From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Output Dips in April, But Select Plants Buck the Trend, Signaling Opportunity

China’s steel market presents a mixed picture. “China’s crude steel production fell 7% in April, m-o-m” and “China reduced steel production by 7% m/m in April” both confirm a recent output decrease. While production targets remain in place, no direct relationship between the stated goals described in “China reduced steel production” and the observed plant activity can be explicitly established.

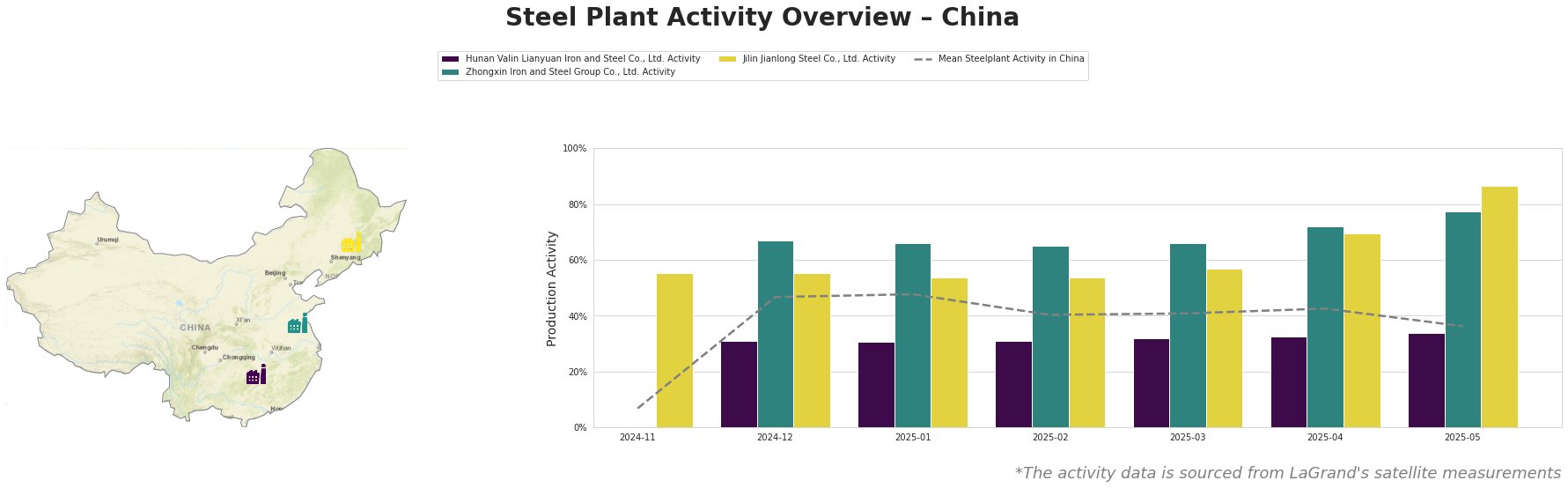

Overall, the mean steel plant activity in China decreased to 36% in May, a significant drop from 47-48% in December-January. This downward trend aligns with news of decreasing steel production reported in “China reduced steel production by 7% m/m in April”. However, individual plant activity varies significantly, suggesting localized factors are at play.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., a major integrated BF/BOF steel producer in Hunan, showed relatively stable activity, gradually increasing from 31% in December 2024 to 34% in May 2025. This trend does not reflect the sharp decline reported in national steel production figures. No direct relationship can be established between this plant’s activity and the named news articles.

Zhongxin Iron and Steel Group Co., Ltd., an integrated BF/BOF steel producer located in Jiangsu, has demonstrated steadily increasing activity, rising from 67% in December 2024 to 77% in May 2025, consistently exceeding the national mean. This increase contradicts the overall production decline reported in “China’s crude steel production fell 7% in April, m-o-m.” No direct relationship can be established between this plant’s activity and the named news articles.

Jilin Jianlong Steel Co., Ltd., an integrated BF/BOF steel producer in Jilin, saw a sharp increase in activity, jumping from 55% in December 2024 to 86% in May 2025. This is significantly above the national mean. Similar to Zhongxin, this increase appears to contradict the national production decrease described in “China reduced steel production”. No direct relationship can be established between this plant’s activity and the named news articles.

Despite overall decreased production reported in “China reduced steel production”, Zhongxin Iron and Steel Group Co., Ltd. and Jilin Jianlong Steel Co., Ltd. are showing increased activity, suggesting localized opportunities for steel procurement. “China reduced steel production by 7% m/m in April” indicates a possible rebound in May’s production due to increased profitability of about 56% of steel companies.

* Procurement Action: Steel buyers should investigate securing supply contracts with Zhongxin Iron and Steel Group Co., Ltd. and Jilin Jianlong Steel Co., Ltd. to capitalize on their increased production and hedge against potential supply disruptions elsewhere. Negotiate contracts promptly, anticipating potential price increases if the expected rebound in May production reported in “China reduced steel production by 7% m/m in April” materializes.