From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Reacts Positively to US-China Trade Truce, AM/NS Calvert Hits Peak Activity

The North American steel market shows a positive sentiment following the recent US-China trade truce. The “Instant View: Investor reaction to US-China trade and tariffs agreement” highlights a relief rally in the S&P 500. This aligns with observed increased production levels at several steel plants. However, the article “U.S.-China Trade Deal: Doesn’t Cover Steel, Cars, Aluminum” explicitly states that the deal doesn’t directly address the steel industry, therefore a direct causal relationship is not established.

Here’s a summary of recent activity:

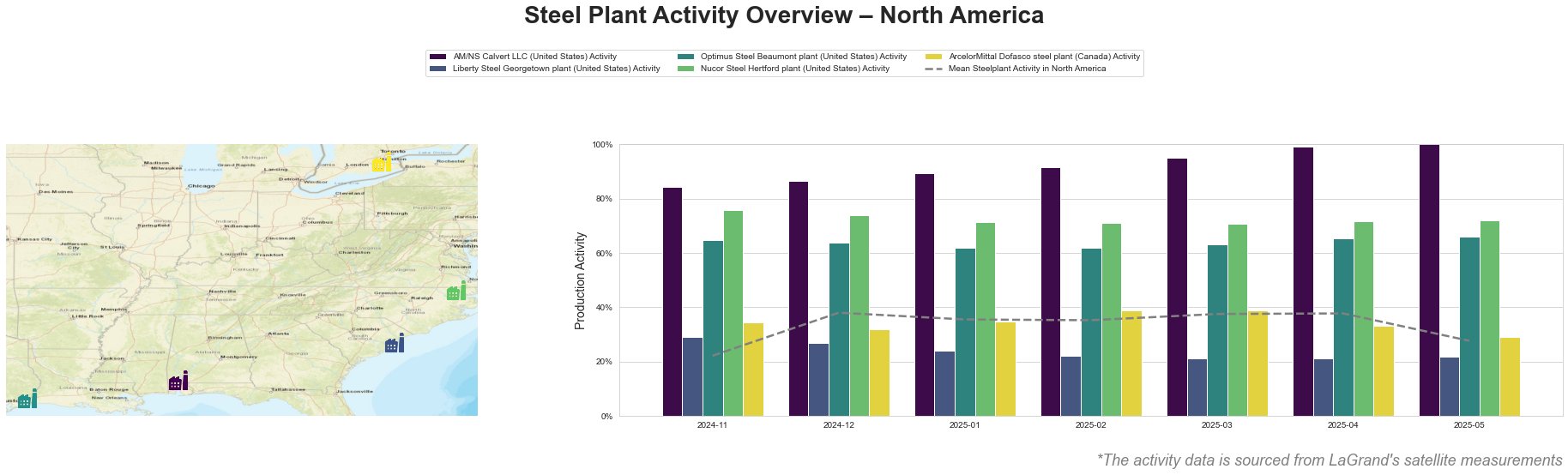

The mean steel plant activity in North America reached a peak of 38.0% in March and April 2025, followed by a significant drop to 28.0% in May 2025.

AM/NS Calvert LLC, a US-based EAF steel plant producing finished rolled products like hot-rolled and cold-rolled sheet, has consistently operated at high capacity. Activity increased steadily from 84% in November 2024 to 100% in May 2025. This peak contrasts with the overall North American average’s May decrease, but no direct link to the provided news articles can be established.

Liberty Steel Georgetown plant, an EAF steel plant in South Carolina producing semi-finished and finished rolled products, has consistently operated below the North American average. Its activity has remained relatively stable, fluctuating between 21% and 29% from November 2024 to May 2025. No connection to the provided news articles can be established.

Optimus Steel Beaumont plant, a Texas-based EAF steel plant producing semi-finished and finished rolled products, has operated well above the North American average. Its activity has seen a minor increase from 65% in November 2024 to 66% in May 2025. No connection to the provided news articles can be established.

Nucor Steel Hertford plant, located in North Carolina and specializing in plate production via EAF, has also shown consistently high activity above the North American average, ranging from 71% to 76%. No connection to the provided news articles can be established.

ArcelorMittal Dofasco steel plant, a Canadian integrated BF/BOF/EAF steel plant producing a wide range of finished rolled products, has operated near or slightly below the North American average, with activity ranging from 29% to 39%. The activity dropped to 29% in May 2025. No connection to the provided news articles can be established.

Evaluated Market Implications

While the news articles “Instant View: Investor reaction to US-China trade and tariffs agreement”, “Analysis-Investors cheer US-China tariff truce, but cautious over a final deal” and “Durchbruch im Handelsstreit: Apple, Nvidia & Co zünden den Turbo” indicate positive market sentiment due to the US-China trade truce, “U.S.-China Trade Deal: Doesn’t Cover Steel, Cars, Aluminum” explicitly states the deal excludes steel. Therefore, it is crucial to interpret increased plant activity cautiously as its root cause is not confirmed by the provided data.

Given the recent transportation rate increases mentioned in “Transportation rates likely to surge during tariff pause“, steel buyers should:

-

Consider Short-Term Procurement: Capitalize on current high production, particularly at AM/NS Calvert, to secure short-term supply contracts. The 100% plant activity suggests readily available supply.

-

Monitor ArcelorMittal Dofasco’s output decrease: Closely monitor the supply of ArcelorMittal Dofasco in Canada. A further drop might result in supply shortages.

-

Negotiate Transportation Costs: As noted in “Transportation rates likely to surge during tariff pause”, negotiate transportation rates and ensure logistical capacity is secured, especially if relying on shipments from plants like AM/NS Calvert.