From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Canada’s Steel Industry Amid Tariff Stalemate

In Canada, the steel market is currently exhibiting a positive sentiment, driven by recent developments in U.S.-Canada trade relations. Notably, President Trump has affirmed that he is “unlikely to lift tariffs on Canada,” as stated in the article “Trump unlikely to lift tariffs on Canada.” This has kept tariffs on Canadian steel products stable, despite Ottawa’s ongoing efforts to negotiate changes. The satellite-observed activity data indicates a notable resilience in steel plant operations, with observable activity that reflects ongoing demand and operational stability amid these trade challenges.

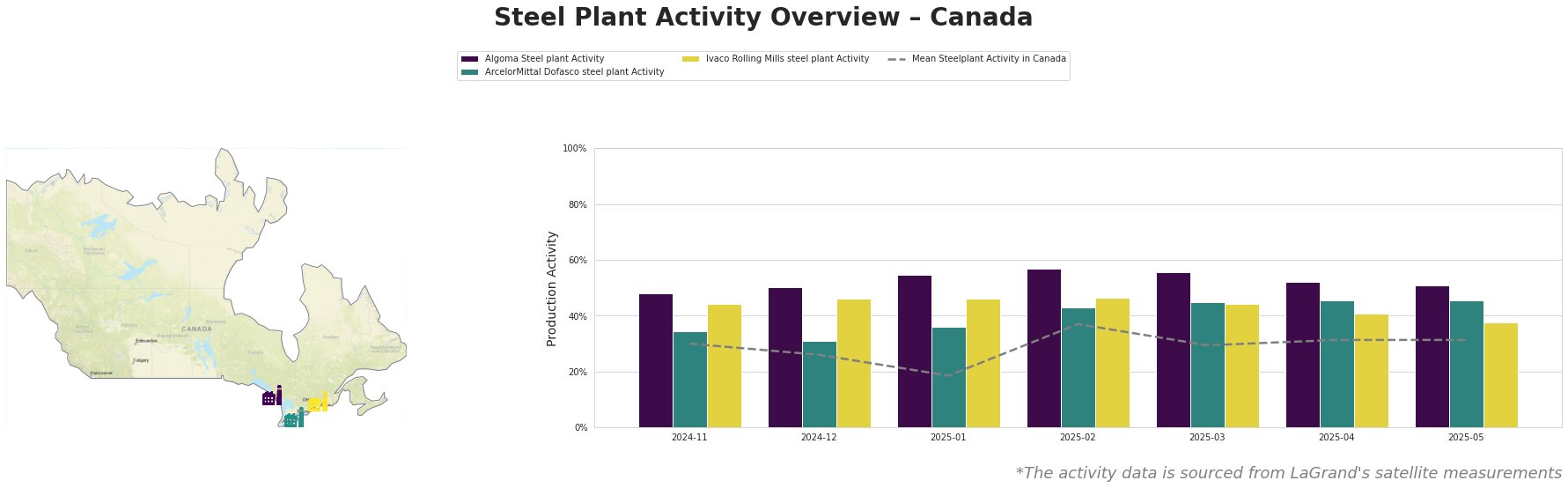

Algoma Steel Plant in Ontario has shown a resilient performance, with activity rising from 48% in November 2024 to a peak of 57% in February 2025 before stabilizing at 51% by May 2025. This upward trend might be indicative of strategic adjustments within the plant as they navigate the tariff landscape, although no explicit connection to the news can be established.

ArcelorMittal Dofasco has experienced moderate fluctuations, beginning with an activity level of 34% in November and increasing to 46% by April 2025 before plateauing. This pattern correlates with statements made by Prime Minister Mark Carney, emphasizing the importance of sustaining Canadian manufacturing despite external pressures, particularly tariffs.

Ivaco Rolling Mills, primarily an electric arc furnace-based plant, consistently maintained activity levels, ranging between 38% to 46% over the past several months. The plant’s stable operation suggests a focused production strategy in light of market dynamics, reflecting a robust demand in semi-finished goods.

The observed steel plant activities reflect stability and slight growth despite the looming trade tensions and tariff issues emphasized by the news. Considerable deviations, such as the 55% activity peak at Algoma in January, suggest that domestic demand may be resilient against the tariff challenges, linked closely with the automotive sector’s need highlighted in “Kanada und USA ringen um neue Beziehung: Was auf dem Spiel steht.”

Given the current landscape, procurement professionals should take the following actions:

– Prioritize sourcing from Algoma Steel and ArcelorMittal Dofasco, where production levels are stabilizing and signs of demand strengthening are evident, to mitigate risks associated with tariff-induced supply disruptions.

– Monitor any updates on trade negotiations closely, as potential shifts could further affect operational capacities and pricing structures for Canadian steel.

In conclusion, while the tariff situation remains a burden as articulated in “never say never,” the resilience demonstrated in operational activities across Canadian steel plants indicates a favorable environment for buyers willing to navigate these challenges strategically.