From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope’s Steel Market Soars: Analyzing Trends Amid Satellite-Observed Plant Activity

The European steel market is experiencing a Very Positive sentiment as plant activity shows promising growth trends. Recent news articles, including “Uncertain Times”: Australians Vote In Election Swayed By Inflation, Trump (2025-05-02) and Australia’s Coalition eyes power, resource funding cuts (2025-05-01), influence perceptions regarding steel production demands, indirectly affecting European market dynamics. Notably, these articles highlight wider economic trends that may encourage investment in production capacities across Europe, although no direct correlations with satellite activity were established.

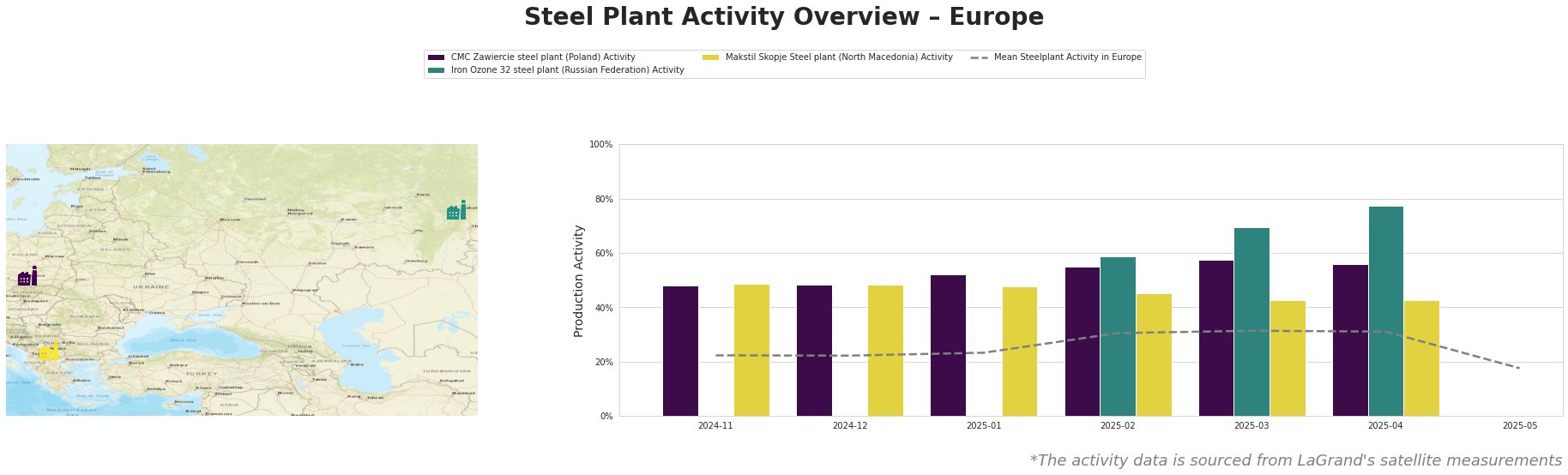

The CMC Zawiercie steel plant in Poland has seen a steady increase, peaking at 57.0% in March 2025, whereas activity has recently stabilized at 56.0% in April. This aligns with rising production capabilities amidst favorable labor conditions emphasized in the Australian political landscape referenced by the news articles. The Iron Ozone 32 steel plant, while starting the year lower, shows an upward trajectory, reaching a peak of 77.0% in April, potentially indicating increased orders despite geopolitical uncertainties. However, a significant drop in May to mean activity levels of 18.0% overall across Europe might suggest temporary supply chain disruptions or shifts in demands.

CMC Zawiercie produces electric arc furnace (EAF) steel for sectors such as automotive and construction, employing around 2,260 personnel to efficiently operate its 1700 crude steel capacity. The consistent increase in production activity aligns with broader market optimism for steel given current economic indicators, as highlighted in the news.

Iron Ozone 32, with a 1250 crude steel capacity, experienced significant growth, peaking at the aforementioned 77.0% in April. Its output is focused on semi-finished steel products and may be bolstered by rising energy demands from the energy sector. However, given the geopolitical landscape mentioned in the news, one must remain vigilant about market accessibility challenges that may arise from regional tensions, despite recent growth.

In contrast, Makstil Skopje has remained relatively stable, reflecting a narrower activity range, yet its engagement in sectors that prioritize steel usage implies ongoing relevance, despite recent fluctuations revealing constraints now reflected in satellite data.

To proactively navigate the market, steel buyers should consider the following actionable steps:

1. Increase procurement from CMC Zawiercie before potential disruptions are expected stemming from fluctuating energy policies as highlighted in the news.

2. Monitor the Iron Ozone 32 plant closely for shifts in operational stability, as geopolitical musings could affect import/export capabilities.

3. Be prepared for price adjustments or supply delays driven by the observed downturn in mean activity across Europe, particularly as it moves to 18.0% in May.

In summary, while the activity levels reflect a general positive momentum, ongoing vigilance is imperative due to external economic factors influencing future procurement strategies.