From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Steel Import Caps Proposed: Monitor Category 4, 7, and 13 Steel Prices Amid Potential Supply Adjustments

Proposed changes to UK steel import quotas are causing concern and uncertainty. Specifically, the news articles, “UK’s TRA recommends caps on some steel quotas,” “UK may impose country-specific caps on three steel product categories,” “TRA unveils proposed restrictions on steel imports from the UK,” and “UK TRA recommends restricting countries’ access to residual quotas on steel imports” all highlight the Trade Remedies Authority’s (TRA) proposal for country-specific caps on certain steel categories. No direct relationship between these proposed regulatory changes and satellite-observed activity changes at Ukrainian steel plants could be established from the provided information.

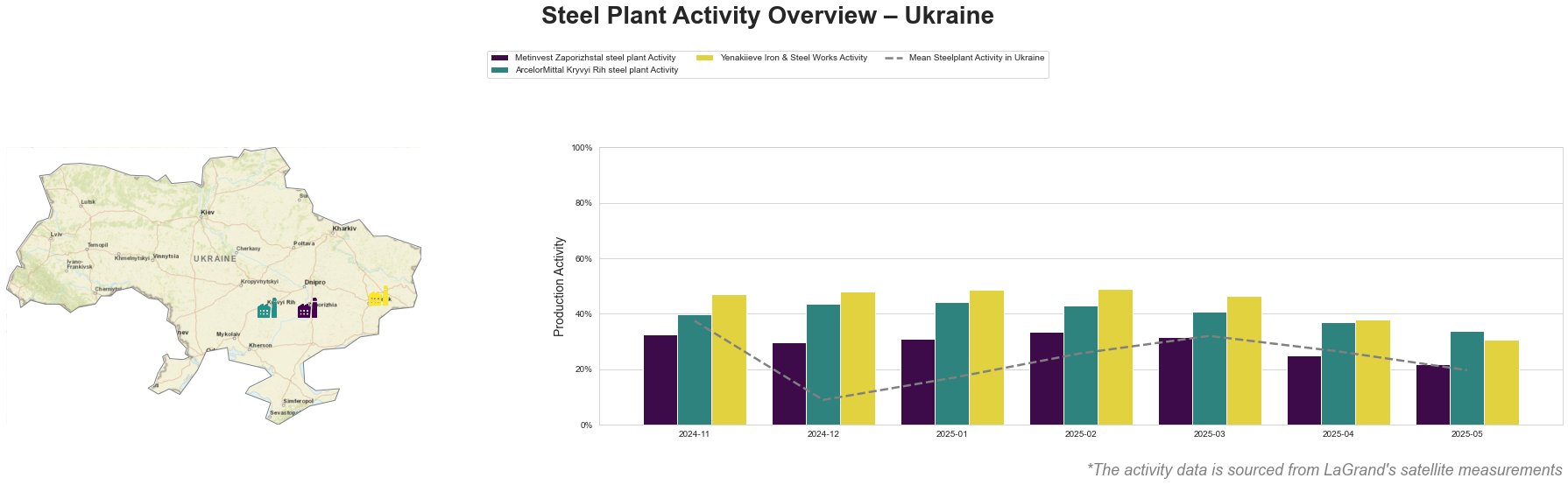

The mean steel plant activity in Ukraine has fluctuated, showing a general decline from November 2024 (38.0%) to December (9.0%), followed by a recovery and then a further decline to 20.0% in May 2025. Metinvest Zaporizhstal experienced a peak in February 2025 (34.0%), followed by a decrease to 22.0% in May. ArcelorMittal Kryvyi Rih showed a stable trend until February 2025 (43.0%), then decreased to 34.0% in May. Yenakiieve Iron & Steel Works had the highest activity relative to other plants, peaking at 49.0% in January and February 2025, before dropping to 31.0% in May.

Metinvest Zaporizhstal, located in Zaporizhzhia, is an integrated steel plant with a crude steel capacity of 4,100 TTPA, primarily using open-hearth furnaces (OHF). Activity at Metinvest Zaporizhstal peaked at 34.0% in February 2025 and has since declined to 22.0% in May. No direct link between this activity decrease and the named news articles regarding UK import quota changes could be established.

ArcelorMittal Kryvyi Rih, situated in Dnipropetrovsk, boasts a larger crude steel capacity of 8,000 TTPA, utilizing both BOF and OHF processes. The plant produces semi-finished and finished rolled products, including rebar. Activity at ArcelorMittal Kryvyi Rih peaked in December 2024 and January 2025 (44.0%) and decreased to 34.0% in May 2025. This trend does not have an explicit connection to the reported UK quota adjustments.

Yenakiieve Iron & Steel Works, located in Donetsk, has a crude steel capacity of 3,300 TTPA, relying on the BOF process. This plant’s activity, while the highest among the observed plants, also saw a decrease from 49.0% in February 2025 to 31.0% in May. Given the plant’s location in Donetsk, which is affected by the war in Ukraine, and the lack of explicit mention in any of the UK-related news articles, no direct link between the reported UK quota adjustments and this activity decrease can be confidently established.

The proposed UK import quota restrictions on specific steel product categories (metallic coated sheet, non-alloy and other alloy quarto plates, and rebar) as reported in “UK’s TRA recommends caps on some steel quotas,” “UK may impose country-specific caps on three steel product categories,” and “TRA unveils proposed restrictions on steel imports from the UK,” combined with UK Steel’s criticism that these changes “fall short,” create uncertainty for steel buyers.

Recommended Procurement Actions:

- Monitor Prices for Categories 4, 7, and 13: Closely track price fluctuations for metallic coated sheet (Category 4), non-alloy and other alloy quarto plate (Category 7), and rebar (Category 13) in the UK market, as the proposed 40% country-specific caps may lead to price volatility and supply adjustments.

- Diversify Sourcing (If Possible): Given the potential for restricted access to residual quotas as highlighted in “UK TRA recommends restricting countries’ access to residual quotas on steel imports,” steel buyers reliant on these categories should explore alternative sourcing options to mitigate potential supply disruptions.

These recommendations are based solely on the explicitly provided news articles and activity data.