From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Sees Significant Growth Amid Positive Trade Outlook

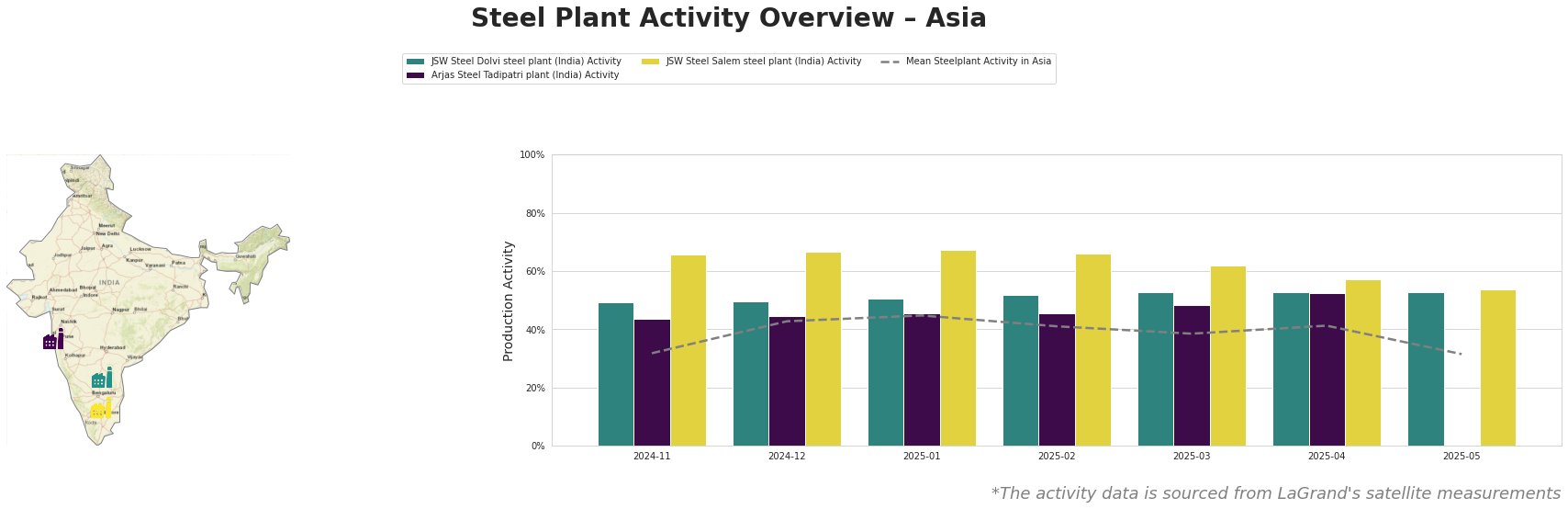

Recent developments in the Asian steel market reflect a highly optimistic sentiment, largely driven by renewed hopes for trade negotiations between the US and China, as highlighted in the articles “Stock market today: Dow, S&P 500, Nasdaq jump amid jobs report beat, hopes for US-China talks” and “FTSE surges to longest winning streak on record.” This strong market sentiment is underscored by satellite-observed activity data from key steel plants, which demonstrate considerable resilience and growth in output levels.

JSW Steel Dolvi, located in Maharashtra, maintained strong operations with a consistent activity level around 53% in recent months, showing resilience amidst fluctuating market conditions. This aligns with the optimistic investor sentiment stemming from ongoing discussions between the US and China, as discussed in “Stock market today: Dow, S&P 500, Nasdaq jump amid jobs report beat, hopes for US-China talks”. The plant, primarily using an integrated (BF and DRI) process, is positioned well within the energy and automotive sectors, indicating steady demand for its products.

In Andhra Pradesh, Arjas Steel Tadipatri’s activity showed improvements with a peak of 53% in April before reporting no data in May, revealing possible operational interruptions. While the link to broader market trends is less direct, the sentiments surrounding trade resolutions could suggest a rebound in demand, prompting steel procurement strategists to monitor this plant closely.

Conversely, JSW Steel Salem in Tamil Nadu exhibited a dip to 54% activity in May, down from 62% in March, which may restrict supply in the semi-finished and finished rolled segments. Although the exact cause of this decrease isn’t linked to the named articles, analysts should prepare for potential short-term delivery challenges, especially given the plant’s significance in infrastructure and automotive markets.

Supply Disruptions: The fluctuations in activity levels, particularly at Arjas Steel and JSW Steel Salem, warrant caution. Particularly, JSW Steel Salem’s drop may impact the supply chain for finished and semi-finished products.

Procurement Recommendations:

– JSW Steel Dolvi: Buyers should consider locking in contracts given the consistent output and strong market sentiment supporting ongoing production levels.

– JSW Steel Salem: Target short-term procurement strategies, anticipating potential delays influenced by recent dips in activity.

– Arjas Steel Tadipatri: Buyers should prepare for possible variability and stay updated on production capacity resumption for timely procurement actions.

In summary, the Asian steel market, buoyed by positive trade discussions, presents opportunities but also cautions buyers about possible supply risks. Proactive engagement and strategic planning will be key for stakeholders navigating this dynamic landscape.