From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Sector Shows Strong Export Growth Amidst Ongoing Challenges

Ukraine’s steel sector demonstrates resilience with increased exports across multiple product categories, despite facing ongoing challenges related to energy costs and geopolitical uncertainties. This report examines recent export trends in relation to observed steel plant activity levels. The increased export of flat products is highlighted in “Ukraine increased exports of flat products to 554 thousand tons in January-April“, while increased scrap metal exports are discussed in “Ukraine increased scrap metal exports by 45% in 4 months” and “Ukraine increased exports of ferrous scrap by 95% year-on-year“. These export increases cannot be directly linked to specific activity changes at the observed steel plants, however the general increase in economic activity shows a clear correlation.

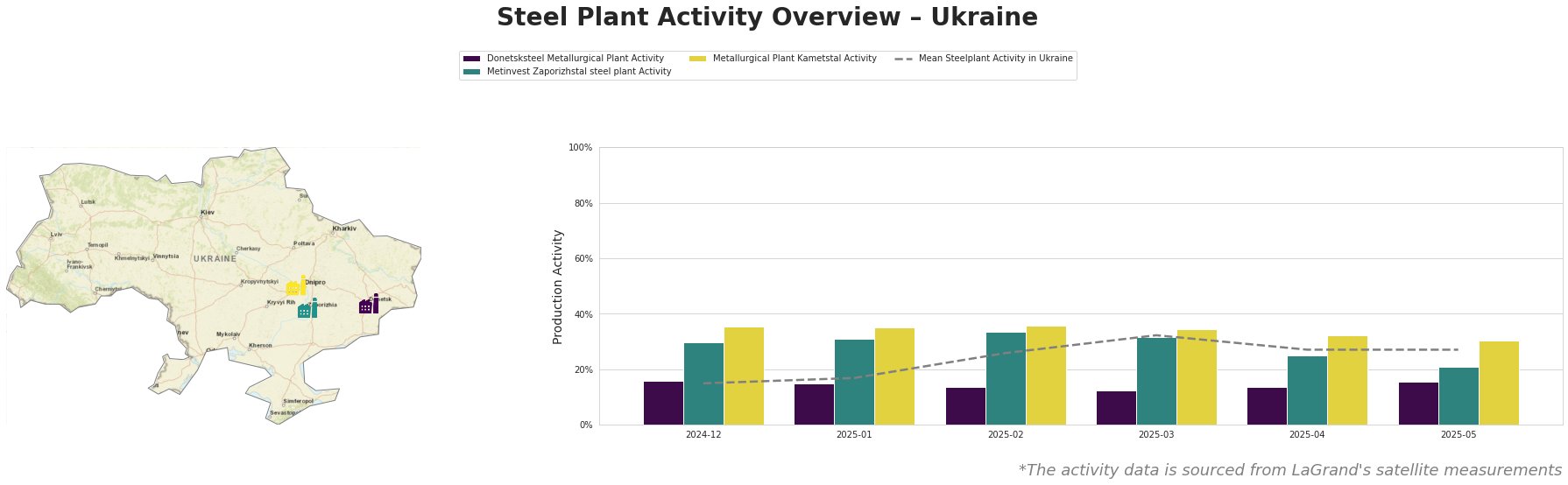

The average steel plant activity across the observed Ukrainian facilities increased significantly from December 2024 (15%) to March 2025 (32%), before stabilizing around 27% in April and May 2025. Donetsksteel Metallurgical Plant shows the lowest activity of all the observed plants, staying consistently below the mean. Metinvest Zaporizhstal saw activity peaking in February 2025, followed by a gradual decline. Metallurgical Plant Kametstal shows the highest activity among observed plants, though also a decline in the last two months.

Donetsksteel Metallurgical Plant, located in Donetsk, primarily produces pig iron using integrated BF-based production. Despite its ResponsibleSteel certification, the plant consistently operates below the average observed activity level for Ukrainian steel plants. Activity levels at Donetsksteel increased slightly from a low of 12% in March 2025 to 16% in May 2025, but remained below the national mean. There are no specific news articles directly relating to Donetsksteel activities; thus, no explicit connection can be established between news developments and observed activity.

Metinvest Zaporizhstal, based in Zaporizhzhia, is an integrated BF-OHF plant producing finished rolled products such as hot-rolled and cold-rolled sheets. Activity at Metinvest Zaporizhstal peaked in February 2025 at 34% but has since declined to 21% in May 2025, below the mean plant activity. While the news article “Ukraine increased exports of flat products to 554 thousand tons in January-April” highlights increased flat product exports, it does not provide a direct link to the observed activity decrease at Metinvest Zaporizhstal. No clear connection can therefore be established.

Metallurgical Plant Kametstal, situated in Dnipropetrovsk, is an integrated BF-BOF plant producing semi-finished and finished rolled products, including billets, wire rods, and rails. Kametstal demonstrated the highest activity levels among the observed plants, peaking at 36% in February 2025. Activity has since decreased to 30% in May 2025. There are no specific news articles directly relating to Kametstal activities; thus, no explicit connection can be established between news developments and observed activity.

The extension of duties on coated steel from Russia and China, as announced in “Ukraine extends duties on coated steel from Russia and China for another 5 years,” aims to protect domestic producers. The simultaneous increase of flat product exports, reported in “Ukraine increased exports of flat products to 554 thousand tons in January-April“, combined with observed fluctuations in plant activity suggests a dynamic but stable market. The significant increase in scrap exports, as detailed in “Ukraine increased scrap metal exports by 45% in 4 months” and “Ukraine increased exports of ferrous scrap by 95% year-on-year“, coupled with proposed export restrictions, may lead to domestic supply constraints, particularly for EAF-based steelmakers.

Evaluated Market Implications:

* Potential Supply Disruptions: The proposed export restrictions on ferrous scrap, discussed in “Ukraine increased scrap metal exports by 45% in 4 months” and “Ukraine increased exports of ferrous scrap by 95% year-on-year“, could lead to increased domestic scrap prices and potential supply shortages for Ukrainian steel plants relying on EAF technology. These constraints could disproportionately affect producers of long products.

* Recommended Procurement Actions:

* Scrap Procurement: Steel buyers should monitor scrap export policy changes and consider securing long-term scrap supply contracts to mitigate potential price increases and supply disruptions.

* Long Product Sourcing: Given the potential impact of scrap restrictions, buyers should diversify their sources for long products, considering imports from regions not affected by Ukrainian scrap export policies.

* Flat Product Procurement: The decrease in activity at Metinvest Zaporizhstal steel plant, coupled with increased flat product exports, warrants careful monitoring of lead times and potential price fluctuations for hot-rolled and cold-rolled sheets. Buyers should maintain close communication with their suppliers and consider forward purchasing to secure supply.