From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts to US-India Trade Talks: Chinese Output Rises as Indian Plants Fluctuate

Asia’s steel market exhibits mixed signals as trade tensions and negotiations between the US and India influence regional dynamics. Specifically, activity at Chinese plants is trending upwards, while Indian plants are showing fluctuations amidst ongoing trade discussions. These observations are linked to the news articles “India proposes retaliatory tariffs on select ex-US imports to counter additional tariffs on steel and aluminium” and “India-US Trade Agreement Talks “Progressing Very Well”: Commerce Secretary“. The rising output in China does not directly correlate with the aforementioned news and is assessed separately.

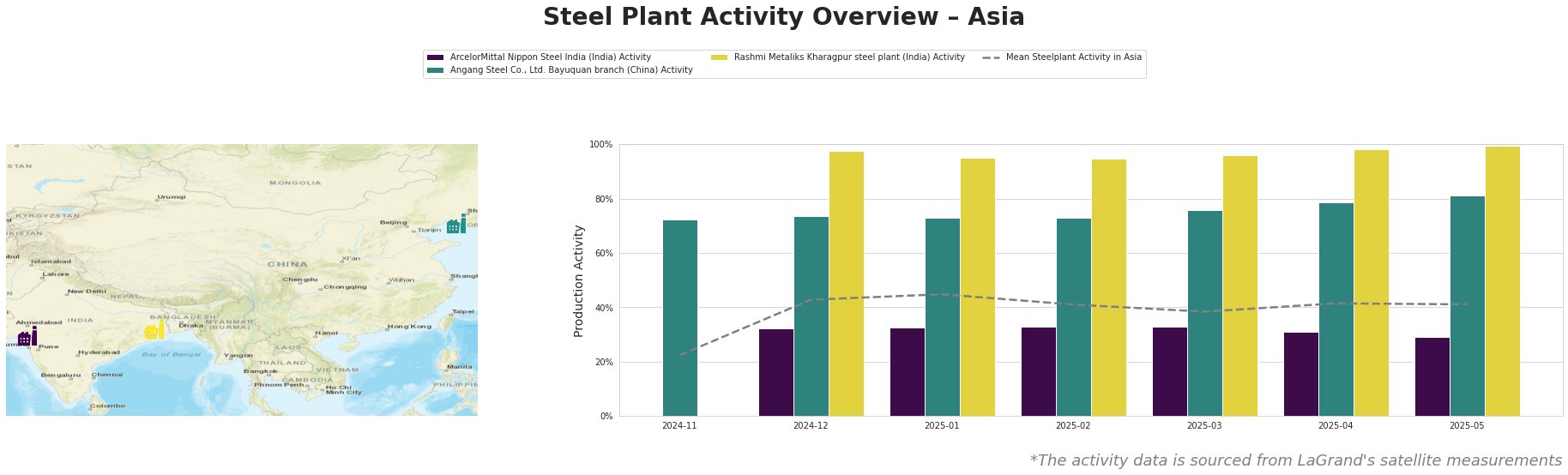

The mean steel plant activity in Asia has seen an overall increase from 22% in November 2024 to a relatively stable level around 41% between April and May 2025. ArcelorMittal Nippon Steel India’s activity has remained consistently below the mean, showing a slight downward trend, decreasing from 33% in January-March 2025 to 29% in May 2025. Angang Steel Co., Ltd. Bayuquan branch has shown a consistent upward trend, rising from 72% in November 2024 to 81% in May 2025, consistently operating well above the Asian mean. Rashmi Metaliks Kharagpur steel plant has maintained high activity levels, fluctuating between 95% and 99% since December 2024, also consistently above the Asian mean.

ArcelorMittal Nippon Steel India, a Gujarat-based plant with 9.6 MTPA crude steel capacity primarily using EAF and DRI technologies, has shown a decrease in activity from 33% in January-March 2025 to 29% in May 2025. This may potentially be correlated to uncertainty surrounding the trade tariffs and potential retaliatory measures outlined in “India proposes retaliatory tariffs on select ex-US imports to counter additional tariffs on steel and aluminium“. The trade negotiations discussed in “India-US Trade Agreement Talks “Progressing Very Well”: Commerce Secretary” could also be influencing production strategies.

Angang Steel Co., Ltd. Bayuquan branch, a Liaoning-based integrated steel plant with 6.5 MTPA crude steel capacity utilizing BF and BOF technologies, exhibits a steady increase in activity, reaching 81% in May 2025. It is possible that this reflects broader Chinese government policy, with no direct impact to news involving the US and India trade relations.

Rashmi Metaliks Kharagpur steel plant, located in West Bengal, has a 1.5 MTPA crude steel capacity using DRI and BF methods. The plant maintained activity levels exceeding 95% from December 2024 through May 2025. No correlation to news could be established.

The potential trade conflicts between the US and India, alongside ongoing trade negotiations, could lead to short-term supply disruptions from Indian producers like ArcelorMittal Nippon Steel India. Simultaneously, the continued high output from Rashmi Metaliks Kharagpur steel plant and steadily increasing production from Angang Steel Co., Ltd. Bayuquan branch may mitigate potential shortages depending on specific product types and regional demand. Steel buyers should:

- Closely monitor the outcome of the India-US trade negotiations, as detailed in “India-US Trade Agreement Talks “Progressing Very Well”: Commerce Secretary“. A positive resolution could stabilize Indian steel production and trade flows, while failure to reach an agreement might exacerbate supply concerns.

- Assess potential risks to steel supply chains in India due to fluctuating production activity at plants such as ArcelorMittal Nippon Steel India, as it could be linked to trade-related uncertainty. Consider diversifying sourcing to include regions unaffected by these trade disputes if this plant is a critical supplier.

- Explore opportunities presented by increased production from Angang Steel Co., Ltd. Bayuquan branch as a potential alternative supply source, while being cautious of geopolitical risks.