From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineRussian Steel Market Faces Uncertainty Despite Prisoner Swap: Plant Activity Declines

The Russian steel market faces continued uncertainty despite recent developments in the Russia-Ukraine conflict. A major prisoner swap, highlighted in news articles titled “Trump Says Major Prisoners Swap “Completed” Between Russia-Ukraine” and “Russia, Ukraine Each Free First 390 Prisoners In Start Of War’s Biggest Swap,” signals a potential, albeit fragile, step towards de-escalation. However, satellite-observed activity at key steel plants reveals a concerning downward trend, though a direct relationship with the prisoner swap cannot be definitively established.

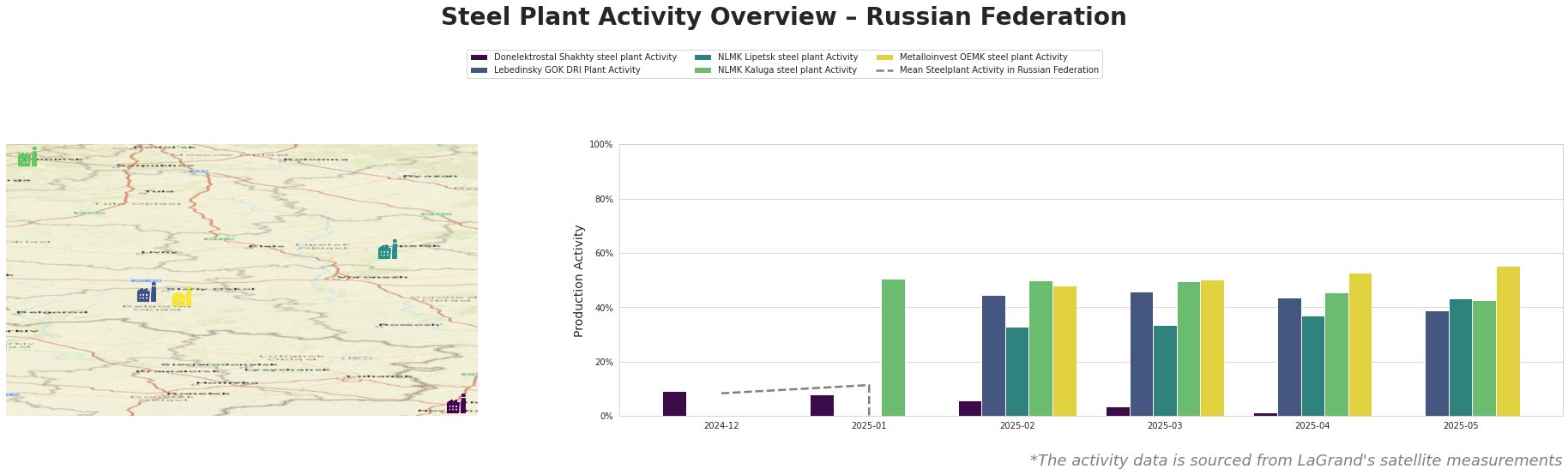

The table shows a significant negative value for the “Mean Steelplant Activity in Russian Federation” starting in February 2025, which indicates an issue with the calculation or data recording. This raises concerns about data reliability. However, individual plant data can still be examined. Donelektrostal Shakhty steel plant demonstrates a clear downward trend, declining from 9% in December 2024 to 0% in May 2025. Lebedinsky GOK DRI Plant activity is relatively stable, fluctuating between 46% and 39%. NLMK Lipetsk steel plant shows a slight increase from 33% in February and March to 43% in May. NLMK Kaluga steel plant declines gradually from 51% in January to 43% in May. Metalloinvest OEMK steel plant shows a slight increase from 48% in February to 55% in May.

Donelektrostal Shakhty steel plant, located in the Rostov region, has an EAF capacity of 1000 ttpa. Satellite data shows its activity plummeting to 0% by May 2025. This decline could signal significant production issues or potential shutdowns, though a direct link to the geopolitical situation described in the news articles “Trump Says Major Prisoners Swap “Completed” Between Russia-Ukraine” and “Prisoner swap begins between Russia and Ukraine but peace talks remain deadlocked” cannot be definitively established.

Lebedinsky GOK DRI Plant, in the Belgorod region, possesses a DRI capacity of 4500 ttpa. This plant’s activity has seen a moderate decline from 45% in February to 39% in May. While the plant has ISO50001:2019 certification and is Responsible Steel certified, the slight decrease may indicate production adjustments, although no explicit connection to the recent news events can be confirmed.

NLMK Lipetsk steel plant, an integrated BF-BOF plant with a crude steel capacity of 13200 ttpa, shows a gradual increase in activity, reaching 43% in May. This plant is a major producer of slabs, rebar, and hot-rolled flat products. Despite its significant scale, no direct relationship between its observed activity and the news articles concerning prisoner swaps can be established.

NLMK Kaluga steel plant, with an EAF capacity of 1500 ttpa, produces semi-finished and finished rolled products. Activity at this plant shows a gradual decline from 51% in January to 43% in May. Although NLMK Kaluga is Responsible Steel certified, the decrease in activity does not appear to directly correlate with the discussed prisoner exchange.

Metalloinvest OEMK steel plant, another Belgorod-based plant, has a DRI capacity of 3200 ttpa and an EAF-based crude steel capacity of 3500 ttpa. Its activity has seen a gradual increase to 55% in May. Although this plant also possesses Responsible Steel certification, similar to the other plants, there is no clear connection between its increased activity and the prisoner swap negotiations mentioned in “Russia, Ukraine Each Free First 390 Prisoners In Start Of War’s Biggest Swap“.

Given the observed decline in activity at Donelektrostal Shakhty, steel buyers should:

- Diversify sourcing: Reduce reliance on steel sourced from the Rostov region to mitigate potential supply disruptions.

- Monitor Donelektrostal Shakhty’s status: Closely track any official announcements regarding production capacity or potential shutdowns at the plant.

For market analysts:

- Investigate data reliability: Verify the accuracy of mean steel plant activity data and assess the underlying data integrity.

- Focus on plant-level analysis: Given potential data reliability issues, prioritize analysis of individual steel plant activities to identify specific trends and potential market impacts.