From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Optimistic Amid US Trade Talks and Steady Plant Activity

India’s steel market maintains a very positive outlook as trade negotiations with the U.S. progress, potentially offsetting the impact of tariffs. Plant activity remains relatively stable, with individual facilities showing distinct trends. The “India-US Trade Agreement Talks “Progressing Very Well”: Commerce Secretary” articles, published on 2025-05-15T14:31:58Z and 2025-05-15T14:29:01Z, suggest a path towards resolving trade tensions and potentially mitigating the effects of tariffs outlined in the article “India proposes retaliatory tariffs on select ex-US imports to counter additional tariffs on steel and aluminium” (published 2025-05-13T15:42:47Z).

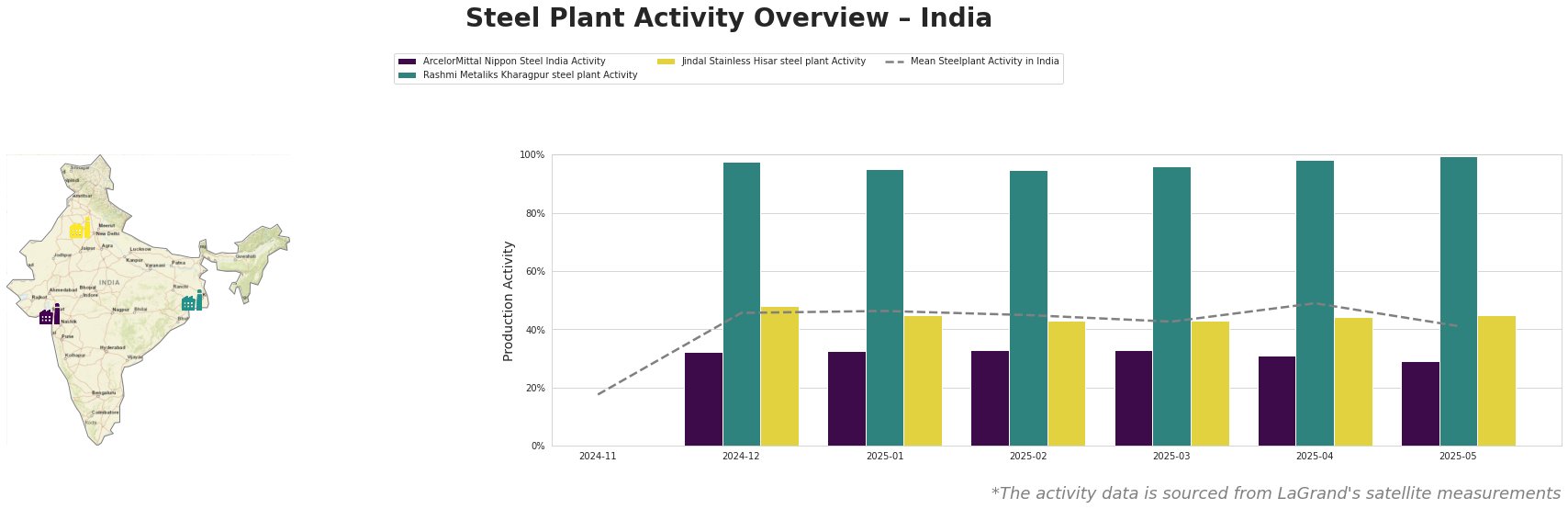

The mean steel plant activity in India has fluctuated, peaking at 49.0% in April 2025 and dropping to 41.0% in May 2025. This recent dip in overall activity does not appear to be directly correlated with the named news articles, which primarily focus on trade negotiations and tariffs.

ArcelorMittal Nippon Steel India, a major player with integrated BF and DRI processes and a significant 9600 ttpa EAF crude steel capacity located in Gujarat, has consistently operated below the national average. Activity has decreased from 32.0% in December 2024 to 29.0% in May 2025. There is no direct correlation between this activity decline and the news articles about US trade.

Rashmi Metaliks Kharagpur steel plant in West Bengal, producing crude, semi-finished, and finished rolled products with DRI and BF processes, has maintained very high activity levels, consistently around 95-99% since December 2024. This high activity level suggests strong regional demand or efficient operations, but no connection to the US trade news can be established.

Jindal Stainless Hisar steel plant in Haryana, an electric arc furnace (EAF) based producer of stainless steel products, has shown relatively stable activity, fluctuating between 43.0% and 48.0% from December 2024 to May 2025, staying close to the overall national mean activity. There is no evident connection between this activity and the provided news articles.

Based on the news articles and plant activity data:

- Potential Supply Disruptions: Given the ongoing trade negotiations and potential for retaliatory tariffs described in “India proposes retaliatory tariffs on select ex-US imports to counter additional tariffs on steel and aluminium”, steel buyers should be prepared for price volatility, particularly if the U.S. and India fail to reach an agreement. A stable operation of the local steel manufacturer like Rashmi Metaliks Kharagpur steel plant might provide a safe haven for local buyers and less dependence on imports in the future.

- Recommended Procurement Actions: Steel buyers should closely monitor the progress of trade talks. Given ArcelorMittal Nippon Steel India’s consistently lower activity, buyers should diversify their supply sources to mitigate risks associated with relying heavily on that specific plant. Given the progress in trade agreement and the high operation of Rashmi Metaliks Kharagpur steel plant, it is recommended to increase the purchase volume of the local production.