From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for North America’s Steel Market Amid Political Changes

Recent developments in Canadian politics are positively influencing the steel market dynamics in North America. The article “Carney’s Liberals to form next Canadian government“ highlights Prime Minister Mark Carney’s victory and its implications for trade policies, which have been a significant concern for the industry. With satellite data indicating stable activity levels, particularly at Nucor Steel plants, this political shift may bolster confidence among steel buyers. However, no direct relationship with activity levels was established with the aforementioned news.

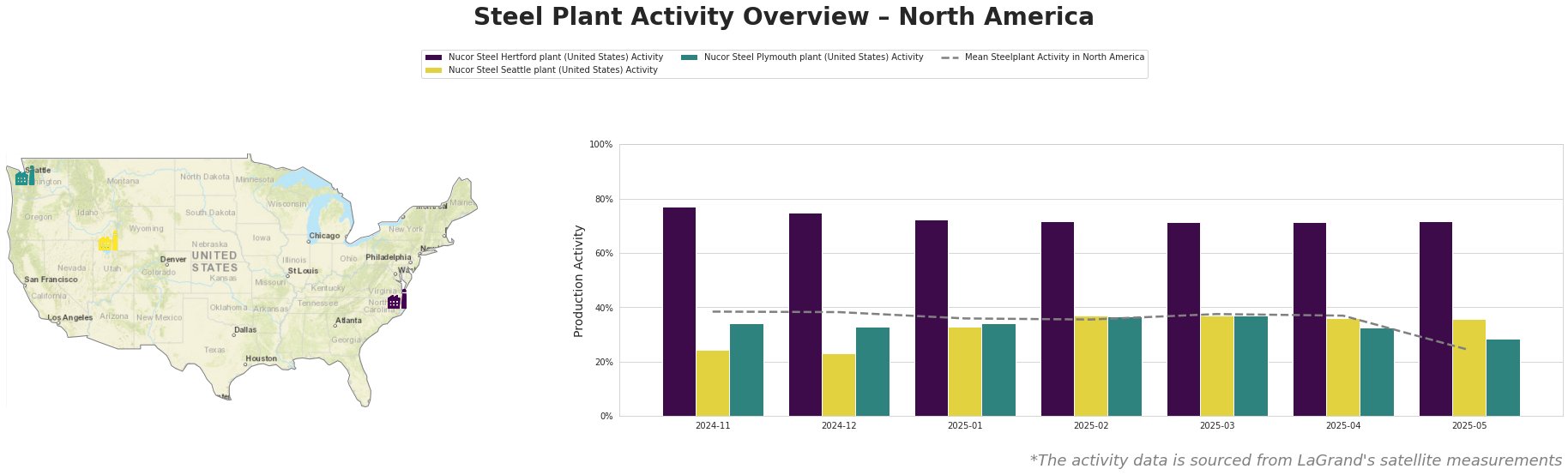

The Nucor Steel Hertford plant in North Carolina has consistently maintained high activity, peaking at 77.0%, aligning well with the growing political stability post-election, as outlined in “Carney and Liberal Party projected as winners as Canadians rally against Trump’s tariffs.” The continued operational strength of this plant suggests robust demand for semis in key sectors such as automotive and construction.

Conversely, Nucor Steel Seattle and Plymouth experienced declines in activity levels during May, with the Plymouth plant dropping to 28%, despite showing signs of stabilization previously. While the Seattle plant maintained a steady activity level at 36%, the downturn in Plymouth’s production may not directly correlate with the current political atmosphere, reinforcing a focus on individual plant dynamics during procurement planning.

Recent trade discussions outlined in “Carney to meet with Trump on 6 May“ point towards potential new economic partnerships that could alter supply chains and tariffs affecting imported materials, but current activity data indicates no immediate supply disruptions.

Steel buyers should prioritize procurement from the Nucor Steel Hertford plant due to its elevated activity levels (72% in May), which promises consistent delivery capabilities for semi-finished products, crucial for automotive and construction sectors.

As the political climate evolves post-election, ongoing monitoring of trade negotiations will be essential. Steel procurement strategies should be tailored to leverage the strengths of well-performing plants like Hertford while remaining vigilant to fluctuations at Seattle and Plymouth, ensuring a responsive and adaptive supply chain framework.