From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market: HRC Prices Soften Amidst Reduced Mill Activity; Procurement Opportunities Emerge

Italy’s steel market faces a neutral outlook as HRC prices soften amid cautious sentiment, as reported in “EU HRC market looks towards bearish downturn” and “HRC prices in the EU are facing downward pressure as market sentiment remains cautious“. The Finarvedi Acciai Speciali Terni steel plant and Finarvedi Cremona steel plant show reduced activity, which may correlate with the overall bearish sentiment; however, no direct causal relationship can be definitively established from the news articles.

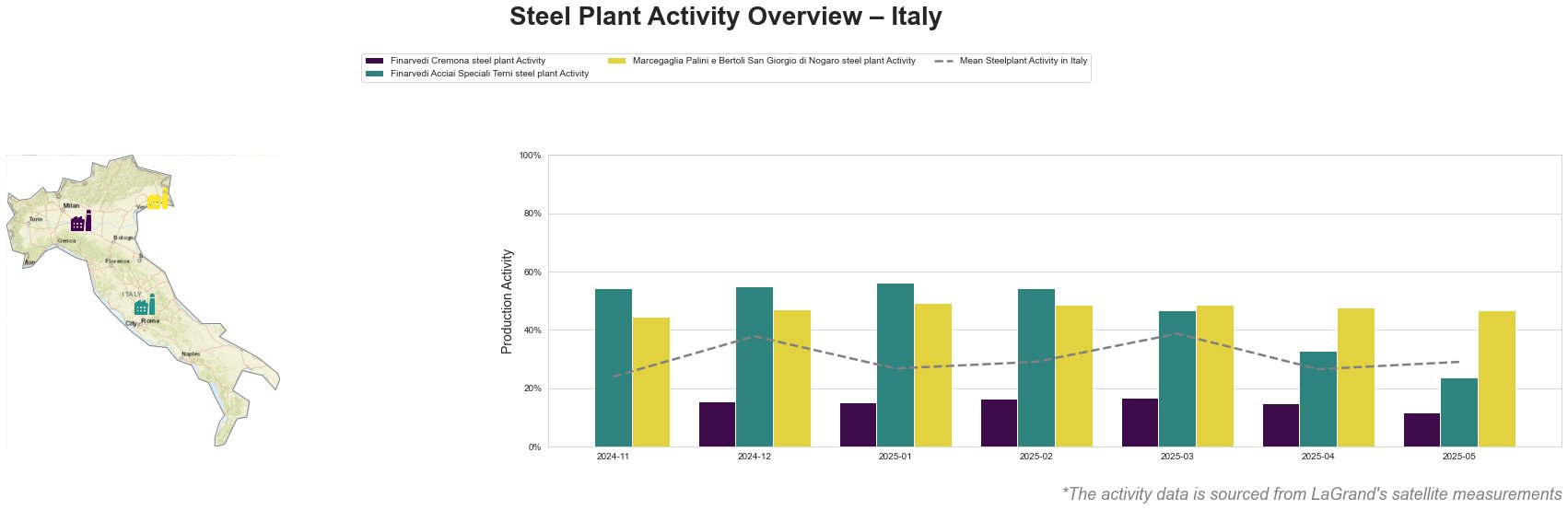

Recent monthly activity trends for selected Italian steel plants are shown below:

The mean steel plant activity in Italy fluctuated, peaking in March 2025 at 39% and ending May at 29%. Finarvedi Acciai Speciali Terni steel plant shows the highest activity levels compared to the other plants, with a peak in January 2025 (56%), followed by a steady decline to 24% in May. Conversely, Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant maintained a relatively stable activity level between 44% and 49%. Finarvedi Cremona steel plant shows very low levels of activity, reaching a low of 12% in May.

Finarvedi Cremona steel plant: This plant, located in the Province of Cremona, has a crude steel capacity of 3.85 million tonnes per annum (ttpa) via Electric Arc Furnaces (EAFs). It produces semi-finished and finished rolled products like hot rolled coil and galvanized products, primarily for the automotive sector. The plant’s activity has been consistently below the Italian mean, showing the lowest activity levels in May (12%). This significant decrease in activity could be related to the market softness reported in “EU HRC: Italian mill cuts prices” and “EU HRC: Italian steel plant reduces prices“; however, no direct link can be explicitly confirmed by the news articles.

Finarvedi Acciai Speciali Terni steel plant: Located in the Province of Terni, this plant has a crude steel capacity of 1.45 million ttpa, also relying on EAF technology. Its product range is broader, including hot-rolled, cold-rolled, and stainless steel products catering to automotive, building, and infrastructure sectors. Activity at this plant peaked in January 2025 at 56% but has since sharply declined to 24% in May. This downward trend may be linked to the overall bearish market sentiment mentioned in “The HRC market in the EU expects a bearish decline,” although a direct connection cannot be confirmed.

Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant: Situated in the Province of Udine, this plant has a smaller crude steel capacity of 0.6 million ttpa, focusing on hot rolled plate produced via EAF. Its activity has remained relatively stable, ranging from 44% to 49%, and is uncorrelated to the price variations reported in the news articles.

Recent Italian HRC price decreases, highlighted in “EU HRC: Italian mill cuts prices” and “EU HRC: Italian steel plant reduces prices“, with the Argus daily HRC index falling to €603.75/t ex-works, coupled with low liquidity, presents potential procurement opportunities. The fire at Acciaierie d’Italia’s smaller blast furnace introduces a potential, though currently subdued, supply risk, as per “EU HRC: Italian mill cuts prices” and “EU HRC: Italian steel plant reduces prices“.

Given the current market conditions, steel buyers and market analysts should consider the following actions:

- Monitor import offers: As highlighted in “EU HRC: Italian mill cuts prices” and “EU HRC: Italian steel plant reduces prices,” import offers from Indonesia ($570/t cfr Italy) and Turkey ($595/t cfr) are available. Procurement professionals should evaluate these offers to leverage potential cost savings, carefully accounting for regulatory uncertainties regarding carbon dioxide emissions as mentioned in “HRC prices in the EU are facing downward pressure as market sentiment remains cautious“.

- Negotiate contracts strategically: With some automotive buyers securing contracts between €650/t and over €700/t, while others are considering price rollovers as reported in “EU HRC: Italian mill cuts prices,” buyers should leverage the softened spot market to secure favorable contract terms. Target prices around €600/t, as indicated by current buyer aspirations in “EU HRC: Italian mill cuts prices” and “EU HRC: Italian steel plant reduces prices,” and carefully assess contract increase requests related to carbon border adjustment mechanisms.

- Assess alternative suppliers: Considering the activity decline at Finarvedi Acciai Speciali Terni steel plant and Finarvedi Cremona steel plant, buyers should diversify their supplier base to mitigate potential supply disruptions, specifically focusing on plants that can provide automotive-grade products.

- Track Acciaierie d’Italia situation: Closely monitor updates regarding the fire at Acciaierie d’Italia. While current market anxiety is low, any significant disruption to their production could impact the supply chain, as reported in “EU HRC: Italian mill cuts prices” and “EU HRC: Italian steel plant reduces prices“.