From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America’s Steel Market: Positive Outlook Amid Trade Challenges

Recent developments in North America’s steel industry signal a positive market sentiment, as plant activity levels begin to stabilize amid ongoing trade uncertainties. Notable articles such as “Steel threat from the South: Canada prepares response to US trade aggression“ and “Canadian factory PMI hits near five-year low on tariff uncertainty“ highlight trade concerns that are influencing steel production dynamics, particularly in Canada.

Measured Activity Overview

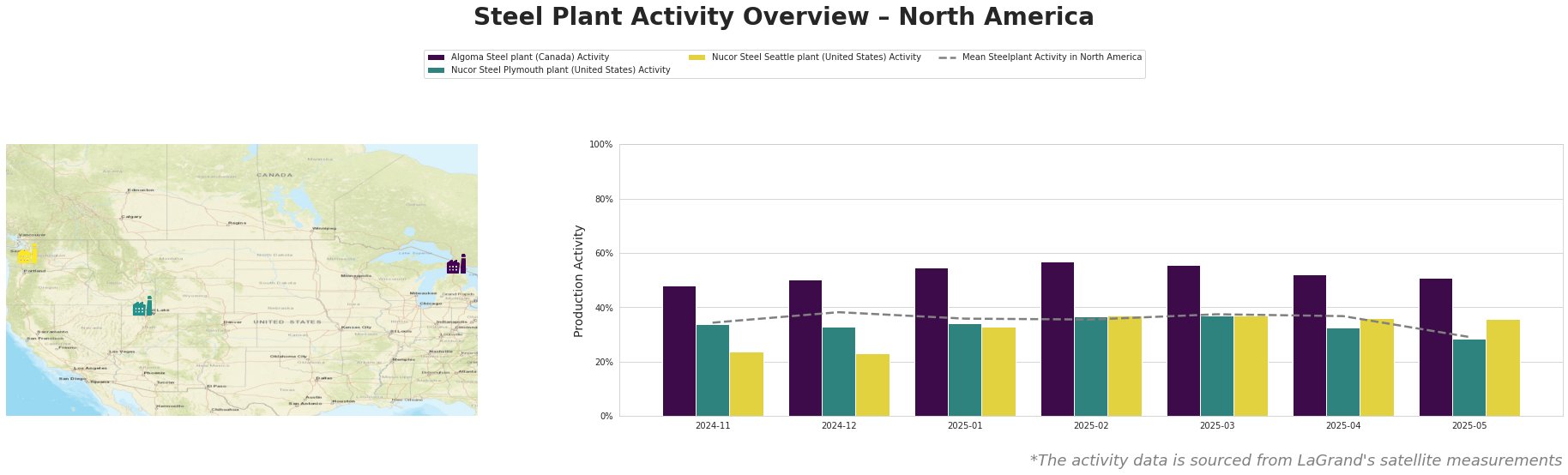

In April 2025, the mean steelplant activity across North America was observed at 37.0%, a notable figure relative to the significant levels in December 2024 (38.0%) and January 2025 (36.0%). The Algoma Steel plant experienced a peak activity of 57.0% in February 2025 but dropped to 51.0% by May, signaling fluctuations that may resonate with trade policy developments. The Nucor Steel Plymouth plant maintained stable output earlier but fell to 28.0% activity by May, further hindered by tariff-related uncertainties from the articles mentioned above. The Nucor Steel Seattle plant remained relatively stable, hovering around 36.0% in recent months, showing resilience amidst broader market fluctuations.

In light of GM lowers 2025 guidance, citing up to $5 billion in tariff exposure and Ford expects $1.5bn tariff hit in 2025, automakers are under increased pressure to adapt, affecting demand for steel products produced in regional plants.

Evaluated Market Implications

Given the ongoing tariff landscape and its predicted effects on North American plants, specifically Canadian operations, the following potential supply disruptions are flagged:

- Algoma Steel plant: As production is tied closely to market demands influenced by U.S. tariffs, procurement professionals should monitor activity closely for any significant disruptions that could affect supply for key sectors, such as the automotive industry.

- Nucor Steel Plymouth plant: With the observed decline in activity, there is a higher risk of supply shortages. Steel buyers should ensure long-term contracts or alternative suppliers to mitigate this risk.

Recommended Procurement Actions:

1. Align Orders with Activity Trends: Steel buyers, especially those relying on Canadian sources, should consider increasing procurement from Algoma Steel plant, particularly during periods of high activity, as seen in February and March 2025.

2. Diversify Suppliers: Given the recent decline in Nucor Steel Plymouth plant activity, it is prudent to establish relationships with alternative suppliers to avoid reliance on any single plant facing tariff-related disruptions.

3. Leverage Volume Commitments: Buyers may benefit from negotiating volume commitments with steel suppliers to buffer against potential price increases tied to tariffs, as indicated by the general trends observed in industry outlooks.

With positive production signals amid uncertainty, strategic procurement decisions will be crucial in navigating the evolving North American steel landscape.