From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for North American Steel Market: Insights & Trends

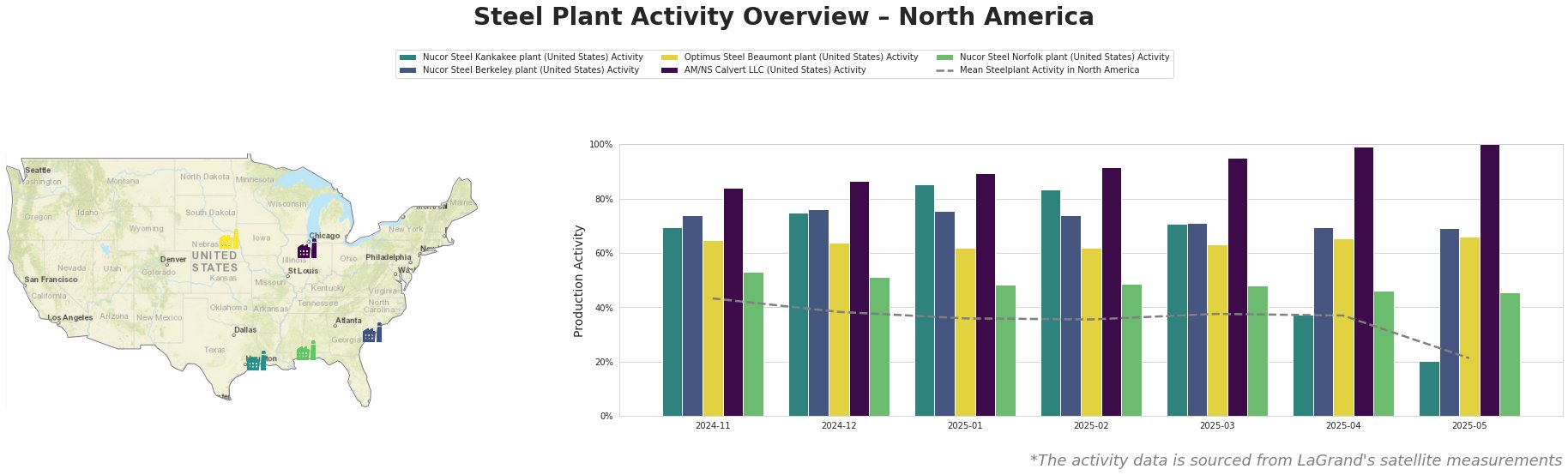

Recent discussions surrounding U.S.-Canada trade relations have prompted notable shifts in North American steel plant activity. Articles such as Trump unlikely to lift tariffs on Canada and Canadian prime minister to Trump: We’re not for sale highlight ongoing tensions affecting supply chains, particularly regarding tariffs on Canadian steel. As a result, satellite observations reveal interesting trends in activity levels across key steel plants, reflecting the market sentiment’s positivity.

The activity levels of the Nucor Steel Kankakee plant in Illinois and the AM/NS Calvert LLC in Alabama have shown resilience in the face of these geopolitical tensions. Both plants peaked at 85% and 99% activity respectively in January and April 2025, indicating robust production capabilities despite the ongoing tariff situations. This aligns with the positive sentiment highlighted in the articles, suggesting U.S. producers are gearing up for sustained demand tied to local industry needs, particularly in the automotive and infrastructure sectors.

Conversely, significant decreases were observed in overall steel activity, particularly a drop to 21% mean activity in May 2025, primarily driven by reduced output in the Nucor Steel Norfolk and Kankakee plants, which fell to 20% and 20%, respectively. This decline appears unrelated to the geopolitical developments outlined in the news articles, as activity levels among other plants remain comparatively stable or high.

Given the current landscape, steel buyers should consider the following:

- Nucor Steel Berkeley and AM/NS Calvert LLC demonstrate consistent activity, likely providing stability in supply amidst fluctuations. Focus procurement on these suppliers for enhanced reliability.

- The strained trading atmosphere posed by U.S. tariffs could result in sudden shifts in pricing or availability. It may be prudent to lock in current rates with trusted local suppliers to mitigate potential costs driven by protected tariffs on Canadian steel, as discussed in Trump unlikely to lift tariffs on Canada.

- Planning for contingencies related to the U.S.-Canada tariff situation is essential. Exploring alternative sourcing options or broadening supplier networks may reduce disruptions.

In conclusion, while current geopolitical concerns are impacting market dynamics, a generally positive production outlook among leading domestic steel plants can provide strategic procurement opportunities for industry professionals navigating these complexities.