From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Under Pressure: Output Declines and Plant Activity Signals Further Weakness

Steel market conditions in Asia are deteriorating, evidenced by declining steel output across key nations and confirmed by satellite-observed plant activity reductions. The observed trends in plant-level activity, while not directly linked to specific news events, correlate with the general market sentiment expressed in reports such as “World crude steel output up 0.3 percent in April,” “Global crude steel production edges down 0.3% y-o-y in April,” and “Global crude steel production decreased 0.3% year-on-year in April,” which highlight overall production decreases, including declines in Japan and South Korea, indicating an overall negative outlook in Asia.

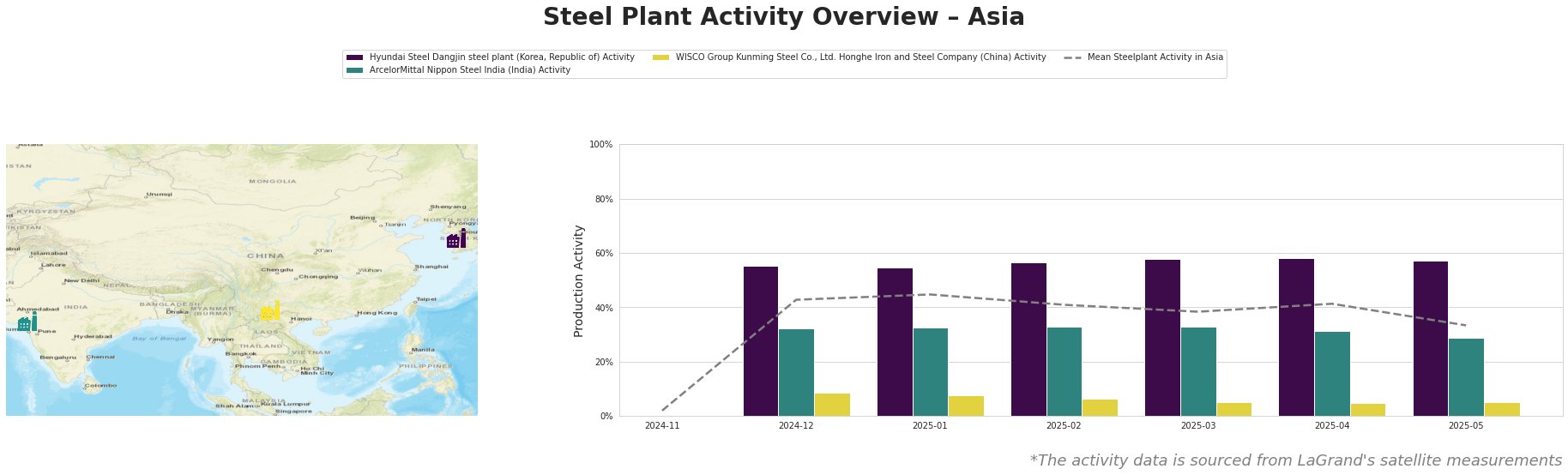

The mean steel plant activity in Asia shows a declining trend, decreasing from a peak of 45% in January 2025 to 33% by the end of May 2025. This downward trend suggests a contraction in overall steel production across the region.

Hyundai Steel’s Dangjin steel plant, a major integrated steel producer in South Korea with a crude steel capacity of 16.6 million tonnes, showed stable activity until May 2025. The activity remained high, fluctuating around 55-58% before settling to 57% in May, consistently exceeding the mean activity level for Asia. While “Japanese crude steel output down 6.4 percent in April” highlights production cuts in Japan, no direct correlation to Hyundai Steel Dangjin could be established based on the provided news.

ArcelorMittal Nippon Steel India, an integrated steel plant in Gujarat with a crude steel capacity of 9.6 million tonnes utilizing both BF and DRI technologies, shows a declining activity trend. After peaking at 33% between January and March, activity dropped to 29% by May 2025. This decline occurred amidst reports of increased production in India as stated in “World crude steel output up 0.3 percent in April,” where India’s output increased by 5.6%, suggesting the reduction in plant activity might be company-specific or related to regional market dynamics within India.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company, a smaller integrated plant in Yunnan, China, with a crude steel capacity of 1.15 million tonnes, operated at very low activity levels. The plant’s activity remained consistently low, at only 5% in April and May 2025. This aligns with the general market sentiment conveyed in articles like “Global crude steel production edges down 0.3% y-o-y in April” and “Global crude steel production decreased 0.3% year-on-year in April,” which highlight broader production cuts in the region, potentially driven by decreased demand or strategic production adjustments in China.

Given the declining average steel plant activity across Asia, coupled with reported production decreases in Japan and South Korea, steel buyers should anticipate potential supply chain disruptions and volatile pricing.

- Recommended Procurement Action: Steel buyers relying on supplies from ArcelorMittal Nippon Steel India should closely monitor delivery times and consider diversifying their supply base to mitigate potential delays. The observed decline in plant activity, combined with broader market uncertainty, introduces risk.

- Recommended Procurement Action: Closely monitor supply dynamics from South Korea, and be aware of potential price volatility, despite the stable activity at the Hyundai Steel Dangjin plant. The report, “Japanese crude steel output down 6.4 percent in April,” indicates regional output decreases, which might impact prices.

- Recommended Analyst Action: Further investigate the reasons behind the significantly reduced activity at WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company. If this is indicative of broader trends among smaller Chinese producers, it could signal further supply reductions.