From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Slowdown & Stable Indian Production Signal Price Pressures

Asia’s steel market faces headwinds due to declining Chinese production, while Indian steel plant activity remains relatively stable. “China’s crude steel production fell 7% in April, m-o-m” and “China reduced steel production by 7% m/m in April” point to a significant production decrease, potentially impacting export volumes and regional pricing dynamics. While these production cuts are occurring, the satellite data shows no clear corresponding drop in activity at the selected Indian plants. Therefore, the news has no direct relationship with the satellite activity of the selected Indian plants.

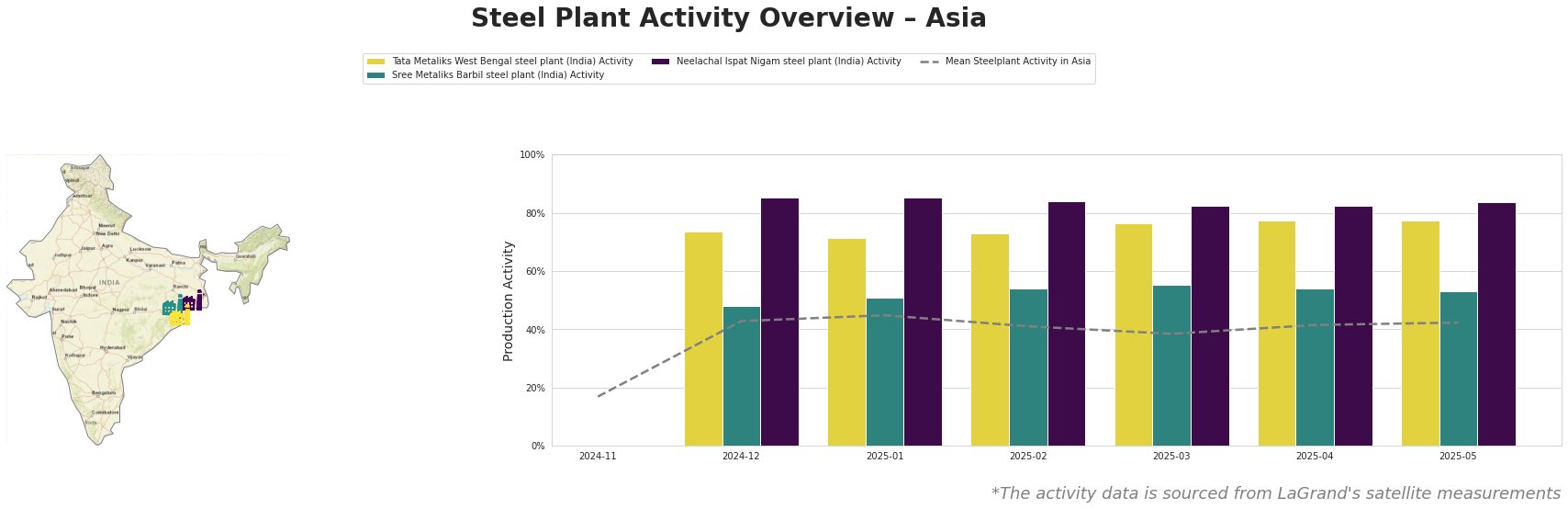

Across all observed plants, activity rose strongly from November 2024 to December 2024, and then has been generally stable with some fluctuations.

Tata Metaliks West Bengal steel plant, an integrated BF-based plant producing primarily pig iron and ductile pipes, has shown consistently high activity. Its activity has steadily increased from 74.0 in December 2024 to 78.0 in May 2025, significantly above the Asian mean. No direct correlation can be established between this steady activity and the provided news articles.

Sree Metaliks Barbil steel plant, an integrated BF and DRI-based plant producing DRI, pig iron, billets, and TMT bars, has shown activity fluctuating in the 48.0-55.0 range. The data shows an initial rise from 48.0 in December 2024 to 55.0 in March 2025, followed by a small decline to 53.0 in May 2025. This plant’s activity is around the mean activity. No direct correlation can be established between this activity and the provided news articles.

Neelachal Ispat Nigam steel plant, an integrated BF-based plant producing pig iron, LAM coke, and billets, among other products, has consistently high activity, remaining stable in the 82.0-85.0 range. Similar to Tata Metaliks, the activity is significantly above the mean. The provided news articles do not directly relate to the activity of this specific plant.

The “EU stainless prices to continue to fall: Assofermet” article highlights increased competitiveness of European producers against Asian imports due to falling prices. The 7% decrease in Chinese steel production reported in “China’s crude steel production fell 7% in April, m-o-m” coupled with stable production at key Indian plants may provide a short-term opportunity for Indian producers to increase exports. However, the article also warns of weak demand in key sectors in Europe, which must be considered.

Based on the observed reduction in Chinese steel output, and stable production activity in India, procurement professionals should:

- Negotiate contracts, especially with Chinese suppliers, more aggressively, citing decreased domestic production as leverage for price reductions.

- Carefully monitor European demand trends as indicated in the EU stainless prices to continue to fall: Assofermet article, before heavily depending on exports.

- Diversify sourcing to include Indian suppliers, specifically considering pig iron from Tata Metaliks West Bengal steel plant and Neelachal Ispat Nigam steel plant given their consistently high output. However, be aware that these plants may already be operating at full capacity.