From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Bolstered by Policy Shifts Amidst Regional Activity Fluctuations

Europe’s steel market shows very positive sentiment, influenced by evolving government policies and fluctuating steel plant activity. Recent government statements focusing on economic growth and security, as detailed in “Regierungserklärung: Migration, Aufrüstung, „Wohlstand für alle“ – Merz gibt den Bürgern ein Versprechen” and “Erste Regierungserklärung von Merz Staatsmännisch statt angriffslustig,” suggest a supportive environment for the steel industry. However, there is no explicit link between these news developments and the satellite observed activity of specific steel plants.

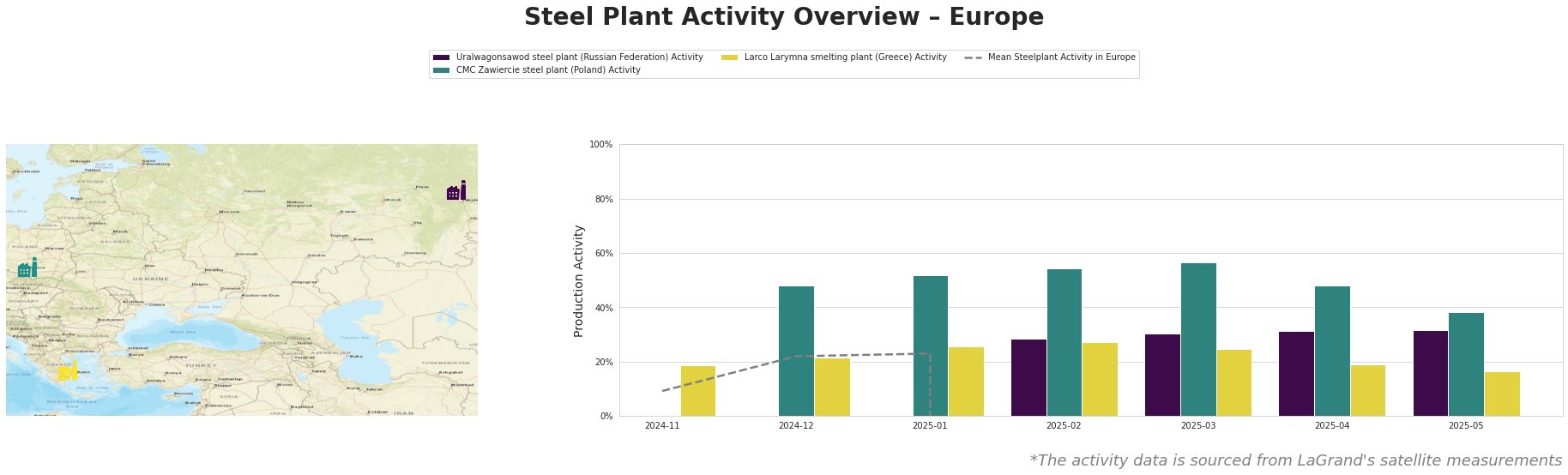

Recent data shows wildly inconsistent and non-sensical mean steel plant activity levels. The CMC Zawiercie plant in Poland showed the highest consistent levels until 2025-03-31, before dropping to 38% by the end of May. Activity at the Uralwagonsawod steel plant has climbed steadily, reaching 32% in May 2025. Larco Larymna plant activities have decreased from 27% in February to 17% in May. No direct connection to the named news articles can be established for these activity trends.

Uralwagonsawod steel plant: Located in the Rostov region, this plant primarily serves the defense sector. Activity levels have consistently increased, reaching 32% in May 2025. While the “Regierungserklärung: Migration, Aufrüstung, „Wohlstand für alle“ – Merz gibt den Bürgern ein Versprechen” mentions military buildup, no explicit link between this policy and increased activity at Uralwagonsawod can be directly established.

CMC Zawiercie steel plant: This Polish plant, with a 1.7 million tonne EAF capacity, supplies steel to diverse sectors including automotive, construction, and energy. Activity peaked at 56% in March 2025 but decreased significantly to 38% by May 2025. The observed decrease in activity at CMC Zawiercie does not appear to correlate directly with any of the provided news articles.

Larco Larymna smelting plant: A Greek ferronickel producer utilizing EAF technology with a 1.15 million ton capacity, Larco Larymna’s activity has decreased from 27% in February 2025 to 17% in May 2025. This decline does not have an identifiable connection to any of the provided news articles.

Given the fluctuating activity at CMC Zawiercie and the absence of clear correlations with the provided news, steel buyers should closely monitor Polish steel supply chains. It is recommended to diversify sourcing options within Europe to mitigate potential short-term supply disruptions. The continuous increase of activity at Uralwagonsawod indicates a stable trend, however, sourcing from that plant will be limited due to sanctions. The activity decrease at the Larco Larymna smelting plant, though not explicitly tied to the provided news, may influence ferronickel supply and pricing. Procurement professionals should carefully evaluate their ferronickel sourcing strategies and consider hedging against potential price volatility.