From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Steel Market Faces Uncertainty Amidst Import Quota Changes and Rising Plant Activity

Europe’s steel market faces uncertainty due to proposed changes in import quotas impacting the UK, while overall plant activity trends upwards. The proposed changes to tariff rate quotas “fall short”, says UK Steel, highlighting the industry’s concerns regarding increasing global overcapacity. These concerns are amplified by the UK’s TRA recommending caps on some steel quotas, specifically targeting certain product categories and countries. Satellite data shows an increase in activity in some European plants, however, a clear and direct relationship between these policy changes and plant activity data cannot be explicitly established.

The UK steel industry is navigating a complex landscape as trade remedies undergo review. The British Trade Remedies Authority (TRA) has proposed new restrictions on steel import quotas. This includes the UK TRA recommends restricting countries’ access to residual quotas on steel imports, focusing on limiting shares of unallocated quotas and canceling the carry-over mechanism. Stakeholders are currently providing feedback on these proposals, as TRA unveils proposed restrictions on steel imports from the UK, which include 40% limits on specific product categories. These changes occur amidst broader concerns raised by UK Steel: TRA’s quota cap recommendation falls short of addressing the industry’s challenges, particularly the impending expiry of safeguard measures and potential impact of increased US tariffs. Simultaneously, UK Steel, 7Steel call for reduced electricity prices, highlighting the need for government intervention to improve competitiveness.

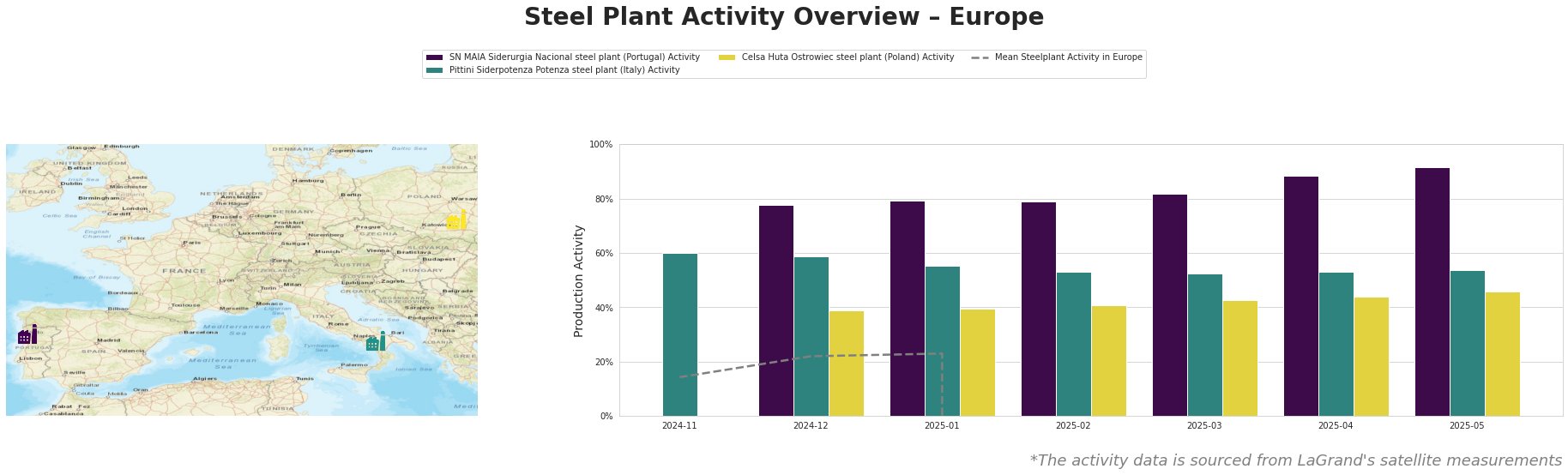

Here’s an overview of recent activity trends, derived from provided data:

The mean steel plant activity in Europe shows an invalid trend due to incorrect values in the source data.

SN MAIA Siderurgia Nacional steel plant (Portugal): This plant, equipped with a 600,000-tonne EAF and certified by ResponsibleSteel, produces semi-finished and finished rolled products, particularly rebar. Activity at SN MAIA shows a steady increase, from 78% in December 2024 to 92% in May 2025. No direct connection between this rise and the UK-focused news articles could be established.

Pittini Siderpotenza Potenza steel plant (Italy): This EAF-based plant, with a 700,000-tonne capacity, focuses on rebar for the building and infrastructure sectors. Its activity has remained relatively stable around the 53-60% range between November 2024 and May 2025. No direct connection between this stable activity and the UK-focused news articles could be established.

Celsa Huta Ostrowiec steel plant (Poland): This plant utilizes EAF technology to produce 900,000 tonnes of crude steel annually, manufacturing bars and rebar for the building and infrastructure sectors. Its activity has risen steadily from 39% in December 2024 to 46% in May 2025. No direct connection between this rise and the UK-focused news articles could be established.

Given the proposed changes to import quotas in the UK and the concerns raised by UK Steel, procurement professionals should anticipate potential supply disruptions in the UK market, particularly for metallic coated sheet, non-alloy, other alloy quarto plate, and rebar (Categories 4, 7, and 13).

Recommended Procurement Actions:

- Diversify Supply Sources: UK buyers reliant on imports from Vietnam, Korea, Algeria, and Egypt (the countries the TRA is attempting to cap) should proactively seek alternative suppliers to mitigate potential shortages resulting from the proposed 40% country-specific caps, especially given the expiry of safeguards in 2026 and the potential for increased US tariffs driving imports into the UK.

- Monitor TRA Recommendations Closely: Track the TRA’s final recommendations and their implementation timeline to understand the exact impact on specific product categories and adjust procurement strategies accordingly. Pay close attention to the stakeholder feedback period ending May 26.

- Evaluate Impact of Carry-Over Cancellation: Assess the implications of the proposed cancellation of the carry-over mechanism for unused quotas. Buyers who typically rely on this mechanism to secure additional supply should explore alternative strategies to ensure consistent access to steel.

- Assess UK Electricity Price Impacts: Follow developments regarding UK Steel’s advocacy for reduced electricity prices. Reduced electricity prices can improve the competitiveness of domestic steel producers, potentially influencing sourcing decisions and reducing reliance on imports in the long term.