From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges: Vietnam Imports Rise, Turkish Demand Shifts, and Indian Plant Activity Soars

Asia’s steel market displays a positive outlook with shifting trade dynamics and increasing production activity. Vietnam’s steel imports are rebounding, as indicated by “Vietnam’s steel imports up 11.6 percent in April from March,” while Turkey’s import landscape is evolving, highlighted in “Turkey’s billet imports up 13.3% in Q1, Malaysia and China preferred” and “Turkey’s CRC imports up 37.0 percent in January-March.” Satellite data reveals surging activity at NMDC Nagarnar steel plant in India, though a direct link to these news articles cannot be established.

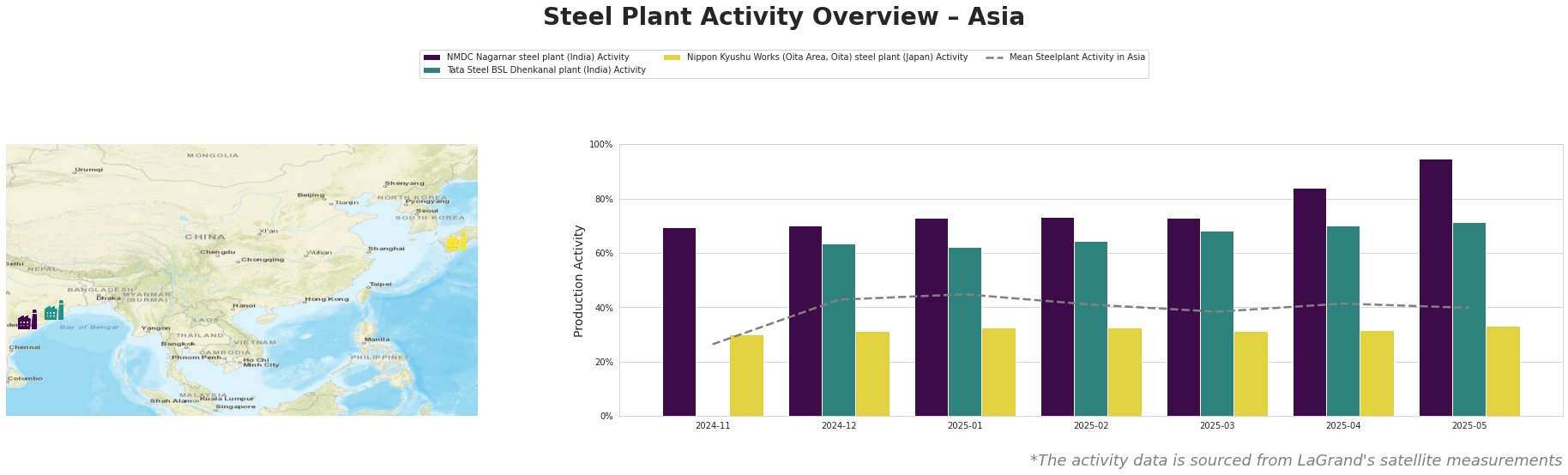

Monthly aggregated activities (in %)

Average steel plant activity in Asia fluctuated over the observed period, reaching a peak in January 2025 at 45% and stabilizing around 40% in April and May. NMDC Nagarnar steel plant in India consistently showed high activity, climbing to 95% in May 2025. Tata Steel BSL Dhenkanal plant also displayed strong activity, hovering around 60-70%. Nippon Kyushu Works in Japan exhibited relatively stable activity, ranging between 30-33%.

NMDC Nagarnar steel plant, a 3 million tonne per annum (ttpa) BOF-based integrated steel plant producing hot rolled coils, sheets, and plates, shows a consistent upward trend in activity. Its activity level steadily increased from 70% in late 2024 to a high of 95% by May 2025. This surge in activity could suggest increased domestic demand or export opportunities, although a direct connection to any specific news article cannot be explicitly established from the provided information.

Tata Steel BSL Dhenkanal plant, with a 5.6 million ttpa capacity utilizing both BF and DRI processes to produce semi-finished and finished rolled products like hot rolled coil, pipe, and sheet, maintained a consistent activity level between 62% and 71% throughout the observed period. A direct connection to the provided news articles cannot be explicitly established based on the provided information.

Nippon Kyushu Works (Oita Area, Oita) steel plant, an integrated BF-based plant with a 10 million ttpa crude steel capacity focused on hot rolled steel sheets and steel plates, displayed a relatively stable activity level fluctuating between 30% and 33%. No direct connection to the provided news articles can be explicitly established.

The shifting import patterns in Turkey, as highlighted in “Turkey’s billet imports up 13.3% in Q1, Malaysia and China preferred” indicate a potential oversupply from Asian exporters in the near term, especially impacting billet prices. The rise in Vietnamese steel imports, as reported in “Vietnam’s steel imports up 11.6 percent in April from March,” may create opportunities for steel exporters, especially from countries like Indonesia, which saw a significant increase in steel exports to Vietnam. Given the surge in activity at NMDC Nagarnar steel plant, steel buyers should closely monitor domestic pricing trends in India, anticipating potential supply-side pressures if domestic demand continues to rise. Procurement professionals should leverage the shifts in Turkish import sources to negotiate favorable billet and CRC prices, particularly with Malaysian and Chinese suppliers.