From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Booms Amid Strategic Plant Activity Improvements

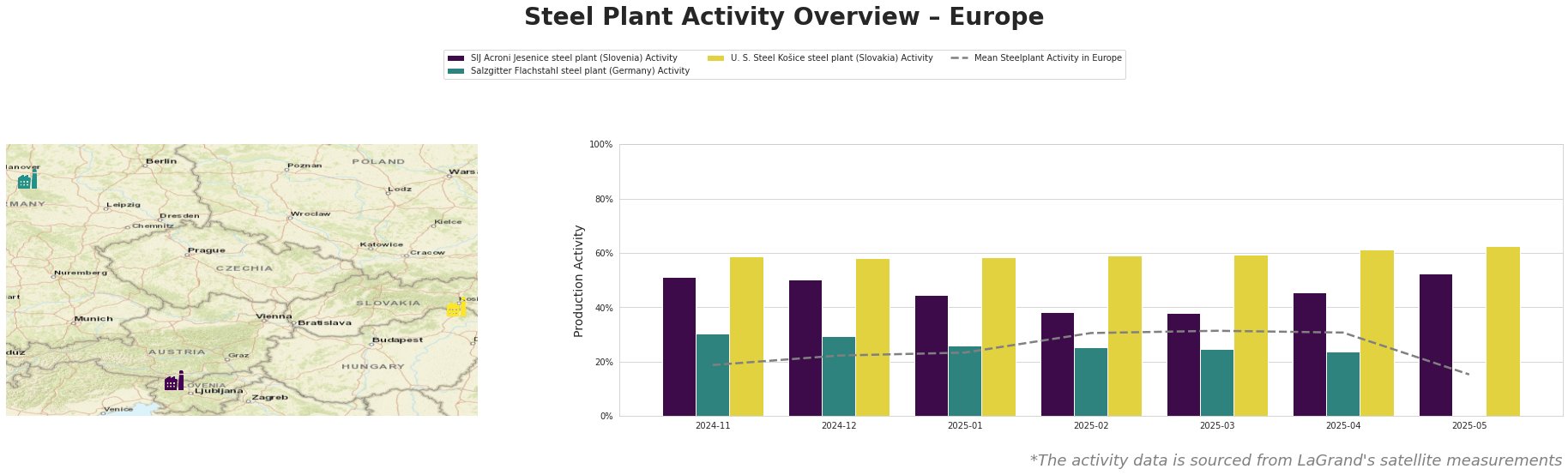

The European steel market is witnessing a very positive sentiment driven by strategic increases in plant activity and a range of favorable economic indicators. Notably, the article “Euro area industrial producer prices down 1.6 percent in March from February“ highlights a decline in input costs, contributing to enhanced profit margins for steel manufacturers. Concurrently, observed activity levels at major steel plants have shown significant upward trends, especially in Slovenia and Slovakia, reflecting broader market optimism.

The SIJ Acroni Jesenice steel plant in Slovenia demonstrated resilience with activity peaking at 53% in May, reflecting potential alignment with reduced competitive pressures following the reported declines in import levels as outlined in “France’s steel trade value declines in Jan–Feb.” In contrast, Salzgitter Flachstahl in Germany faced a decline, reaching lowest activities of 24% amid structural transitions aimed at reducing emissions. Despite this, U. S. Steel Košice achieved its highest activity, reaching 63%, indicating strong operational output likely benefiting from competitive pricing as indicated by the euro area’s price changes.

Supply disruptions are possible at the Salzgitter Flachstahl plant due to ongoing transitions to hydrogen-based steel processes, which may affect availability in the short term. For steel buyers, it is advisable to prioritize procurement from the U. S. Steel Košice plant given its rising activity and performance efficiencies established through technological upgrades. Furthermore, the SIJ Acroni Jesenice, benefiting from favorable export conditions and operational adjustments, represents a secure procurement source for flat rolled products necessary in infrastructure development.

Overall, the current market landscape suggests strategic procurement efforts targeting higher-performing producers while remaining cautious of potential disruptions linked to transitioning plants.