From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Bullish Despite Ukrainian Export Shifts: Activity Data Signals Strong Regional Production

Europe’s steel market shows overall strength despite shifts in Ukrainian exports. According to the news article “Ukrainian steelmakers cut exports of semi-finished products by 25% y/y in January-April,” Ukrainian semi-finished product exports have decreased. The article “Metallurgists of Ukraine exported 1.23 million tons of rolled metal in 4 months,” further details a decrease in total rolled metal exports from Ukraine, potentially impacting European supply chains, while “Ukraine increased exports of flat products to 554 thousand tons in January-April” presents a more differentiated picture. Satellite data on European steel plant activity provides insight into how regional producers are responding to these changes, with some activity levels rising. No direct relationship can be established with the “Ukraine increased scrap metal exports by 45% in 4 months“, “Pig iron exports from Ukraine increased by 37% in 4 months” and “Ukraine’s ferroalloy industry exported 39 thousand tons of products in January-April” articles.

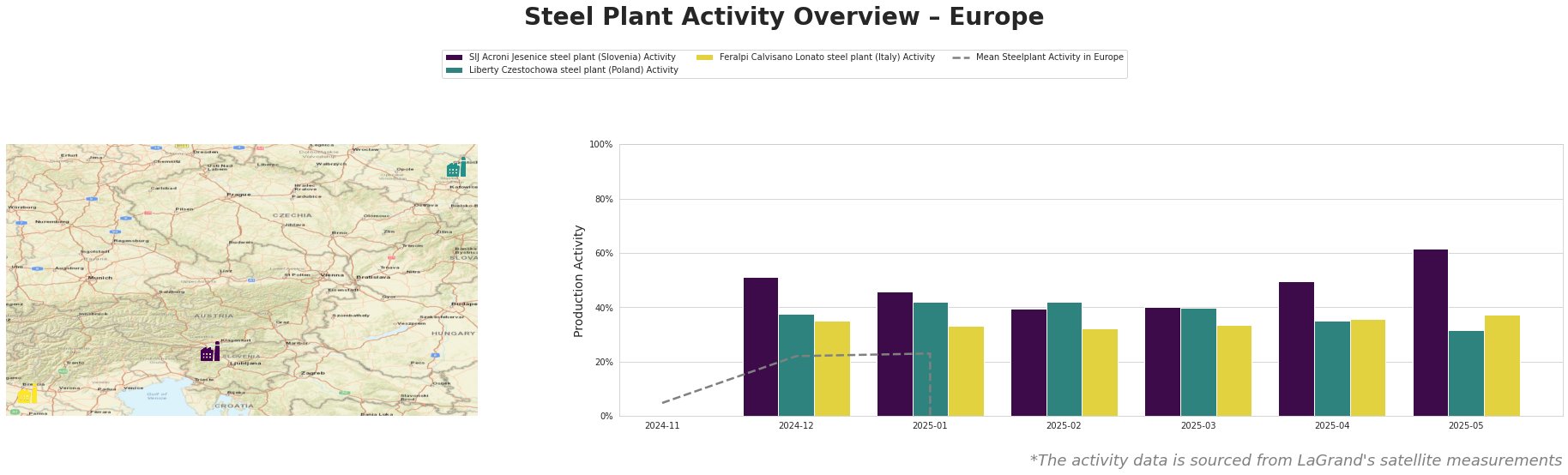

The mean steel plant activity in Europe cannot be interpreted meaningfully due to corrupted data points.

SIJ Acroni Jesenice steel plant (Slovenia), an EAF-based producer with a 726 ttpa crude steel capacity, specializing in flat rolled products, shows a significant upward trend in activity. Starting at 51% in December 2024, activity dipped slightly before steadily climbing to 62% by May 2025. This suggests increased production to meet regional demand potentially offsetting some of the Ukrainian export decline detailed in the article “Metallurgists of Ukraine exported 1.23 million tons of rolled metal in 4 months.”

Liberty Czestochowa steel plant (Poland), an EAF-based producer with an 840 ttpa crude steel capacity focused on plate production, exhibited relatively stable activity between December 2024 (38%) and February 2025 (42%), before declining to 32% in May 2025. This may be a response to the decrease in exports of semi-finished products from Ukraine as cited in “Ukrainian steelmakers cut exports of semi-finished products by 25% y/y in January-April“.

Feralpi Calvisano Lonato steel plant (Italy), an EAF-based producer with a 600 ttpa crude steel capacity that focuses on billet production, shows relatively stable activity, fluctuating between 32% and 37% from December 2024 to May 2025. The stability does not show any influence of any of the news articles.

Despite decreased overall export volumes from Ukraine, the increase in flat product exports mentioned in “Ukraine increased exports of flat products to 554 thousand tons in January-April” coupled with increased activity at SIJ Acroni Jesenice suggests flat product supply in Europe remains robust. The observed decrease in activity at Liberty Czestochowa, in contrast, indicates a potential constraint for plate supply.

Recommended Procurement Actions:

* Steel buyers focusing on flat rolled products: Should leverage the increased activity at SIJ Acroni Jesenice and stable Ukrainian flat product exports to negotiate favorable terms. Monitor the situation closely, but immediate supply concerns are low.

* Steel buyers requiring steel plate: Should explore alternative suppliers besides Liberty Czestochowa, as the plant activity declined while Ukranian steel exports of semi-finished products decline, negotiate contracts with built-in flexibility, and closely monitor inventory levels.