From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Feels the Pressure: Production Dip, Oversupply Concerns

Italy’s steel sector faces headwinds due to reduced production and stainless steel overcapacity. According to “Italy reduced steel production by 10.8% m/m in April,” steel output fell sharply in April. This drop, coupled with the challenges highlighted in “Excess production capacity affects Italian stainless steel sheets,” suggests a complex interplay of supply-side adjustments and demand pressures. The Assofermet report, “Assofermet on the Italian steel market: Lack of momentum in April amid global tensions and slowing industrial growth in the EU,” further underscores the subdued market sentiment.

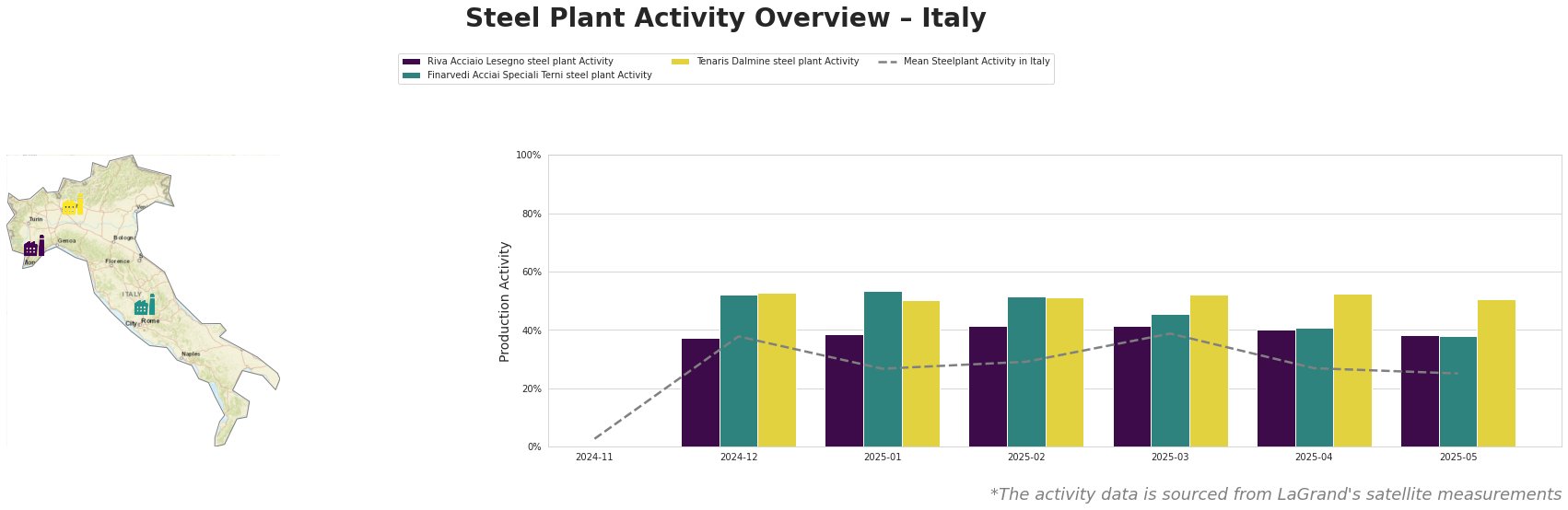

Overall steel plant activity in Italy experienced a peak in March 2025 at 39%, followed by a decline to 25% in May 2025. Riva Acciaio Lesegno saw relatively stable activity between December 2024 and May 2025. Finarvedi Acciai Speciali Terni and Tenaris Dalmine maintained comparatively higher activity levels, though both experienced declines in recent months.

Riva Acciaio Lesegno, an EAF-based plant in the Province of Cuneo with a crude steel capacity of 600ktpa, showed a moderate fluctuation in its activity, ranging from 37% in December 2024 to 42% in March 2025, before settling at 38% in May 2025. This stability does not directly correlate with any specific news item.

Finarvedi Acciai Speciali Terni, a significant stainless steel producer in the Province of Terni with a capacity of 1450ktpa relying on EAF technology, registered a marked decrease in activity from 53% in January 2025 to 38% in May 2025. This decline could be linked to the challenges described in “Excess production capacity affects Italian stainless steel sheets,” where oversupply and declining demand are impacting stainless steel producers.

Tenaris Dalmine, located in the Province of Bergamo with a 700ktpa EAF-based capacity focused on tubes and pipes, exhibited the most consistent activity level, remaining around 50-53% throughout the observed period. The observed stability suggests that Tenaris Dalmine is not immediately affected by the oversupply issues mentioned in the news articles, however the company is still seeing a small decline, down to 51% in May of 2025.

The 10.8% month-over-month drop in national steel production reported in “Italy reduced steel production by 10.8% m/m in April” is reflected in the reduced mean activity across the observed steel plants. However, the individual plant activity levels indicate varying responses to the market conditions. The decline observed at Finarvedi Acciai Speciali Terni aligns with the issues of overcapacity and price pressure in the stainless steel sheet market.

Given the reported production decrease and oversupply in stainless steel, buyers should:

- Short-Term Stainless Steel Procurement: Prioritize securing contracts with firm price commitments to mitigate potential price volatility stemming from oversupply, as mentioned in “Excess production capacity affects Italian stainless steel sheets.”

- Monitor Tenaris Dalmine’s Activity: Closely track the activity levels at Tenaris Dalmine. While currently stable, any significant drop could signal broader market weakness impacting tube and pipe production.

- Supply Chain Diversification: Assess and potentially diversify supply sources for flat products, given the production cuts reported in “Assofermet on the Italian steel market: Lack of momentum in April amid global tensions and slowing industrial growth in the EU.”