context of “At least 82 killed in Israeli strikes on Gaza as critical aid fails to reach Palestinians,” raise concerns about potential disruptions to trade flows and supply chains, although no direct impact on steel plants has yet been observed. These events, exacerbated by “Netanyahu accuses the UK, France and Canada of ‘enabling Hamas’,” further destabilize the region.

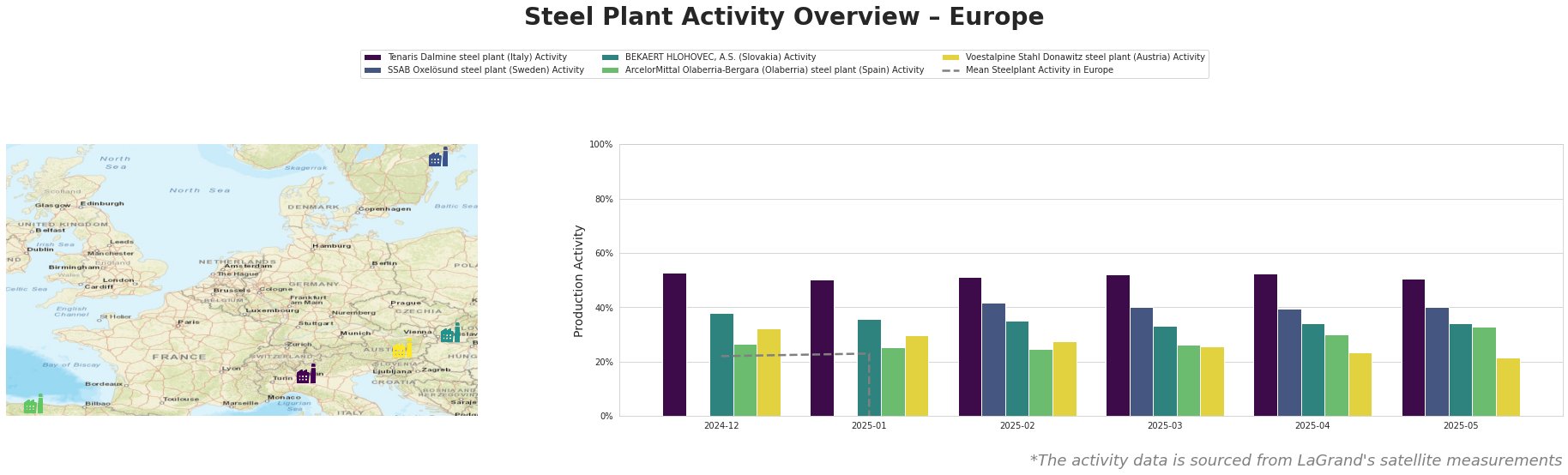

While the mean steel plant activity in Europe displays wild fluctuations due to corrupted data, individual plant activity provides some insight. Tenaris Dalmine in Italy, producing mainly tubes and pipes with a capacity of 700ktpa of crude steel via EAF, has shown relatively stable activity, hovering around 50-53% utilization. SSAB Oxelösund in Sweden, an integrated BF/BOF plant producing 1500ktpa of crude steel specializing in high-strength steel, shows a stable activity level around 40%. BEKAERT HLOHOVEC, A.S. in Slovakia, specializing in wire rod for the automotive and construction sectors, exhibits a steady activity level around 33-38%. ArcelorMittal Olaberria-Bergara in Spain, with a 4200ktpa BOF capacity producing flat products, shows a recent increase from 27% to 33% activity. Voestalpine Stahl Donawitz in Austria, an integrated BF/BOF plant with a 1570ktpa capacity producing various steel strips, has seen a notable drop in activity from 32% to 21%. No direct connection between these plant-level activity changes and the political news could be explicitly established.

The Voestalpine Stahl Donawitz plant’s activity decline is the most significant amongst the observed plants but cannot be directly attributed to the geopolitical developments highlighted in the news articles. The plant specializes in higher-value steel strip products, suggesting a potential softening of demand in automotive or related sectors.

Given the Very Negative overall market sentiment and the geopolitical uncertainty introduced by “Utterly Intolerable”: UK Pauses Israel Trade Talks Over West Bank Violence,” steel buyers should prioritize securing existing supply contracts and consider diversifying their sourcing to mitigate potential disruptions. Focus should be placed on suppliers less vulnerable to geopolitical shifts. Steel buyers should closely monitor developments related to international trade agreements.