From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Initiatives Drive Positive European Market Sentiment Despite Activity Fluctuations

European steel market sentiment remains very positive, driven by green steel initiatives across the region. “Blastr Green Steel Signs Land Use Agreement for Finnish Mill” signals progress in establishing new, sustainable production capacities. Simultaneously, “Sweden’s Stegra and LKAB to carry out test pellet deliveries” indicates efforts to secure raw material supply chains for green steel production. These developments correlate with observed activity at certain steel plants, while others show fluctuations requiring careful monitoring.

The positive outlook stems from the European steel industry’s proactive approach to decarbonization, as highlighted in the news, although the direct relationship with observed activity shifts may not always be immediately apparent.

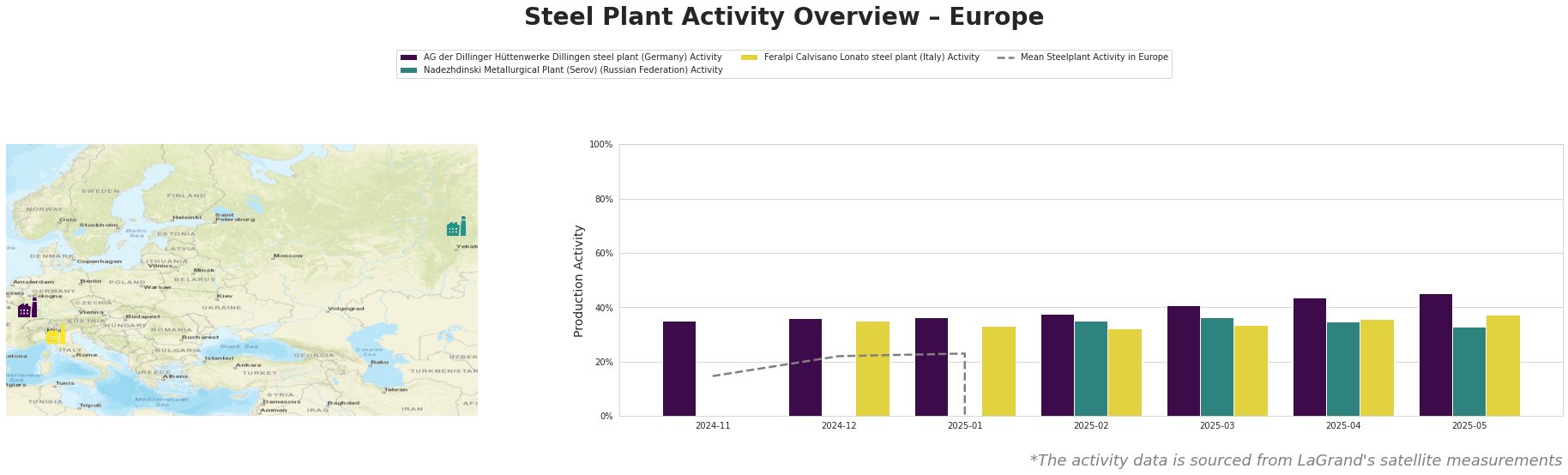

The activity data reveals that AG der Dillinger Hüttenwerke Dillingen steel plant in Germany, an integrated BF/BOF steel plant with a crude steel capacity of 2760 ttpa, exhibits a consistently increasing activity level, rising from 35% in November 2024 to 45% in May 2025. This increase does not have a direct explicit connection to the green steel initiatives highlighted in the news articles, but it may be indirectly related to increased demand in anticipation of green steel availability or general economic recovery. The Nadezhdinski Metallurgical Plant (Serov) in the Russian Federation, an EAF-based plant with a crude steel capacity of 756 ttpa, shows a decrease in activity from 35% in February 2025 to 33% in May 2025. There are no explicit news articles directly explaining this decline, so potential causes are unclear. The Feralpi Calvisano Lonato steel plant in Italy, another EAF-based plant with a smaller crude steel capacity of 600 ttpa, saw some increase in activity from 35% in December 2024 to 37% in May 2025. No direct relationship can be established between that trend and the provided green steel project news. The monthly Mean Steelplant Activity in Europe value is anomalous as of February 2025.

Given the positive developments around green steel production highlighted in articles like “Blastr Green Steel Signs Land Use Agreement for Finnish Mill” and “Sweden’s Stegra and LKAB to carry out test pellet deliveries”, steel buyers should prioritize establishing relationships with producers committed to sustainable practices. Procurement analysts should closely monitor the Nadezhdinski Metallurgical Plant (Serov) activity for potential supply disruptions. Diversifying sourcing strategies to include suppliers like Stegra and Blastr may mitigate risks and secure access to future green steel supplies.